Charles Schwab

Charles Schwab is a financial services company that provides a range of investment services and products to its clients. The company was founded in 1971 and is headquartered in San Francisco, California.

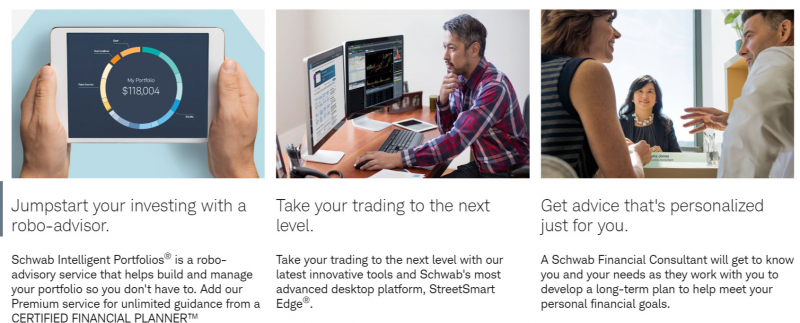

Charles Schwab offers a variety of investment options, including stocks, bonds, mutual funds, ETFs, and options trading. The platform also offers a robo-advisory service called Schwab Intelligent Portfolios, which creates a diversified portfolio for clients based on their investment goals, risk tolerance, and time horizon.

In addition to investment services, Charles Schwab also offers a range of research and educational resources to help clients make informed investment decisions. These resources include market analysis, news updates, and educational articles and videos.

Charles Schwab offers a range of account types, including individual and joint brokerage accounts, traditional and Roth IRA accounts, education savings accounts, and small business retirement accounts. The platform also offers a cash management account called Schwab Bank High Yield Investor Checking, which provides clients with a high-yield checking account and a debit card with no account fees or ATM fees.

Pros

- Three platforms with no minimum or fees.

- Above-average mobile app.

- Extensive research.

- Large fund selection.

- Commission-free stock, options and ETF trades.

Cons

- Low default cash sweep rate.

Google rating: 5.0/5.0

Fees :$0 stock and ETF trades

Website: https://www.schwab.com/