Top 10 Largest Financial Service Companies in Denmark

In this post, let's take a look at the top 10 largest financial service companies in Denmark. Visit other related Toplist articles directly if you want to see ... read more...more of the largest financial companies in other regions ranked by market capitalization.

-

MasterCard Worldwide is a multinational corporation based in Purchase, New York, United States. This company's business is to make payments between the buyer's and seller's banks using "MasterCard" branded debit and credit cards for purchases.

Since 2006, MasterCard Worldwide has been a publicly traded company. MasterCard Worldwide has been a membership organization owned by the 25,000+ financial institutions that issue its cards since its initial public offering.

Mastercard grants licenses to banks all over the world for the production of their cards and the hiring of contractors. (acquiring licenses). Mastercard is accepted by nearly 35 million contracting businesses, and there are approximately a million cash payment offices worldwide. (as of 2014). Mastercard's market capitalization is $332.98 billion as of March 2023.

By market capitalization, this places Mastercard as the 20th most valuable company in the world. According to Mastercard's most recent financial reports, the company's current revenue (TTM) is $22.23 billion. In 2021, the corporation generated $18.88 billion in revenue, up from $15.30 billion in 2020.

Founded: 1966

Headquarters: 2000 Purchase Street, Purchase, New York, U.S.

Size: 10000+ Employees

Industry: Financial Transaction ProcessingWebsite: mastercard.com

Screenshot via mastercard.com

Screenshot via mastercard.com -

Wells Fargo & Company is an American multinational financial services firm with corporate headquarters in San Francisco, California, operational headquarters in Manhattan, and managerial offices around the world.

The corporation has operations in 35 countries and more than 70 million customers worldwide. It is regarded as a systemically important financial institution by the Financial Stability Board. The former Wells Fargo & Company and the Minneapolis-based Norwest Corporation merged in 1998 to form the current Wells Fargo.

Even while Norwest was technically still in business, the amalgamated company used the more recognizable Wells Fargo moniker and relocated to Wells Fargo's headquarters in San Francisco. At the same time, its banking division merged with Wells Fargo's banking division in Sioux Falls. Wells Fargo established itself as a coast-to-coast bank after purchasing Charlotte-based Wachovia in 2008.

As of March 2023, the market value of Wells Fargo was $141.56 billion. Wells Fargo is now the world's 77th most valuable company by market capitalization. According to Wells Fargo's most recent financial reports, the company's current revenue (TTM) is $73.78 billion. In 2021, the corporation generated $78.02 billion in revenue, up from $72.34 billion in 2020.

Founded: January 24, 1929

Headquarters:- San Francisco, California, U.S. (corporate)

- New York, NY (operational)

Size: 10000+ Employees

Industry: Banking & LendingWebsite: wellsfargo.com

Screenshot via rbc.com

Screenshot via rbc.com -

HSBC ranks 3rd in the list of the largest financial service companies in Denmark. By connecting the developed and developing worlds, HSBC is able to create long-term investment opportunities for investors worldwide. HSBC delivers solutions to support your financial ambitions through a long-term commitment to their clients and a structured and disciplined investment approach.

They managed USD617 billion globally as of the end of December 2022 for a variety of clients, including some of the world's largest institutional investors, commercial and corporate clients, financial intermediaries, retail and private banking clients. Their investment platform includes more than 600 professionals across 23 countries and territories, who perform in-depth due-diligence locally, and share their intellectual capital globally.

Being truly global allows them to capture opportunities wherever they may arise. Across their global network, their local presence in each region also provides them with greater insight into the markets and companies in which they invest.

Founded: 1865

Headquarters: Canary Wharf, London

Size: 10000+ Employees

Industry: Banking & Lending

Website: https://www.hsbcnet.com/

Screenshot via hsbcnet.com

Image by HSBC via hsbcnet.com -

Goldman Sachs is an American global investment bank and financial services provider. Goldman Sachs was founded in 1869 and has regional headquarters in London, Warsaw, Bangalore, Hong Kong, Tokyo, Dallas, and Salt Lake City, as well as additional offices in major global financial hubs. Its main office is located at 200 West Street in Lower Manhattan.

Goldman Sachs is the world's second-largest investment bank by revenue and the 57th-largest American company by total revenue on the Fortune 500 list. It is classified as a systemically important financial institution by the Financial Stability Board.

Goldman Sachs' market capitalization is $107.77 billion as of March 2023. Goldman Sachs is now the world's 123rd most valuable company by market capitalization. According to Goldman Sachs' most recent financial reports, the company's current revenue (TTM) is $47.36 billion. In 2021, the corporation generated $58.21 billion in revenue, up from $44.55 billion in 2020.

