Top 8 Best Stock Trading Apps

The best stock trading apps make it simple and easy to trade online anytime, anywhere using your smartphone at home or on the go. This is possible because the ... read more...app has revolutionized the way people interact with global financial markets and stock exchanges. Today's best stock trading apps can help you track market trends, make investments and learn about the financial world. Here are the best stock trading apps currently available.

-

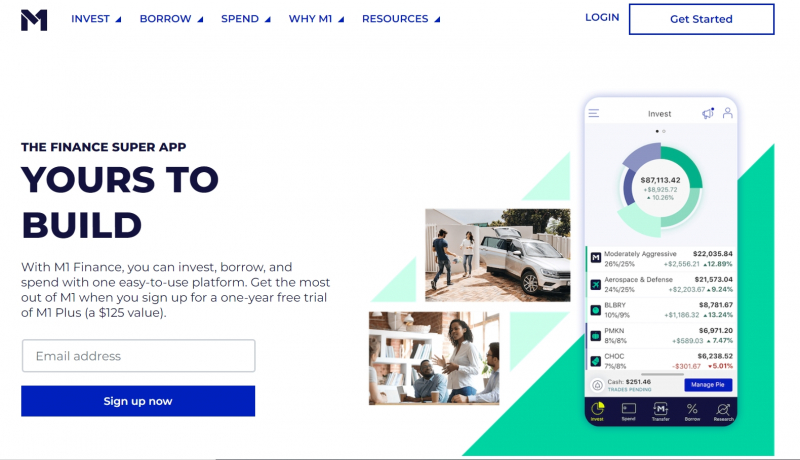

Chicago-based M1 Holdings Inc provides financial services to robo-advisors and develops the M1 Finance app for Android and iOS devices. You can even use the M1 Finance platform on your desktop thanks to its user-friendly web interface. Unlike other robo-advisors, with M1 Finance you have complete control over your investment.

M1 Finance is known for its well-thought-out finance package called Smart Money Management. In addition to investing, you can use the app to borrow if you have a $10,000 investment and spend it with your M1 checking account and debit card. When it comes to

stock trading, the M1 allows you to build your portfolio however you like with impressive automated investing features. The M1 allows you to build an investment strategy for individual stocks, low-risk ETFs, or a mix of both.Trading with M1 works through the so-called investment pie system. A pie chart contains up to 100 slices, each representing an investment such as an ETF, stock, or other circle. When you create a pie, the app automatically purchases your investment according to the percentage you choose. Premade investment Pies are also available.

Happily, M1 is totally free from trading fees. That means no maintenance payments, no trading commissions, and zero up charging for deposits or withdrawals. However, the platform will charge you for account termination if you close a retirement account early and for inactivity if you have a low balance and don`t use the app for over 90 days.

Reasons to buy

- +uses fractional shares

- +no minimum deposit

- +hands-off portfolio manager

Reasons to avoid

- -not suitable for day trading

- -inactivity fees

- -can’t trade mutual funds

Website: https://www.m1finance.com/

https://www.m1finance.com/

https://www.m1finance.com/ -

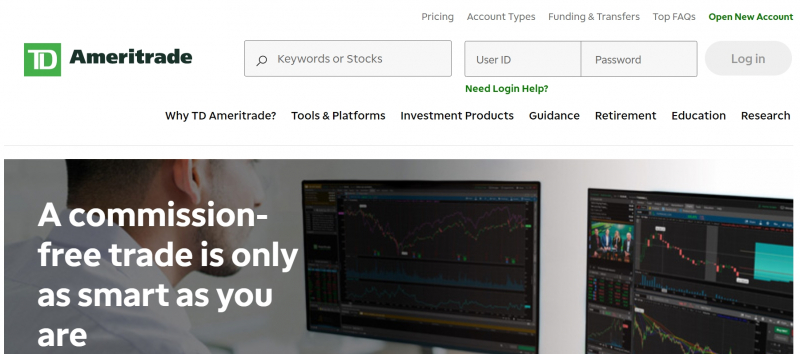

TD Ameritrade is one of the most influential and popular stock trading services on the market today, and it`s easy to see why.

