Top 10 Best Books On Accounting

Whether you're a sole proprietor, a new bookkeeper, or an experienced CPA, having the correct accounting records can assist ensure that your finances are in ... read more...order. If you want to excel in business, you must be financially literate and have strong accounting abilities. Accounting expertise is essential for everything from tax planning to making sound financial decisions. With so many accounting books available, we selected the best books on accounting that are both practical and readable.

-

The author, Mike Michalowicz co-founded Profit First Professionals, a membership association of accountants, bookkeepers, and business coaches that teach the Profit First method. He is a former Wall Street Journal writer, a prominent speaker, and has spoken about business and entrepreneurship at TEDx, creativeLIVE, INCmty, and other events. He is the author of The Toilet Paper Entrepreneur and The Pumpkin Plan. Entrepreneur Magazine, Open Forum, and Harvard Business Review have all published his columns. In this book, the author proposes a simple, counterintuitive cash management strategy that will help small businesses break free from the doom spiral and reach quick success.

Traditional accounting employs the logical (albeit incorrect) formula: Sales - Expenses = Profit. The difficulty is that businesses are controlled by people, and people aren't always logical. Serial entrepreneur Mike Michalowicz has created a behavioral accounting system that flips the formula: Sales - Profit = Expenses. Just as the most effective weight loss method is to limit portions by using smaller plates, Michalowicz demonstrates how entrepreneurs can change their firms from cash-eating monsters to successful cash cows by prioritizing profit and allocating only what remains for expenditures. Readers will discover using Michalowicz's Profit First system:

- By looking at bank account balances, you may simplify accounting and make it easier to maintain a profitable business by following four easy concepts.

- A small, profitable business can be worth much more than a large, unprofitable business.

- Businesses that achieve early and sustained profitability have a better chance of achieving long-term growth.

Michalowicz offers the game-changing roadmap for any entrepreneur to get the money they always dreamed of, with dozens of case studies, practical, step-by-step instruction, and his characteristic sense of humor. Profit First is exactly among the best books on accounting.

“Quit being a slave to your own business and start making some serious money. Follow Mike’s counter-intuitive advice and put profits first.”- VERNE HARNISH, author of Scaling Up

Author: Mike Michalowicz

Link to buy: https://www.amazon.com/gp/aw/d/073521414X/

Ratings: 4.8 out of 5 stars (from 6378 reviews)

Best Sellers Rank: #1,216 in Books

#1 in Financial Accounting (Books)

#1 in International Accounting (Books)

#1 in Private Equity (Books)