Founded: 1869

Headquarters: 200 West Street, New York City, New York, U.S.

Size: 10000+ Employees

Industry: Investment & Asset ManagementWebsite: goldmansachs.com

Screenshot via goldmansachs.com

Screenshot via goldmansachs.com -

Citi has had a presence in Denmark since 1975. Their business is focused on Danish-based multinational companies, financial institutions, the public sector as well as providing services to subsidiaries of foreign multinational companies operating in Denmark. For these companies, they are among their most important banks, and they work with them across the globe, making full use of their international network.

Citi's Banking, Capital Markets, and Advisory division strives to be the best financial partner to its institutional clients by offering comprehensive relationship coverage and a full suite of products and services. They assist mid-sized businesses with revenues beginning at $10MM USD in addressing the challenges of rapid growth and international expansion by rationalizing complex legacy setups or allowing clients to avoid them entirely, allowing them to scale faster and grow larger.

Markets offers world-class solutions and a global presence that is unrivaled. From trading floors in nearly 80 countries, they serve corporations, institutional investors, and governments.Their treasury services help their clients optimize their needs on a global scale. Treasury and Trade Solutions offers global solutions to help clients advance their businesses while investing in innovation to bring new solutions to life.

Founded: 1812

Headquarters: New York City, New York, U.S.

Size: 10000+ Employees

Industry: Investment & Asset Management

Website: https://www.citigroup.com/global

Image by citi via citigroup.com

Screenshot via citigroup.com -

Banco Santander, S.A., also known as Santander Group, is an international financial services firm headquartered in Madrid and Santander, Spain. Furthermore, Santander, the world's 16th largest banking organization, maintains a presence in all major financial centers. Although it is best known for its European banking operations, it has recently expanded into continental Asia as well as North and South America. This bank is regarded as having systemic importance by the Financial Stability Board.

Several subsidiaries, including Abbey National, have been renamed Santander. The company is a component of the Euro Stoxx 50 stock market index. In May 2016, Forbes Global 2000 ranked Santander as the 37th largest public company in the world. Santander is Spain's largest bank.

Ana Patricia Botn-Sanz de Sautuola O'Shea is the granddaughter and daughter of previous chairs Emilio Botn-Sanz de Sautuola y Garca de los Ros and Emilio Botn-Sanz de Sautuola López.

Santander's market capitalization as of April 2023 is $61.48 billion. Santander is now the world's 246th most valuable corporation by market capitalization. According to Santander's most recent financial reports, the company's current revenue (TTM) is $54.62 billion. In 2021, the corporation generated $56.32 billion in revenue, up from $54.12 billion in 2020.Founded: 15 May 1857

Headquarters: Santander, Spain

Size: 5001 to 10000 Employees

Industry: Banking & Lending

Website: www.santander.com

Screenshot via www.santander.com

Screenshot via www.santander.com -

Nordea ranks 7th in the list of the largest financial service companies in Denmark. They have a presence in 17 countries, including their four Nordic home markets of Denmark, Finland, Norway, and Sweden, which together have the world's tenth largest economy.

They have lofty goals for Nordea, and together they are shaping the future of banking. Their industry is being challenged. Their customers' requirements are changing. They are evolving. That is why they require enthusiastic individuals who enjoy learning and growing. Because whether you want to be a leader or a specialist in technology, finance, or compliance, transformation happens through small changes every day.

As part of Nordea, you’ll be supporting individuals, families, small start-ups and big companies and institutions. You’ll experience that together they play an important part in society and that their choices – big or small – really matter. Their vision is to be a strong and personal financial partner for their customers, and they are all here to create value for them.

They are a Nordic universal bank with 200 years of experience in the industry. Their business performance is directly related to the engagement of their employees. Every day, their people are their most valuable asset in front of their customers. They must make sound decisions and provide customers with appropriate solutions. The formula is simple: happy people make happy customers.

Founded: 1820

Headquarters: Helsinki, Finland

Size: 10000+ Employees

Industry: Banking & Lending

Website: www.nordea.com

Screenshot via www.nordea.com

Screenshot via www.nordea.com -

Danske Bank is a Nordic bank with strong local roots and bridges to the rest of the world. For more than 145 years, they have helped people and businesses in the Nordics realise their ambitions. Danske Bank has more than 19,000 employees in 16 countries around the world who serve their 3.4 million personal, business and institutional customers. In addition to banking services, they also offer life insurance and pension, mortgage credit, wealth management, real estate and leasing services.