This broker was one of the first major trading services to remove all commission charges on ETFs and stocks in late 2019. Today, with TD Ameritrade, you can trade commissionfree on ETFs, exchangelisted stocks, and options. However, a fee does apply for contracts on options trades. Also, nonUS OTC stock trades incur an additional charge.

You can actually access your TD Ameritrade trading account from multiple applications. First up is the TD Ameritrade mobile application. It is aimed at a relatively simple investment. It allows you to create price alerts, view stock watchlists, and browse charts with custom indicators. If you are new to stock trading, this is the right choice for you. The app allows you to easily view a summary of your trading activity and access TD Ameritrade's rich content and research to better understand the market.

However, if you are an experienced trader or day trader and do not use a buy-and-hold strategy, thinkorswim is the best choice for developing your TD Ameritrade portfolio. This mobile tool is powerful enough to be used to develop and execute complex trading strategies on the go. The thinkorswim app makes this possible by providing essentially the same features you would find on a full desktop trading platform. This means you can send real-time data and trade directly from the charting interface.

The TD Ameritrade thinkorswim platform was originally released only as a desktop tool that can still be used with a mobile app. Additionally, the company recently launched a web version of thinkorswim for a more convenient trading experience in your browser.

Reasons to buy

- +top customer support

- +separate apps for different trading styles

- +single page market and account summaries

Reasons to avoid

- -non-us over-the-counter trades are pricey

- -broker-assisted trades are expensive

Website: https://www.tdameritrade.com/

https://www.tdameritrade.com/

https://www.tdameritrade.com/ -

There are many sophisticated stock trading apps that can help seasoned investors make trading decisions based on the latest market movements, but SoFi Invest doesn't. This application is intentionally designed for users who want a streamlined and convenient trading experience and stock buying recommendations.

The SoFi offers two main account types: Active Investments and Automated Investments. Both of these work with other SoFi financial products such as loan refinancing and can be used to access a variety of stocks and ETFs in your name. This option is worth considering if you want to almost completely stop trading stocks. When you sign up for an automated investment account, the platform asks you a few questions about your risk appetite and suggests an appropriate ready-made portfolio. Most roboadvisory tools charge an administration fee of up to 0.5% per year, but SoFi is completely free.

A SoFi Active Investing account, on the other hand, is completely independent, allowing you to decide exactly how to divide your capital between different ETFs and stocks. Like the other best stock trading apps we've gathered here, SoFi has no fees, so you can trade as many times as you like without paying a penny. One of the coolest features of the SoFi is what the company calls Stock Bits. Essentially, these are fractional stocks that can be bought with dollar amounts. You can use Stock Bits to get a portion of your favorite companies without having to invest the entire stock.

Although the SoFi Invest app lacks some of the advanced search tools, metrics and customization options found in other stock trading tools, the design of the SoFi Invest app is simple and easy to navigate on desktop and mobile devices. This makes the platform ideal if you don't want to be overwhelmed by stats every time you log in to check your holdings.

Reasons to buy

- +Helpful automated investing service

- +No trading fees

- +Straightforward interface

Reasons to avoid

- -Only available to US-based customers

Website: https://www.sofi.com/

https://www.sofi.com/

https://www.sofi.com/ -

Fidelity Investments is a reputable global stockbroker that was originally founded in 1946. Like TD Ameritrade, if you open an investment portfolio with Fidelity, you’ll be able to manage it through multiple mobile, web, and desktop applications.

If you want a capable service that provides access to a wide range of asset classes and holdings, Fidelity could well be the brokerage for you. Unlike many of the simpler stock trading apps featured here, you can actually choose your base currency — 16 are available — and you can use Fidelity to invest in nonUS stocks and bonds.

So that you can monitor your investments wherever you are, the standard Fidelity app is compatible with a large selection of devices, including Apple TVs and Amazon products. No matter where you have installed the Fidelity app, you can use it to find detailed charts and important data to inform your investment strategy.

