Top 10 Best Stock Brokerage Firms

Financial assets such as stocks, bonds, commodities, and currencies have seen alternating cycles of rising and declining prices throughout history. Market ... read more...possibilities presented by these changes are available to traders and investors hoping to increase the value of their hard-earned money. Finding an online broker that best suits your personality and financial objectives is a crucial step in getting the most of the financial markets. Nowadays, all major online brokers provide free stock and ETF trading, and many also provide free commissions on trading other asset classes. The finest trading platforms have transparent cheap fees and few gamification techniques that encourage excessive trading. Here are some the Best Stock Brokerage Firms.

-

American global brokerage company Interactive Brokers LLC (IB). According to the quantity of daily average revenue deals, it runs the most prominent electronic trading platform in the United States. Stocks, options, futures, EFPs, futures options, FX, bonds, funds, and some cryptocurrencies are all traded by the company. It is one of the best stock brokerage firms.

The business has offices throughout four cities, with its central location in Greenwich, Connecticut. It is a division of the brokerage firm Interactive Brokers Group, Inc., which was established by Chairman Thomas Peterffy, a pioneer in the development of trading with computer assistance. IB is governed by the Financial Industry Regulatory Authority, the National Futures Association, the Chicago Mercantile Exchange, the New York Stock Exchange, the Commodity Futures Trading Commission, the Securities and Exchange Commission of the United States, and other self-regulatory bodies. As of 2014, the business offers 200 introducing brokers worldwide correspondent clearing services and fully disclosed, omnibus, and non-disclosed broker accounts. The corporation has 1.76 million customers as of February 2022, and its equity totaled US$348.5 billion. The Boston Options Exchange was founded by Interactive Brokers Group, which was also an equity partner and 40% owner of the now-defunct futures exchange OneChicago.Pros:

- Large investment selection.

- Strong research and tools.

- Over 18,000 no-transaction-fee mutual funds.

- NerdWallet users who sign up for IBKR Pro get a 0.25 percentage point discount on margin rates.

Cons:

- The website is difficult to navigate.

Founded: 1978

Revenue: US$2.714 billion (2021)

Website: https://www.interactivebrokers.com/

NerdWallet rating: 5.0/5.0

https://en.wikipedia.org/

https://en.wikipedia.org/ -

Common stocks, preferred stocks, futures contracts, exchange-traded funds, foreign exchange, options, mutual funds, fixed-income investments, margin lending, and cash management services are just a few of the financial instruments that can be traded electronically through the stockbroker TD Ameritrade. Revenue for the business comes from commissions for executing orders, interest income on margin accounts, and payment for order flow.

You're in the right place if investing is your passion. They equip you with the information you need to become an even wiser investor, from knowledgeable associates to market-leading education and technology. To keep diversified and prepared to seize more chances, have access to equities, bonds & CDs, options, non-proprietary mutual funds, derivatives, currency, commission-free ETFs*, and more. Trades without commissions are prevalent. There are wiser investors here. Value is so much more than just a dollar amount. You may trade online commission-free with TD Ameritrade, and there are no deposit requirements, trading minimums, or additional fees to worry about.

The platforms are packed with cutting-edge tools and features to give you everything you need to make wiser, more informed decisions, whether you are actively trading or investing over the long term. Regardless of the platform you select, you can do stock research, make trades, and manage your portfolio with information supported by real-time prices, experts with years of experience, and live-streaming CNBC.

Pros:

- Commission-free stock and ETF trades.

- Free research.

- High-quality trading platforms.

- No account minimum.

- Good customer support.

- Large investment selection.

Cons:

- No fractional shares.

Founded: 1971

Revenue: $4.358 billion (2020)

Website: https://www.tdameritrade.com/

NerdWallet rating: 5.0/5.0

https://www.tdameritrade.com/

https://www.tdameritrade.com/ -

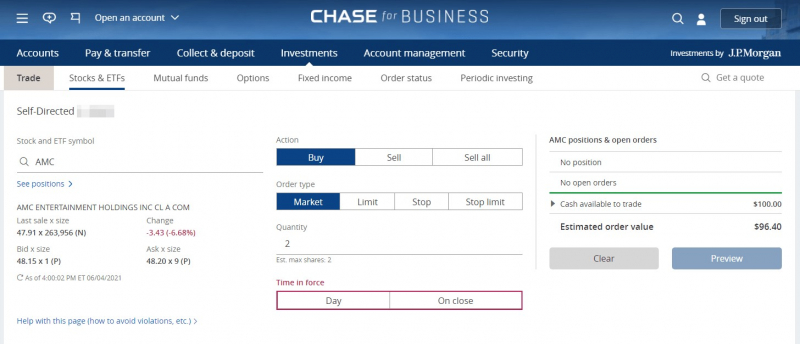

The Manhattan Company, founded in New York in 1799 by Aaron Burr and Alexander Hamilton, is where J.P. Morgan's career began more than 200 years ago. It is one of the best stock brokerage firms. Building and maintaining the best and most reputable financial services organization in the world is J.P. Morgan's goal.