https://www.amazon.com/

https://www.amazon.com/ -

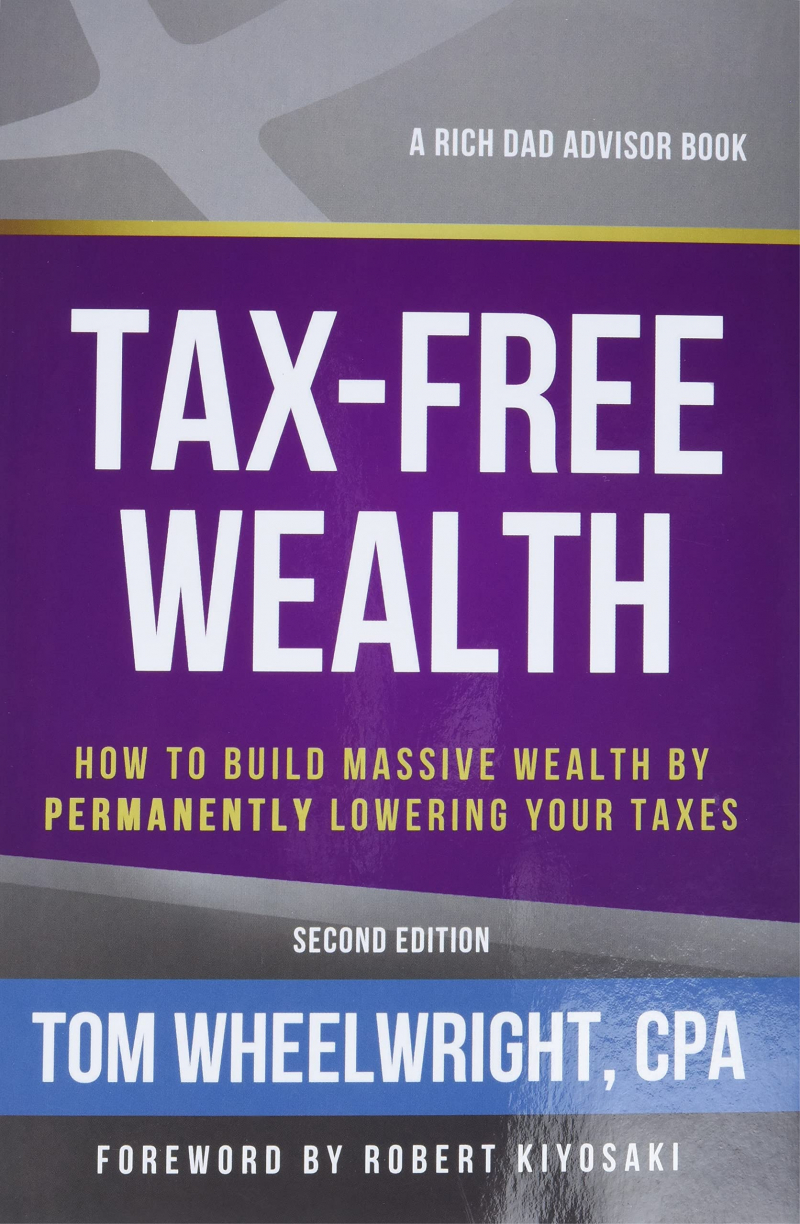

The author, Tom Wheelwright, CPA, is the driving force behind WealthAbility, the world's leading Tax-Free Wealth movement that serves businesses and investors all over the world. Tom has been responsible for inventing new tax, business, and wealth consulting and strategy services for premium clients for the past 22 years as the founder and CEO. Tom is a well-known platform speaker and wealth education pioneer, as well as a prominent expert and published author on partnership and corporate tax solutions. Donald Trump chose Tom to be a part of his Wealth Builders Program, calling him the "best of the best."

Tax-Free Wealth is about tax preparation and how to use tax rules to your advantage. Tom discusses how tax laws work and how they are intended to lower your taxes rather than raise them. The book discusses how to use tax rules to your benefit and to help business owners' vision and growth plans for their businesses.

Once listeners understand the fundamental principles of tax reduction, they can begin lowering their taxes right away, with the goal of eventually being able to legally remove income taxes and dramatically cut other taxes.

Author: Tom Wheelwright

Link to buy: https://www.amazon.com/gp/aw/d/1947588052/

Ratings: 4.7 out of 5 stars (from 3309 reviews)

Best Sellers Rank: #1,618 in Books

#1 in Personal Taxes (Books)

#1 in Tax Law (Books)

#2 in Business Law (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Kenneth W. Boyd has 30 years of accounting and financial services experience. He is a four-time Dummies book author, a blogger, and a video host on accounting and finance topics. Accounting All-in-One For Dummies by Kenneth W. Boyd is one of the best books on accounting you should read.

It's your fortunate day if you like numbers! Accounting employment are on the rise, with the Bureau of Labor Statistics predicting an 11 percent increase in the industry through 2024. So, if you want long-term work security while still pursuing your passion, establishing a career in accounting will tip the scales in your favor.

Accountants do not always work alone behind a desk at a bank. Auditing, budget analysis, financial accounting, management accounting, tax accounting, and other areas are available. Accounting All-in-One For Dummies has top-tier content drawn from multiple previously released books. It will assist you in excelling in whatever specialty you wish to conquer in the great world of accounting. You'll also have free online access to a quiz for each section of the book.