You can request a real-time quote, access the broker's latest research, and set up your trades with multiple options from within the app. If something goes wrong, you can call a Fidelity representative from the app itself. To enhance and complement the core Fidelity app, the company recently launched Fidelity Spire, a free tool to help you align your investments with your financial goals. Fidelity's Active Trader Pro is also available, which can be used to create custom feeds for intraday trading. If you have enough assets stored in Fidelity, you can use another desktop tool known as WealthLab Pro to test and develop advanced trading strategies.

Reasons to buy

- +outstanding research and screeners

- +use on almost any device

- +customize alerts and feed

Reasons to avoid

- -competing platforms may be confusing

- -only open to us-based customers

Website: https://www.fidelity.com/

https://www.fidelity.com/

https://www.fidelity.com/ -

Stash was founded to give inexperienced investors access to stock trading. To facilitate multi-portfolio investing, Stash supports micro-investments in fractional stocks. This means that, like SoFi Stock Bits, you don't have to invest money to buy the entire stock. The complete absence of minimum accounts makes Stash a valuable option for first-time investors. You can open and start investing with any level of capital you have access to.

Besides, Stash really helps you find additional funds to expand your investment portfolio through so-called automated investments and SmartStash. If you enable this option, whenever you purchase something with your Stashlinked account, the platform will automatically organize your purchase and invest additional money. For example, if you buy a latte for $3.55, an additional $0.45 is withdrawn and deposited in Stash.

To help you make smart choices about where to invest your money, Stash provides a wealth of easy-to-understand information about which ETFs or stocks it recommends investing in. A description of the risks associated with the investment.

Stash operates on a monthly subscription model that costs between $1 and $9 per month depending on the level of features you need to access. For example, if you want to open a retirement account or savings plan, you'll need to upgrade to one of the more expensive Stash subscriptions.

Reasons to buy

- +uncovers extra cash to invest

- +a wealth of educational material

- +free from account minimums

Reasons to avoid

- -monthly pricing costs add up

- -etf expense ratio could be lower

Website: https://www.stash.com/

https://www.stash.com/

https://www.stash.com/ -

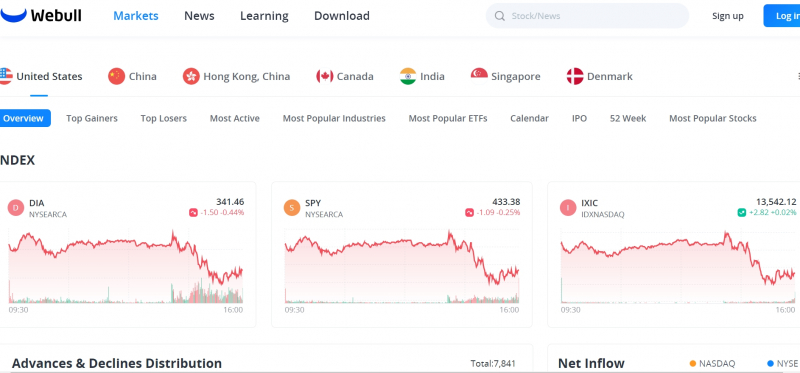

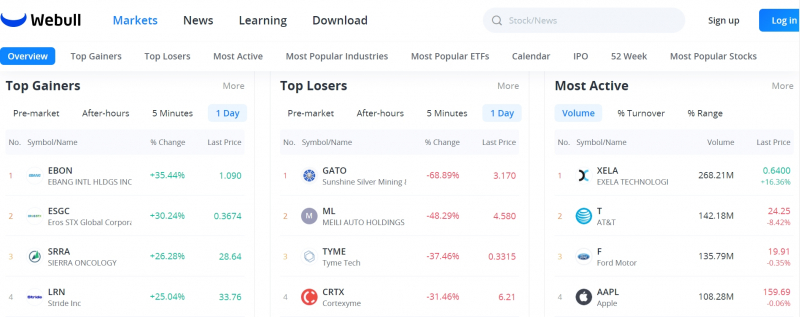

Founded in 2017, Webbull is a New York-based online broker that offers trading on multiple global markets, including stocks, ETFs, indices, IPOs, ADRs, foreign exchange and futures, offered on over 100 exchanges worldwide. They offer their clients an exclusive allinone trading platform that is user-friendly and has a variety of integrated, advanced and intelligent trading tools. Webull is customer-centric and offers stable trading conditions including competitive transaction fees, fast execution, and all-day customer support. However, the broker only accepts US clients and has limited funding options.