J.P. Morgan announced a number of accomplishments in 2021, including being the top underwriter of green and ESG-labeled bonds. J.P. Morgan Chase opened a digital Chase Bank on September 21, 2021, in the UK. J.P. Morgan announced on October 26, 2021, that it had already paid out more than $13 billion of the $30 billion it had promised to contribute to bridging the wealth gap between races.The principal financial organization, which includes the Chase banking division, is J.P. Morgan Chase & Co. Broker-dealer J.P. Morgan Securities LLC (JPMS), which is owned by J.P. Morgan Chase & Co., operates the J.P. Morgan Wealth Management division with a full-service broker that offers a range of financial products and services. J.P. Morgan Self-Directed Investing (formerly "You Invest") is a discount broker owned by JP Morgan Wealth Management that offers commission-free stocks and ETFs. J.P. Morgan Self-Directed Investing excels at giving clients access to user-friendly platforms, resources, and tools. More active traders might, however, decide to use one of J.P. Morgan's rivals due to a lack of sophisticated trading tools and other essential characteristics.

Pros:

- Easy-to-use platform.

- $0 commissions.

- App connects all Chase accounts.

- No account minimum.

Cons:

- Limited tools and research.

- The portfolio Builder tool requires a $2,500 balance.

Founded: December 1, 2000

Revenue: US$121.65 billion (2021)

Website: https://account.chase.com/

NerdWallet rating: 5.0/5.0

https://www.moneyunder30.com/

https://www.moneyunder30.com/ -

One of the most well-known internet brokers for a very long time is E*TRADE. Active traders are drawn to the firm's $0 commissions and robust trading platforms, while new investors profit from the company's extensive collection of training materials. Regardless of your level of trading experience, E*TRADE has a platform and a mobile app for you. Real-time quotes, market commentary, stock, and exchange-traded fund screeners, as well as extensive account management, are all available on the E*TRADE Web platform and mobile app. Technical analyses, drawing tools, configurable options chain views, trading ladders, and other facilities for sophisticated strategies are available on the Power E*TRADE platform and app for more active traders.

E*TRADE offers a broad selection of investment options, including futures and sophisticated option techniques in addition to stocks, bonds, ETFs, and more than 6,500 no-transaction-fee mutual funds. The support services and instructional tools provided by E*TRADE are among the best. You can view webinars on a variety of subjects, including technical analysis, options trading, and diversification. Morningstar offers a variety of online investing courses, and its thematic investing section explains how to invest in businesses that share your values.Pros:

- Easy-to-use tools.

- Large investment selection.

- Excellent customer support.

- Advanced mobile app.

- Commission-free stock, options, mutual fund and ETF trades.

Cons:

- Website can be difficult to navigate.

Founded: 1982

Revenue: $2.88 B (2019)

Website: https://us.etrade.com/

NerdWallet rating: 5.0/5.0

https://us.etrade.com/

https://us.etrade.com/ -

The Charles Schwab Corporation is a global provider of financial services based in the United States. Both retail and institutional clients can take advantage of its banking, commercial banking, investment, and allied services such as consultancy and wealth management advisory services. It has more than 360 branches, most of which are located in financial hubs in the United States and the United Kingdom. With client assets totaling more than US$8.5 trillion, it ranks as the 7th largest banking institution in the country. As of February 7, 2022, it had 29.0 million active brokerage accounts, 2.1 million members in corporate retirement plans, 1.5 million banking accounts, and $8.5 trillion in client assets. Its corporate headquarters are in Westlake, Texas, and it was established in San Francisco, California.

Charles R. Schwab, the business's namesake, established it as Charles Schwab & Co. in 1971. This was the first company to offer discount sales of equity securities by utilizing the financial deregulation of the era. Prior to the 1980s economic development financing the bank's expenditures in technology, automation, and digital record keeping, the bank first opened its flagship location in Sacramento and then moved into Seattle. It was the first to provide 24-hour order entry and quote, and Bank of America bought it in 1983 for $55 million. Three years later, the founder decided to repurchase his business for $280 million due to the success of the bank's free mutual funds.