Den Danske Landmandsbank, Hypothek- og Vexelbank I Kjbenhavn ("The Danish Farmers' Bank, Mortgage and Exchange Bank of Copenhagen"), often known as Landmandsbanken ("the Farmers' Bank"), was established on October 5, 1871. The bank's previous name was Den Danske Bank ("The Danish Bank") until 2000, when the current name was chosen.

Danske Bank's market capitalization was $17.22 billion in April 2023. Danske Bank is the 964th most valuable corporation in the world based on market capitalization. According to the most recent financial reports from Danske Bank, the company's current revenue (TTM) is $6.30 billion. In 2021, the company generated $7.41 billion in revenue, up from $7.22 billion in 2020.

Founded: 1871

Headquarters: Copenhagen, Denmark

Size: 10000+ Employees

Industry: Banking & Lending

Website: danskebank.com

Screenshot via danskebank.com

Screenshot via danskebank.com -

Pleo is the budgeting solution for forward-thinking teams all over the world. Thousands of businesses across Europe benefit from their smart business cards. Pleo was founded in 2015 in Copenhagen by fintech veterans Jeppe Rindom and Niccolo Perra. Both were early members of the successful start-up Tradeshift and had experienced the agony of expense management. As a result, they created something better.

Pleo Financial Services A/S issues the Pleo Card under a license from Mastercard International Incorporated. Mastercard International Incorporated's registered trademarks include Mastercard and the Mastercard Brand Mark. Pleo Financial Services A/S is a regulated Electronic Money Institution that is licensed by the Danish Financial Supervisory Authority.

Team Pleo is made up of over 1000 dedicated individuals from over 55 different countries. They're dispersed around the world, but they get together on a regular basis for company-wide Team Camps. They have a goal of making everyone feel valued at work, and it all starts with their team.

Pleo is made up of 800+ dedicated individuals who are all on a mission to become the go-to spend solution for forward-thinking teams worldwide. They're honored to have over 25,000 customers join them on their journey, and they're eager to expand into (even) more markets. However, they require your assistance.

Founded: 2015

Headquarters: Copenhagen, Hovedstaden, Denmark

Size: 201 to 500 Employees

Industry: Banking & Lending

Website: https://www.pleo.io/en

Screenshot via pleo.io

Image by Pleo via pleo.io -

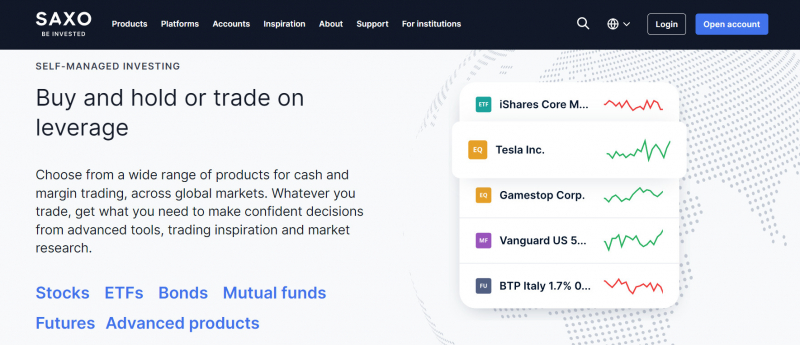

Saxo Bank is a Danish investment bank that provides online trading and investment services. This is a leading European retail brokerage. Saxo Bank is privately owned, founded in 1992, and headquartered in Copenhagen.

Saxo Bank is considered a safe exchange because it is supervised by more than 10 financial regulators, including the UK's leading regulator, the FCA. Saxo Bank has a very good research service; they constantly provide trading ideas. Saxo Bank's trading platform is also quite strong. This exchange has a wide portfolio of forex, bonds, options, etc. However, Saxo Bank's transaction fees are quite high, and the time to open an account is not short.

Saxo Bank is licensed by the UK Financial Conduct Authority (FCA) with license number 551422, providing protected interests of up to £50,000 to investors through the Service Compensation Scheme (FSCS). To open a Saxo Bank account, you need a minimum of £500.

At Saxo Bank, there are 2 groups of accounts: Saxo Bank accounts and corporate accounts. Both of these groups include three types of accounts: classic, platinum, and VIP. The difference between these 3 account types is the minimum deposit, and when customers open Platinum and VIP accounts, they will enjoy a better transaction fee structure as well as more special care.

Founded: 1992

Headquarters: Copenhagen, Denmark

Size: 1001 to 5000 Employees

Industry: Investment & Asset Management

Website: home.saxo

Screenshot via home.saxo

Screenshot via home.saxo