Top 10 Best Online Finance Courses

Are you wondering which remote classroom to attend? You have spare time and want to broaden your horizon about a specific field of study whilst just staying at ... read more...home. Thus, to satisfy the burgeoning demand for online yet qualifying courses, Toplist has complied a rundown of the Best Online Finance Courses offered by the prestigious universities, famous companies, top organizations and knowledgeable instructors across the globe for who in need!!!

-

The Financial Markets course differs from the others on this list in that it aims to improve society through a thorough grasp and application of finance. This practical course is offered to you by Yale University and taught by an economics professor from the Ivy League. Yale University has been inspiring the brains that inspire the globe for over 300 years. Yale University, based in New Haven, Connecticut, brings people and ideas together to make a good difference around the world. Yale is a place for connection, creativity, and innovation among cultures and disciplines. It is a research university that focuses on students and fosters learning as a way of life.

Don't be put off by this; it's written for novices in finance and employs simple terminology. Financial markets, behavioral finance, nonprofits, and finance vocations are just a few of the topics discussed. The training also provides crucial leadership qualities that are necessary for a finance job. It takes 33 hours to finish and contains readings, quizzes, and videos that you may complete at your own speed. Lectures, student salons, chalk speeches, and interviews are all featured in the videos. Unless you want a certificate of completion, the course is free. Keep reading to discover more best online finance courses.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Shareable Certificate: Earn a Certificate upon completion

- 100% online: Start instantly and learn at your own schedule.

- Beginner Level

- Approx. 33 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Portuguese (Brazilian), Vietnamese, Korean, German, Russian, English, Spanish, Japanese

Price: Free without a certificate; $49 with a certificate

Time to complete: 33 hours

Prerequisites required: No

Flexible schedule: Yes

Includes verified certificate of participation: For $49Rating: 4.8/5

Link: https://www.coursera.org/learn/financial-markets-global#about

coursera.org

coursera.org -

IESE, the graduate business school at the University of Navarra in Spain, offers Corporate Finance Essentials by Coursera. IESE has been at the vanguard of management education for more than fifty years, educating and motivating business leaders who aspire to create a deep, constructive, and enduring influence on the people, organizations, and society they serve.

The course is delivered in English with subtitles in a variety of languages, including Arabic, Spanish, and Korean. You can join up for a 7-day free trial, but it costs $79 per month after that. The course takes most students 13 weeks to finish, but it is self-paced, so you may go at your own pace. This is the third course in the Think Like a CFO Specialization, and it covers corporate finance, financial risk, evaluation, and investment. The other courses aren't required, but they are available. This course's purpose is for students to have a better comprehension of what they read in the financial press after completing it, which is not stated by others on this list.

Corporate Finance Essentials will help you grasp key financial issues involving corporations, investors, and the capital markets interplay between them. By the end of this course, you should be able to understand the majority of what you read in the financial news and apply basic financial terminology used by businesses and finance experts.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Shareable Certificate: Earn a Certificate upon completion

- 100% online: Start instantly and learn at your own schedule.

- Course 3 of 4 in the: Think like a CFO Specialization

- Approx. 13 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Chinese (Simplified), Italian, Vietnamese, Korean, German, Russian, English, Spanish

Price: $79 per month following a 7-day full access free trial.

Time to complete: 13 hours

Prerequisites required: No

Flexible schedule: Yes

Includes verified certificate of participation: YesRating: 4.8/5

Link: https://www.coursera.org/learn/corporate-finance-essentials?action=enroll#about

coursera.org

coursera.org -

The Essentials of Corporate Finance Specialization from Coursera is the most specialized finance curriculum on the list, focusing solely on corporate finance. It's offered by the University of Melbourne in Australia, and it's taught by the university's business and economics faculty. The five-month curriculum, which was designed through a unique, real-world relationship with Bank of New York Mellon, consists of five modules in accounting concepts and financial analysis. It culminates in a hands-on capstone project that connects the five courses. It's worth noting that this software has the most requirements, including a basic understanding of statistics, basic algebra, data summarizing skills, and experience with Microsoft Excel or a functionally equivalent spreadsheet tool.

You'll get a solid understanding of corporate finance, including accounting concepts and financial analysis, how global markets produce value, the choices companies confront when making financial decisions, and risk attitudes. The Specialization comes to a close with a Capstone project that allows you to put everything you've learned in class to use.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Shareable Certificate: Earn a Certificate upon completion

- 100% online: Start instantly and learn at your own schedule.

- Intermediate Level: Some related experience required.

- Approximately 5 months to complete: Suggested pace of 3 hours/week

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish, Korean

Price: $49 month following a 7-day full access free trial.

