SoFi

SoFi, short for Social Finance, is an online personal finance company that offers a range of financial services to its members. The company was founded in 2011 and is headquartered in San Francisco, California.

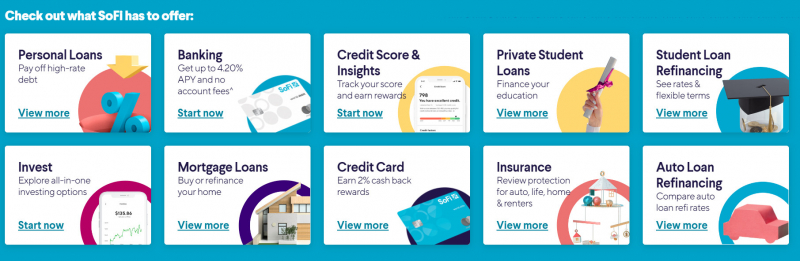

SoFi offers a variety of financial services, including student loan refinancing, personal loans, home loans, investing, and banking. In addition to traditional financial products, the company also offers a range of member benefits, including career coaching, financial planning, and exclusive events.

One of the unique features of SoFi is its focus on community and member benefits. The company aims to create a community of like-minded individuals who are interested in improving their financial well-being. Members can connect with each other through the platform and attend exclusive events and experiences.

SoFi's investment platform offers a range of investment options, including stocks, ETFs, and cryptocurrency. The platform also offers a robo-advisory service called SoFi Automated Investing, which creates a diversified portfolio for clients based on their investment goals, risk tolerance, and time horizon.

Pros

- Broad range of low-cost investments.

- Free management.

- Automatic rebalancing.

- Customer support.

- Access to certified financial planners.

Cons

- Limited account types.

- No tax-loss harvesting.

Google rating: 4.9/5.0

Fees: $0 for stocks, $0 for options contracts

Website: https://www.sofi.com/