- Financial statements report

- Make wise business decisions.

- Financial fraud must be audited and detected.

- Managing money and making purchase decisions

- Online subject quizzes are available for free.

This book covers it all, whether you're a student learning the application of accounting theory or a professional seeking for a reliable desktop reference.

Author: Kenneth W. Boyd

Link to buy: https://www.amazon.com/Accounting-All-Dummies-Online-Practice/dp/1119453895/

Ratings: 4.5 out of 5 stars (from 1345 reviews)

Best Sellers Rank: #6,017 in Books

#1 in Personal Finance Software (Books)

#1 in Accounting (Books)

#2 in Business Accounting Software Computer

kobo.com

amazon.in -

Among the best books on accounting, (ISC)2 CISSP Certified Information Systems Security Professional Official Study Guide & Practice Tests Bundle were written by Mike Chapple, James Michael Stewart and Darril Gibson.

Mike Chapple, Ph.D., CISSP, is a University of Notre Dame Teaching Professor of IT, Analytics, and Operations. Mike worked with the National Security Agency's information security research branch for four years before joining the United States Air Force as an intelligence officer. Mike's website, CertMike.com, offers cybersecurity certification resources.

For nearly thirty years, James Michael Stewart, CISSP, CEH, CHFI, and Security+ has worked with technology. His work is mostly concerned with security, certification, and various operating systems. Michael has recently begun teaching job skill and certification courses including CISSP, ethical hacking/penetration testing, computer forensics, and Security+. He has written various publications, books, and courseware.

Darril Gibson, CISSP, is the CEO of YCDA, LLC. He regularly writes and advises on a wide range of technical and security topics and holds a number of additional certifications such as MCSE, MCDBA, MCSD, MCITP, ITIL v3, and Security+. He has written or cowritten over 30 novels.

This value-packed set for the serious CISSP certification candidate combines the best-selling (ISC)2 CISSP Certified Information Systems Security Professional Official Study Guide, 9th Edition with an updated and refined collection of Practice Exams to provide you with the best preparation for the high-stakes CISSP Exam ever.

The current 2021 CISSP Body of Knowledge has been thoroughly revised in the (ISC)2 CISSP Study Guide, 9th Edition. This best-selling Sybex study book covers every exam objective. Sybex's expert content, real-world examples, tips on passing each area of the exam, access to the Sybex online interactive learning environment, and much more will help you prepare for the exam smarter and faster. Use key topic test fundamentals and chapter review questions to reinforce what you've studied.

You also get access to Sybex's superior online interactive learning environment, which includes four practice exams, each with 125 unique questions to help you identify where you need to study more, more than 1000 Electronic Flashcards to reinforce your learning and give you last-minute test prep before the exam, and a searchable glossary in PDF to give you instant access to the key terms you need to know for the exam.

Add to that the updated (ISC)2 CISSP Certified Information Systems Security Professional Official Practice Tests, 3rd edition, which includes four more complete 125-question examinations and 100 additional questions for each of the eight domains, and you'll be as prepared as you can be for the CISSP exam.

All of the practice questions in both books have been vetted again for 2021 by numerous CISSPs and instructors, with only the best questions from prior editions remaining, ensuring that the questions you practice with provide you with the greatest possible preparation.

