Acorns

Acorns is an online investing platform that aims to make investing more accessible to everyday individuals. The company was founded in 2012 and is headquartered in Irvine, California.

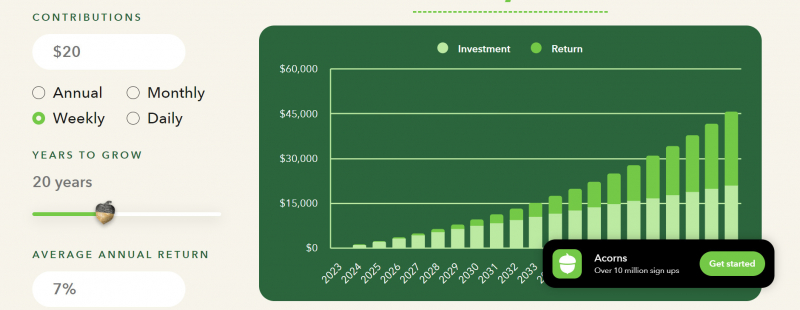

Acorns is a unique platform in that it focuses on micro-investing, which allows clients to invest small amounts of money on a regular basis. The platform rounds up each of the client's debit or credit card transactions to the nearest dollar and invests the difference into a diversified portfolio of ETFs.

In addition to micro-investing, Acorns also offers a range of investment options, including individual stocks and ETFs. The platform also offers a robo-advisory service called Acorns Later, which creates a retirement account for clients and automatically invests their contributions based on their retirement goals and time horizon.

Acorns also offers a cash management account called Acorns Spend, which provides clients with a checking account, a debit card, and a high-yield savings account. The account also offers features like instant funding, mobile check deposit, and fee-free ATM withdrawals.

Pros

- Automatically invests spare change.

- Cash back at select retailers.

- Educational content available.

Cons

- High fee on small account balances.

Google rating: 4.5/5.0

Fees: $3 - $5 per month

Website: https://www.acorns.com/