Time to complete: 5 months at 3 hours per week

Prerequisites required: Yes

Flexible schedule: Yes

Includes verified certificate of participation: YesRating: 4.7/5

Link: https://www.coursera.org/specializations/learn-finance

coursera.org

coursera.org -

The first online course Toplist would like to introduce to you in this list of the best online finance courses is Finance for Non-Financial Professionals. Coursera's online course Finance for Non-Financial Professionals offers a good introduction to basic finance and accounting topics for non-financial professionals with only a seven-hour commitment. It is part of a 10-course Career Success Specialization program offered by the University of California, Irvine's Division of Continuing Education. The University of California in Irvine has combined the assets of a large research university with the benefits of an unrivaled Southern California location since 1965. UCI's unwavering dedication to rigorous academics, cutting-edge research, and leadership and character development positions the university as a catalyst for innovation and discovery that benefits our local, national, and worldwide communities in a variety of ways.

The additional courses aren't required, but they are available if you choose to take them. Finance for Non-Finance Professionals is self-paced and deadlines are flexible. Financial analysis, planning, forecasting, budgeting, cash flow, and strategic finance are just a few of the ideas addressed in this well-rounded course. While the course is presented in English, there are subtitles available in 11 other languages. The course has the best learning/time ratio reviewed here due to an exceptional professor, a rich material, and a fair time commitment.

You will be able to do the following after completing this course:

- Discuss the relevance of finance and the interpretation of financial data.

- Analyze financial data using accounting and finance concepts

- Acquire a working knowledge of key accounting and finance terms.

- Use important ratios to examine the financial statement.

- Discuss the significance of the budgeting process.

- Become familiar with the essential components required to boost profitability.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Shareable Certificate: Earn a Certificate upon completion

- 100% online: Start instantly and learn at your own schedule.

- Course 3 of 10 in the Career Success Specialization

- Approx. 7 hours to complete

- Subtitles: Arabic, French, Ukrainian, Portuguese (European), Chinese (Simplified), Italian, Vietnamese, Korean, German, Russian, English, Spanish

Price: $39 per month following a 7-day free trial

Time to complete: 7 hours

Prerequisites required: No

Flexible schedule: Yes

Includes verified certificate of participation: YesRating: 4.6/5

Link: https://www.coursera.org/learn/finance-for-non-finance-managers#about

coursera.org

coursera.org -

The Introduction to Corporate Financial course on Coursera can be thought of as a crash course in finance principles. This is one of the best online finance courses. It is taught by a professor of finance at the University of Pennsylvania's Wharton School. The University of Pennsylvania (often known as Penn) is a private university in Philadelphia, Pennsylvania, in the United States. Penn, a member of the Ivy League, is the fourth-oldest university in the United States and claims to be the first university in the country to provide both undergraduate and graduate programs.

This course is a component of the school's Introduction to Finance and Accounting Specialization, a 5-month Coursera program. The time value of money, interest rates, and return on investments are among the subjects addressed in Introduction to Corporate Finance. The course is self-directed and takes 7 hours to finish, and it has the most comprehensive curriculum in our guide. You can complete the course for free if you take advantage of Coursera's 7-day free trial option and are diligent. While there are no prerequisites, some Coursera reviewers suggest that prior accounting education may be beneficial.

This course is applicable to a variety of Specializations and Professional Certificate programs. This course will transfer to any of the following programs if you complete it:

- Finance & Quantitative Modeling for Analysts Specialization

- Introduction to Finance and Accounting Specialization

- Business Foundations Specialization

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Shareable Certificate: Earn a Certificate upon completion

- 100% online: Start instantly and learn at your own schedule.

- Approx. 7 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, Korean, German, Russian, English, Spanish

Price: $79 a month following a 7-day full access free trial. Financial aid available