Because each book covers all of the exam topics, you'll be prepared for:

- Asset Protection and Risk Management

- Architecture and Engineering for Security

- Identity and Access Management in Communication and Network Security (IAM)

- Security Evaluation and Testing

- Operations of Security

- Security in Software Development

Author: Mike Chapple, James Michael Stewart and Darril Gibson

Link to buy: fado.vn

Ratings: 4.7 out of 5 stars (from 494 reviews)

Best Sellers Rank: #5,545 in Books

#1 in Computer Networking (Books)

#2 in Financial Auditing (Books)

#3 in Computer Network Security

fado.vn

lazada.sg -

Do you wish to learn the principles of financial and managerial accounting as a student? Are you a business owner who wishes to run a successful and profitable operation? Do you work in finance and need to understand financial statements? Then you must have Accounting QuickStart Guide. It is one of the best books on accounting for beginners

Meet Josh Bauerle, a reluctant accounting student turned super CPA and third-edition author of the Accounting QuickStart Guide. This groundbreaking book skillfully simplifies accounting concepts and is a vital resource for accounting students, business owners, bookkeepers, and other financial and record keeping professionals throughout the world! This book will be invaluable on your journey, whether you are a business owner trying to improve your bottom line or an accounting student looking to improve your grade.

Why is this book so popular among accounting students, business owners, and finance professionals? The Accounting QuickStart Guide debunks the idea that accounting is boring, thick, and difficult to master. Josh Bauerle simplifies accounting's key principles with amusing stories and examples, as well as clarifying graphics and practice problems—all of which work together to give learners with a road to fast and successful mastery of the content.

IMPORTANT INFORMATION:

- FOR BUSINESS OWNERS: Learn how to manage your cash flow, audit your company, and enhance your earnings. In an easy-to-read, instructive manner, the Accounting QuickStart Guide will teach you the crucial insights to increase your bottom line.

- FOR STUDENTS OF ACCOUNTING: Learn the essential principles of financial and managerial accounting in a fun and informative way that you won't find in a textbook. Through practical, real-world situations, learn essential accounting topics such as the fundamental accounting equation, financial statements, managerial accounting, and more. Use the Accounting QuickStart Guide to enhance existing high school, undergraduate, or graduate course material.

You'll Discover:

- Classic Double-Entry Accounting's Logic and Methods!

- Business Entity Types: Benefits, Drawbacks, and Financial Statements!

- Financial Accounting Principles, Managerial Accounting Principles, and Tax Accounting Principles!

- Accounting Standards and Why They Matter!

- How to Fraud-Proof Your Company Using Simple Accounting Techniques!

Workbooks, cheat sheets, calculators, reference guides, chapter summaries, and other online resources are included in each book.

Author: Josh Bauerle CPA

Link to buy: https://www.amazon.com/Accounting-QuickStart-Guide-Simplified-Professionals/dp/1945051795/

Ratings: 4.5 out of 5 stars (from 831 reviews)

Best Sellers Rank: #5,087 in Books

#1 in Accounting Standards (Books)

#1 in Managerial Accounting (Books)

#1 in Small Business Taxes (Books)

https://www.amazon.com/

https://www.amazon.com/ -

The author, David McKnight, earned an honors degree from Brigham Young University in 1997. Over the last two decades, David has assisted hundreds of Americans in reaching the zero percent tax rate. He has been frequently on Bloomberg Radio, in Investors Business Daily, and in national outlets such as the New York Times and Reuters. The Power of Zero, his best-selling book, has sold over 250,000 copies. He educates hundreds of financial advisors from across the country who specialize in The Power of Zero retirement approach as the President of David McKnight & Company.

According to David McKnight, a gigantic freight train is barreling down on the average American investor, and it's called increased taxes. The US government has made trillions of dollars in unfilled commitments for programs like Social Security and Medicare, and the only way to fulfill these pledges is to raise taxes. Some experts have even recommended that tax rates should be doubled simply to keep our country afloat. Unfortunately, if you're like most Americans, you've put the majority of your retirement funds in tax-deferred accounts such as 401(k)s and IRAs. How much of your hard-earned money will you be able to keep if tax rates rise?

McKnight's The Power of Zero gives a succinct, step-by-step roadmap for reaching the 0% tax bracket by the time you retire, thus eliminating tax rate risk from your retirement picture. McKnight has updated the book in this edition with a new chapter on the 2017 Tax Cuts and Jobs Act, telling readers how to negotiate the new tax code in its first year of implementation and how to extend the life of their retirement funds by taking advantage of it now.

