TaxAct

TaxAct is a tax preparation software and online service that helps individuals and small businesses file their tax returns. It was founded in 1998 and has since become one of the most popular options for self-filing taxes in the United States.

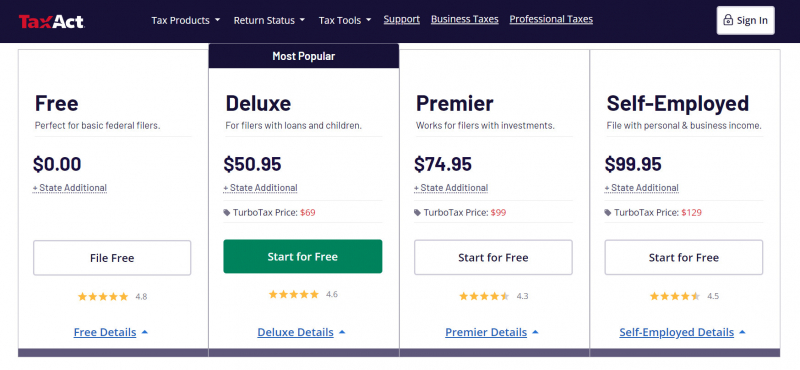

TaxAct provides a range of products and solutions to cater to different tax situations. Their software guides users through the tax preparation process, asking relevant questions and prompting for necessary information to ensure accurate filing. Users can input their income, deductions, and credits, and the software calculates the tax liability or refund based on the entered data.

TaxAct offers versions of its software for individual taxpayers, self-employed individuals, and small businesses. They also provide specialized features for specific tax situations, such as rental property income, investment income, and more. Additionally, TaxAct supports e-filing, enabling users to submit their completed tax returns electronically to the Internal Revenue Service (IRS) for faster processing.

The software includes various features to help users maximize their deductions and credits. It checks for potential errors or omissions and performs calculations to optimize the tax outcome. TaxAct provides guidance on tax deductions and credits, as well as access to tax resources and support.

Pros:

- Free expert support for all 1040 returns, regardless of service tier

- Navigate your tax return easily using TaxAct Bookmarks

- Unlimited access to returns for seven years

Cons:

- State returns are pricey

- Poor audit support

Released: 1998

Website: https://www.taxact.com/