Webbull provides its clients with a highly customizable desktop, web and mobile trading platform. The desktop platform is available for Mac and Windows computers, and the web platform can be run on any modern web browser. Those who want to manage their accounts from anywhere and trade on the go can use the mobile trading platform available for iPhone, iPad, Android phones and tablets. The platform comes with several basic tools including earnings and historical earnings per share. Data, key statistics, insider trading, dividends, stock splits and other news.

There are also technical analysis tools including various chart types (real-time charts, candlesticks, line charts), technical indicators, and more. Webbull provides market research information that customers can access through desktop, web and online platforms. Their educational materials include: Individual stock reviews, market news and screener pages, as well as trading courses to help clients familiarize themselves with the trading platform and financial markets.

Reasons to buy

- +no commissions platform-wide

- +paper trading available (virtual currency trading)

Reasons to avoid

- -limited assets available

- -limited customer service options

Website: https://www.webullapp.com/

https://www.webullapp.com/

https://www.webullapp.com/ -

Tastyworks is the new broker in the marketplace. Founded in Chicago in 2017. Although Tasty Works is a new product, it is regulated by top financial authorities such as FINRA and NFA and is also a member of SIPC. Tastyworks is not a Forex or CFD broker, but its main products are stocks, options and futures. The good thing is that there are very competitive fees among similar brokers.

Tastyworks has made the trading industry more accessible for everyone by providing an easy-to-use online platform that provides all the necessary information in one place. The trading app is ideal for beginners, experts and everyone in between. Tastyworks is dedicated to providing the best opportunities in the stock market so people can trade smarter, faster and with more confidence.

Tastyworks is a company that uses machine learning and artificial intelligence to trade stock options. The company allows people to buy and sell stocks on their own, but balance the situation by doing tedious tasks like research. In this way, people can trade smarter, faster and more confidently. The first thing you need to do is to open an account with Tastyworks. The process is relatively simple and takes less than 5 minutes. When you access the main page of

Tastyworks, you will see a "Open Account" button at the top. On the next screen, enter your name, email address, select your language and click Continue at the bottom of the page. Then fill out the new account form with basic information including address and phone number and submit.The company constantly adds new features to keep up with everything in the market. It has a very high level of customer service, which is important when you are dealing with options trading that can be stressful at times. They provide all types of educational content to help people learn how to trade options in an easy way through videos, blogs, tutorials, and much more!

Reasons to buy

- +capped fees for options trades

- +advanced options trading features

- +follow community members for trade ideas

- +many account types supported

Reasons to avoid

- -not the cheapest per-contract fee

Website:https://www.tastyworks.com/

https://www.tastyworks.com/

https://www.tastyworks.com/ -

Ally Invest's $0 account minimum and $0 trading fees on eligible US securities make it a great choice for all traders. The low $0.50 options contract fee will attract option traders. Ally Invest is suitable for both novice investors and experienced stock traders alike with no trading fees, no minimum account, and low-cost options trading on eligible U.S. securities. Ally not only competes with the big online brokers in terms of cost, but also offers bells and whistles.

While uninvested cash in Ally Invest brokerage accounts, such as Forex trading, automatic portfolio management options and a set of free tools for tech investors, does not accrue interest, Ally Invest offers instant fund transfers between Ally's savings and brokerage accounts, so investors can take advantage of interest rates that are many times higher than the typical base rate of most brokerage firms.

However, this requires a separate Ally savings account. While mutual funds provide an easy way to build a diverse portfolio, Ally Invest offers mutual funds with no transaction fees. You may have to look elsewhere to schedule a face-to-face meeting. We chose Ally as the best banking app because it gives you access to your bank and trading accounts from one easy-to-use platform.

Reasons to buy

- +pair bank accounts with your investments in one app

- +user-friendly stock trades

- +simple and easy to use and manage

Reasons to avoid

- -mobile app research somewhat limited

- -some advanced traders may find trading tools limited

Website: https://www.ally.com/

https://www.ally.com/

https://www.ally.com/