Author: David McKnight

Link to buy: https://www.amazon.com/Power-Zero-Revised-Updated-Retirement/dp/1984823078/

Ratings: 4.7 out of 5 stars (from 1886 reviews)

Best Sellers Rank: #6,136 in Books

#2 in Personal Taxes (Books)

#10 in Accounting (Books)

#18 in Retirement Planning (Books)

https://www.amazon.com/

insurancequotes2day.com -

For nearly a decade, Darrell Mullis was the Director of Training and Development at Educational Discoveries, where he taught EDI's learning technology and built a training program for its trainers. Mullis has also instructed thousands of Americans in almost 300 of the phenomenally successful Accounting Game seminars. The Accounting Game is a straightforward, simple explanation of major financial accounting fundamentals.

Accounting may be a daunting profession. Whether you're a manager, business owner, aspiring entrepreneur, or taking a college accounting course, you'll find yourself needing to know the fundamentals...but befuddled by intricate accounting books. What if learning accounting was as easy and enjoyable as running a kid's lemonade stand? It can.

The Accounting Game delivers financial information in such a simple and unique way that you may forget you're learning skills that will help you get ahead! This book makes a boring subject enjoyable and clear by using the world of a child's lemonade business to teach the principles of financial management. As you run your stand, you'll learn and use financial words and ideas such as assets, liabilities, earnings, inventory, and notes payable, as well as:

- The interactive style allows you to gain hands-on experience.

- Color-coded charts and worksheets aid in the retention of crucial terms.

- With ease, the step-by-step method takes you from novice to expert.

- The use of a fun story structure aids in the memory of important concepts.

- Designed to help you apply what you've learned in the classroom to the real world.

The Accounting Game's groundbreaking technique transforms the tough disciplines of accounting and corporate finance into something you can simply learn, understand, remember, and apply!

Author: Darrell Mullis and Judith Orloff

Link to buy: https://www.amazon.com/dp/1402211864

Ratings: 4.6 out of 5 stars (from 1108 reviews)

Best Sellers Rank: #16,004 in Books

#6 in Education Funding (Books)

#7 in Financial Accounting (Books)

#123 in Finance (Books)