Pros:

- Three platforms with no minimum or fees.

- Above-average mobile app.

- Extensive research.

- Large fund selection.

- Commission-free stock, options and ETF trades.

Cons:

- Low default cash sweep rate.

Founded: 1971

Revenue: US$18.52 billion (2021)

Website: https://www.schwab.com/

NerdWallet rating: 5.0/5.0

https://commons.wikimedia.org/

https://commons.wikimedia.org/ -

Webull Financial LLC is a part of SIPC, which provides up to $500,000 in protection for consumers of its members who purchase securities (including $250,000 for claims involving cash), that is one of the best stock brokerage firms.. A description brochure is offered upon request or online at www.sipc.org. The clearing company, Apex Clearing Corp., has added another insurance coverage.

Through a software licensing arrangement with Webull Pay LLC, Apex Crypto LLC (NMLS ID 1828849) offers cryptocurrency execution and custody services. Trading in cryptocurrencies is possible with an Apex Crypto account. Your cryptocurrency holdings are not FDIC or SIPC insured because Apex Crypto is neither a licensed broker-dealer nor a FINRA member. Before trading, please be sure you completely comprehend the dangers involved.Risk is a component of all investments, and not all risks are acceptable to all investors. Because securities' values might change, clients run the risk of suffering losses over and beyond their initial investment. A security's or financial product's previous performance is not a guarantee of its future performance or returns. Recall that while diversification may aid in reducing risk, neither a profit nor protection from loss in a bear market is guaranteed by it. If you invest in securities or other financial items, you could always lose money. Before making an investment, investors should carefully assess their investment goals and risks.

Webull's sleek desktop and mobile app interfaces will appeal to the mobile-first generation of casual investors, but the brokerage also offers an outstanding selection of tools for serious traders. However, it lacks access to some basic asset classes and has only a limited amount of teaching content, which may leave real beginners in the dark.

Pros:

- Low costs.

- Easy-to-use platform.

- Advanced tools.

- Access to cryptocurrency.

Cons:

- No mutual funds.

- Thin educational support.

Founded: May 24, 2017

Revenue: $8 Million

Website: https://www.webull.com/

NerdWallet rating: 4.9/5.0

https://www.equitypandit.com/

https://www.equitypandit.com/ -

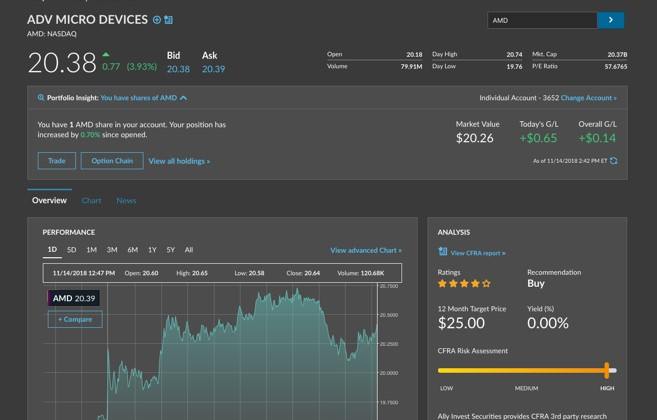

With no account minimum, low-cost options trading, and $0 trading charges on qualifying U.S. stocks, Ally Invest caters to both novice and seasoned stock traders. In addition to offering bells and whistles like FX trading, an automatic portfolio management option, and a collection of complimentary tools for technical investors, Ally competes with the main online brokers not just on price. Ally Invest allows fast money movement between Ally savings and brokerage accounts, allowing investors to benefit from interest rates several times greater than the standard default sweep interest rates of most brokerages. Uninvested funds in an Ally Invest brokerage account do not earn interest. However, you must open Ally savings account separately in order to achieve this.

The browser-based platform from Ally Invest features real-time streaming quotes and data, rapid trading capabilities, a customized dashboard, and access to all of the broker's tools. Customers who often conduct business from different computers—at home and at work, for instance—will value this web-based platform's lack of download requirements. Customers of Ally can also trade using mobile devices thanks to Ally Mobile or Ally FX, the brokerage's app for forex trading.

Pros:

- Commission-free trades on eligible U.S. stocks, options, and ETFs.

- No account minimum.

- Strong web-based platform.

Cons:

- No fractional shares.

- Limited third-party research providers.