Time to complete: 7 hours

Prerequisites required: No

Flexible schedule: Yes

Includes verified certificate of participation: YesRating: 4.6/5

Link: https://www.coursera.org/learn/wharton-finance

coursera.org

coursera.org -

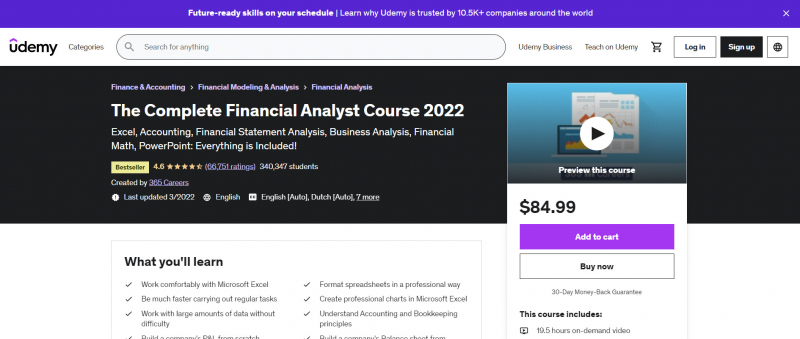

The Complete Financial Analyst Course 2021 on Udemy teaches the principles of finance to prospective financial analysts with no prior experience. It takes a very practical approach, covering the fundamentals, as well as how to utilize Microsoft Excel and create effective PowerPoint presentations. Balance sheets, financial statements, solvency, profitability, and other topics will be covered. 18 hours of on-demand videos, 11 articles, and interactive activities, such as estimating a company's sales in Excel, are used to convey the material. The instructor provides you with personalized feedback on these problems. If you don't comprehend a subject, Udemy guarantees that you'll get a response within one business day. While no prior knowledge or expertise is required for this course, you will need Microsoft Excel (2010 or newer) and Microsoft PowerPoint (2010 or newer) to complete the interactive learning sections.

What you'll learn

- Working with Microsoft Excel is a breeze.

- Spreadsheets should be formatted in a professional manner.

- Be significantly more efficient when performing routine activities

- In Microsoft Excel, make professional charts.

- Working with enormous amounts of data is not a problem.

- Understand the fundamentals of accounting and bookkeeping.

- Create a company's P&L from the ground up.

- Create a balance sheet for a business from the ground up.

- Analyze the financial statements

- Recognize the significance of timing when it comes to revenue and cost recognition.

This course offers:

- 19.5 hours on-demand video

- 17 articles

- 495 downloadable resources

- Full lifetime access

- Access on mobile and TV

- Certificate of completion

Price: $18.99

Time to complete: 18 hours of on-demand video

Prerequisites required: No but some software is required

Flexible schedule: Yes

Includes verified certificate of participation: YesRating: 4.6/5

Link: https://www.udemy.com/course/the-complete-financial-analyst-course

udemy.com

udemy.com -

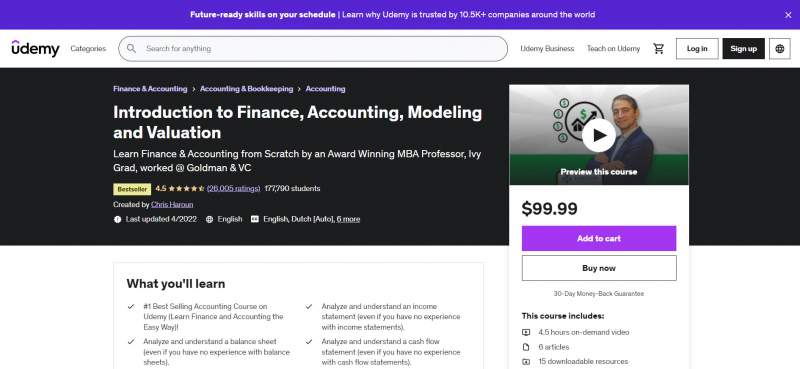

Chris Haroun, a venture capitalist, MBA professor, and author, teaches Introduction to Finance, Accounting, Modeling, and Valuation, which is the number one best-selling accounting course on Udemy. When split down by time, it's the most costly course on the list, with only 4.5 hours of video study and a price tag of $149.99. While no prior accounting or finance expertise is required, you must have access to Microsoft Excel and have a basic understanding of how to use it. The lecturer is noted for his 'edutainment' and visualization teaching methods, which he uses to simplify complex finance topics. Valuation methodology, profitability ratios, and discounted cash flow are among the topics covered.

This course will teach you the fundamentals of accounting, finance, financial modeling, and valuation (no prior accounting, finance, modeling, or valuation experience is required). You will also learn how to evaluate firms using multiple different valuation procedures so that you can come up with target values for the companies you are examining by the end of this course.

What you'll learn

- Examine and comprehend a balance sheet (even if you have no experience with balance sheets).

- Examine and comprehend a cash flow statement (even if you have no experience with cash flow statements).

- To construct financial models, you must understand and use modeling best practices.

- Know where to gather data to develop a financial model (in-depth knowledge of discovering and navigating the finest free websites and sources to build your financial model)!

- Make a financial model for an income statement (one that forecasts the future).

- Create a cash flow statement financial model (projecting the future).

- Understand the best procedures for valuing assets so you can set target values based on your financial models.