https://www.amazon.com/

https://www.amazon.com/ -

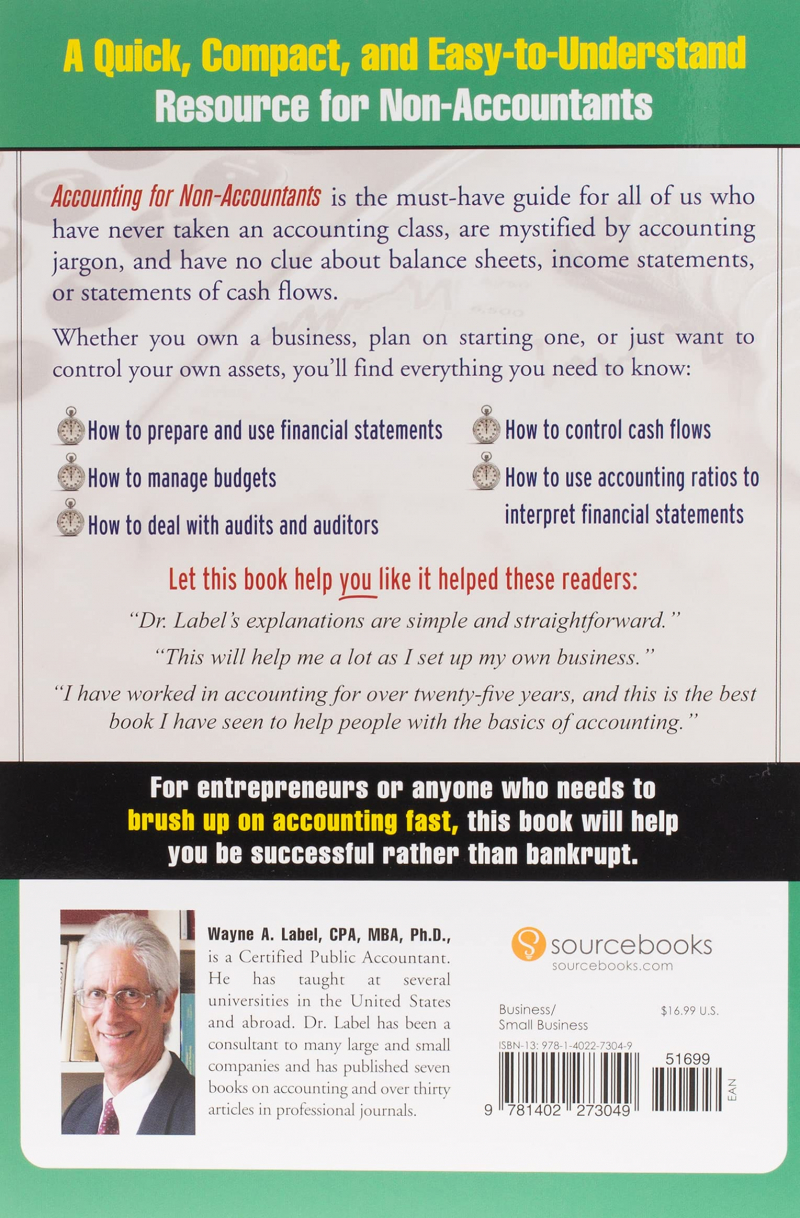

Dr. Wayne A. Label, CPA, MBA, PhD, is a Texas Certified Public Accountant. He has taught at many colleges in the United States and abroad, and he has written three accounting books and over 30 articles for professional journals.

Accounting for Non-Accountants is a quick, concise, and simple resource for non-accountants! It is the ideal financial accounting handbook for beginners and one of the best books on accounting.

Accounting for Non-Accountants is a must-read for anyone who has never taken an accounting class, is baffled by accounting jargon, and has no idea what balance sheets, income statements, payroll management, corporation taxes, or statements of cash flows are. This easy-to-use accounting book simplifies bookkeeping.

You'll find all you need to know whether you own a business, want to establish one, or simply wish to own your own assets:

- Financial statement preparation and use

- How to Manage Cash Flows

- Budget Management

- Accounting Ratios: How to Use Them

- How to handle audits and auditors' interpretation of financial statements

This book is ideal for entrepreneurs or anyone who needs to quickly brush up on their accounting skills.

Author: Wayne Label

Link to buy: https://www.amazon.com/dp/1402273045

Ratings: 4.5 out of 5 stars (from 627 reviews)

Best Sellers Rank: #17,177 in Books

#8 in Financial Accounting (Books)

#74 in Small Business (Books)