Founded: 1919

Revenue: US$8.206 billion (2021)

Website: https://www.ally.com/invest/

NerdWallet rating: 4.8/5.0

https://www.investopedia.com/

https://www.investopedia.com/ -

Firstrade offers commission-free mutual fund trading in addition to free stock and options trading, which is a benefit no other broker can match. Options traders will value the broker's lack of contract fees, which is also uncommon among brokers. Additionally, Firstrade added 38 cryptocurrencies to its platform so far.

In addition to a highly regarded mobile app for iOS and Android, Firstrade offers three trading platforms, including a desktop platform, Options Wizard, and Firstrade Navigator. Firstrade does not charge a per-contract fee for trading options. Professional investors might be unhappy that Firstrade doesn't offer trading in forex, futures, or futures options to go along with its extremely low options trade pricing. However, retirement retirees have plenty of possibilities to use Firstrade to create and manage their portfolios.

Before $0 trades became the industry norm, Firstrade was a pioneer in commission-free trading for stocks, options, and ETFs. Prior to that, only Firstrade offered retirement accounts as a commission-free broker (unlike the original free-trade brokerage, Robinhood, which offers only taxable brokerage accounts).

Pros:

- Commission-free stock, ETF, and options trades.

- $0 contract fee on options trades.

- All mutual funds are commission-free.

- Chinese language options.

- Large selection of cryptocurrencies.

Cons:

- No 24/7 customer support.

Founded: 1985

Total assets: US$4 billion (2019)

Website: https://www.firstrade.com/

NerdWallet rating: 4.7/5.0

https://www.firstrade.com/

https://www.firstrade.com/ -

A platform for electronic trading is offered by BofA Securities, a unit of Bank of America's retail banking division, under the name Merrill Edge. The debut date was June 21, 2010. Research, investment tools, and contact center support from Merrill Lynch and Bank of America Online Investing (Quick & Reilly) were combined to form Merrill Edge. That is one of the best stock brokerage firms. Merrill Edge had 500,000 Bank of America clients when it first opened. The firm focuses on clients with investable assets of up to $250,000. The firm had two million customers and $118 billion in 2015, and it employed 2,500 consultants in contact centers and bank locations.

Merrill Edge offers competitive pricing, thorough research, and top-notch customer service. Customers of Bank of America, the parent business, will appreciate the intelligent integration and the convenience of only needing one login to access both accounts. You can take advantage of a variety of special savings and perks with Bank of America Preferred Rewards, many of which are based on the ways you bank with Bank of America and invest with Merrill®. You can maximize the rewards you receive when your balances are in harmony.

Pros:

- Robust third-party research.

- Integrated with Bank of America.

Cons:

- Advanced traders may find fewer securities on offer.

Founded: June 21, 2010

Revenue: $216 Million

Website: https://www.merrilledge.com/

NerdWallet rating: 4.7/5.0

https://www.gobankingrates.com/

https://www.gobankingrates.com/ -

Clearing services are provided by Robinhood Securities, LLC, a licensed broker-dealer, and brokerage services are provided by Robinhood Financial LLC, a registered broker-dealer (member SIPC) (member SIPC). Services for cryptocurrencies are provided by Robinhood Crypto, LLC ("RHC") (NMLS ID: 1702840). Robinhood Money, a registered money transmitter, provides the Robinhood Money spending account. A license from Mastercard® International Incorporated allows Sutton Bank, Member FDIC, to issue the Robinhood Cash Card, a prepaid card. Although assets kept in the Robinhood Money spending account and the Robinhood Cash Card account may be eligible for FDIC pass-through insurance, RHY products are not entitled to SIPC coverage (see the Robinhood Cash Card Agreement and the Robinhood Spending Account Agreement).

Options trading has a high level of risk and is not suitable for all clients. Before using any options trading techniques, customers must read and comprehend the Characteristics and Risks of Standardized Options. Transactions involving options are frequently complicated and include the risk of losing the entire investment very quickly. There is an additional risk associated with some complicated options techniques, including the possibility of losses that could be greater than the initial investment.

Exchange of stocks, ETFs, and options without commission refers to $0 commissions for self-directed individual cash or margin brokerage accounts with Robinhood Financial that electronically trade U.S. listed securities and some OTC equities. Remember that additional charges, such as non-commission trading costs, gold subscription fees, wire transfer fees, and paper statement fees, could be incurred.Pros:

- No account minimum.

- Streamlined interface.

- Cryptocurrency trading.

Cons:

- No mutual funds or bonds.

- Limited customer support.

Founded: April 18, 2013

Revenue: US$1.82 billion (2021)

Website: https://robinhood.com/

NerdWallet rating: 4.6/5.0

https://www.mvp.vc/

https://www.mvp.vc/