This course offers:

- 4.5 hours on-demand video

- 6 articles

- 15 downloadable resources

- 1 practice test

- Full lifetime access

- Access on mobile and TV

- Certificate of completion

- NASBA CPE credits: 6.0

Price: 149.99

Time to complete: 4.5 hours

Prerequisites required: Yes

Flexible schedule: Yes

Includes verified certificate of participation: YesRating: 4.5/5

Link: https://www.udemy.com/course/introduction-to-accounting-finance-modeling-valuation-by-chris-haroun

udemy.com

udemy.com -

Edx's ColumbiaX Corporate Finance program offers three months of expert training and a professional certificate of completion. This self-directed curriculum is based on a first-year course given in the MBA core program at Columbia Business School. It is designed for students who want to improve their careers in a variety of finance fields, such as investment banking, private equity, general management, consulting, and corporate CFO track employment. Introduction to Corporate Finance, Free Cash Flow Analysis, and Risk & Return are the three courses that make up the basic basis for a career in finance. Although ColumbiaX's top-notch professors and Ivy League name reputation make it the most expensive online finance course on the list, it is well worth it. ColumbiaX is also known for providing hands-on learning opportunities through real-world transactions and case studies.

What you'll learn:

- Understand both strong financial theoretical ideas and the real-world environment in which financial decisions are made.

- How to evaluate a company using the free cash flow method.

- Use valuation and discounting frameworks.

- Stocks and bonds should be valued.

- Calculate the profit on any project.

- Project cash flows and calculates the residual value to value a company.

- How to make corporate investment decisions.

- Understand how a company's capital structure affects the risk of its equity and debt.

- Risk is measured, and the expected return of an asset is estimated depending on the risk.

This course offers:

- Expert instruction: 3 skill-building courses

- Self-paced: Progress at your own speed

- 3 months: 3 - 4 hours per week

- Discounted price: $607.50 For the full program experience

Price: $607.50

Time to complete: Three months at 3 to4 hours a week

Prerequisites required: No

Flexible schedule: Yes

Includes verified certificate of participation: YesLink: https://www.edx.org/professional-certificate/columbiax-corporate-finance

edx.org

edx.org -

Finance for Everyone by Edx is a beginner-friendly introduction to financial literacy for personal and professional usage. MichiganX, which offers free online programs from the University of Michigan, is sponsoring the online financial course. While auditing the course is free, upgrading to the verified track for a certificate of completion and other benefits is recommended. It takes five to six hours each week for six weeks to finish, and you must have completed high school algebra and have a basic understanding of mathematics topics. Stocks and bonds, the time worth of money, and various decision-making frameworks are among the topics covered in Finance for Everyone. Unlike many of the other courses on this list, if you're enrolled in the validated course, you'll have access to instructor help.

What you'll learn:

- Why is finance omnipresent, and how does it affect us all?

- An understanding of the financial world, as well as a respect for its beauty and strength

- Gain fundamental financial information, skills, and tools, as well as the ability to use them in both personal and professional circumstances

- Different decision-making frameworks

- Learn to use a variety of decision-making tools and make informed personal and professional financial decisions.

- Applying the Time Value of Money (TVM) concept and related tools and frameworks to daily decision

This course offers:- Institution: MichiganX

- Subject: Business & Management

- Level: Introductory

- Prerequisites: secondary school (high-school) algebra, basic mathematics concepts

- Language: English

- Video Transcript: English

Price: Free in the audit track; $49 in the verified track

Time to complete: 6 weeks at 5 to 6 hours a week

Prerequisites required: Yes

Flexible schedule: Yes

Includes verified certificate of participation: Yes for verified track onlyLink: https://www.edx.org/course/finance-for-everyone-smart-tools-for-decision-ma-2

edx.org

edx.org -

The Finance Essentials course on Edx is designed for students who want to study finance in an MBA program. An educator teaches it from Imperial BusinessX, the Imperial College Business School's free online learning branch. The course is free to audit, but you'll have to pay $79 if you want a certificate of completion and other premium features like access to an expert online instructor and graded assignments. Capital budgeting, bonds, equities, and diversification are among the topics discussed. This course, which takes six weeks to complete at two to four hours each week, requires high school arithmetic as a prerequisite. Finance Essentials is the most customized course in our guide for learners interested in entering business school in the future.

What you'll learn:

- How can the time value of money be used to value assets?

- Understanding how to allocate assets for retirement Understanding capital budgeting for a project (such as a flat or house purchase)

- Recognize the value of risky cash flows.

- What is the worth of a bond?

- Recognize how a yield curve is created.

- Learn how to value a firm and how to handle a portfolio selection challenge.

- Recognize how correlations and diversification options change over time.

- To determine the needed rate of return for hazardous assets, use the Capital Asset Pricing Model (CAPM)

This course offers:

- Institutions: ImperialBusinessXImperialX

- Subject: Business & Management

- Level: Introductory

- Prerequisites: Secondary school (high school) math

- Language: English

- Video Transcript: English

- Associated programs: Professional Certificate in PreMBA Essentials for Professionals

Price: Free in the audit track; $79 in the verified track

Time to complete: 6 weeks (2-4 hours a week)

Prerequisites required: Yes

Flexible schedule: Yes

Includes verified certificate of participation: Yes for verified track only

Link: https://www.edx.org/course/finance-essentials

edx.org

edx.org