#348 in Business & Investing Skills

https://www.amazon.com/

https://www.amazon.com/ -

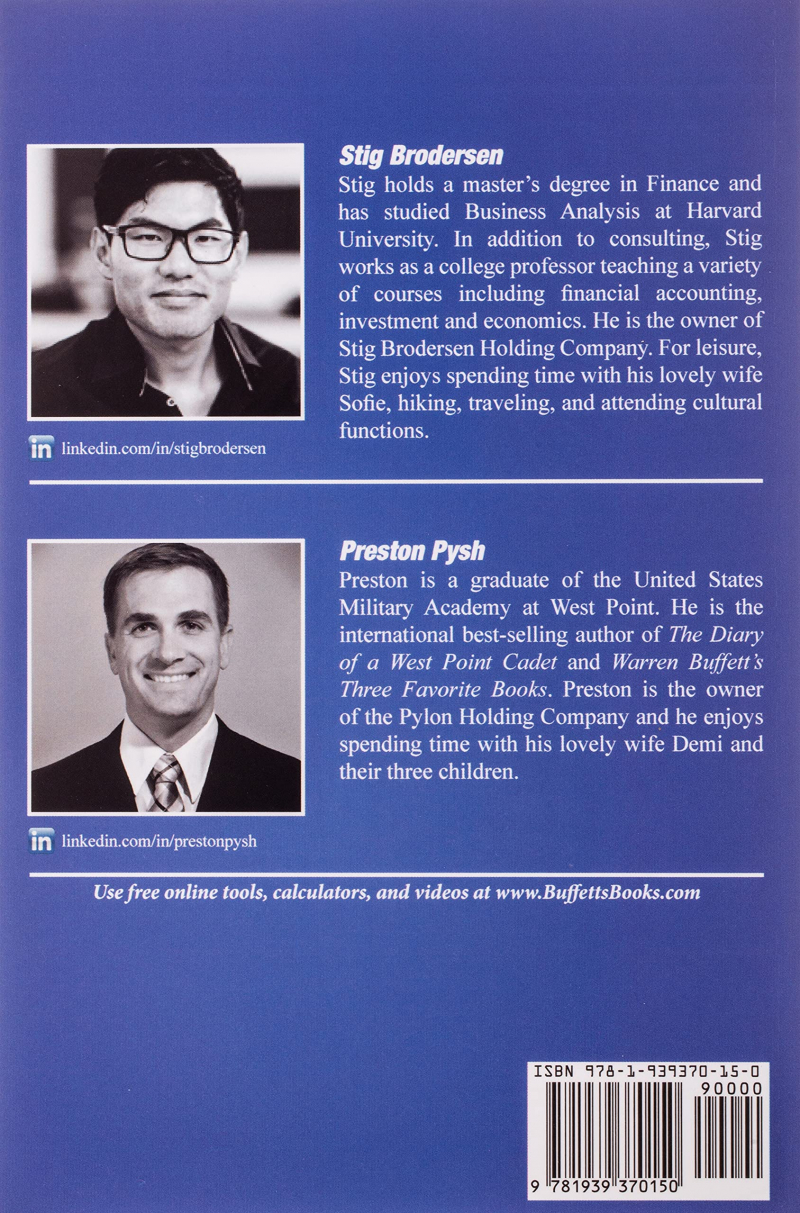

Preston Pysh is a business, investing, and leadership expert. His business podcast is ranked #1 on iTunes worldwide for stock investing and a variety of other topics. Preston is a top 100 business author on Amazon worldwide. His work has been translated into multiple languages, and he is a Forbes writer who writes about international finance and central banking.

Because Warren Buffett is well-known for his investment abilities, co-authors Stig Brodersen and Preston George Pysh's "Warren Buffett Accounting Book: Reading Financial Statements for Value Investing" focuses on accounting ideas to learn from this renowned investor himself. It's the second book of a three-book series that includes tactics for picking winning stocks.

Most importantly, the book teaches you how to calculate a company's value using two distinct methodologies. Furthermore, potential investors will learn how to interpret an income statement, balance sheet, and cash flow statement—all of which are important when determining which companies to include in their portfolio.

This book teaches:- Two methods for calculating a company's intrinsic value

- What exactly is a discount rate, and how does it operate?

- Step-by-step instructions for reading an income statement, balance sheet, and cash flow statement

- How to calculate critical ratios in order to properly value any business

Author: Stig Brodersen and Preston George Pysh

Link to buy: https://www.amazon.com/dp/1939370159

Ratings: 4.6 out of 5 stars (from 863 reviews)

Best Sellers Rank: #35,200 in Books

#9 in Managerial Accounting (Books)

#18 in Financial Accounting (Books)

#59 in Investment Analysis & Strategy

https://www.amazon.com/

https://www.amazon.com/ -

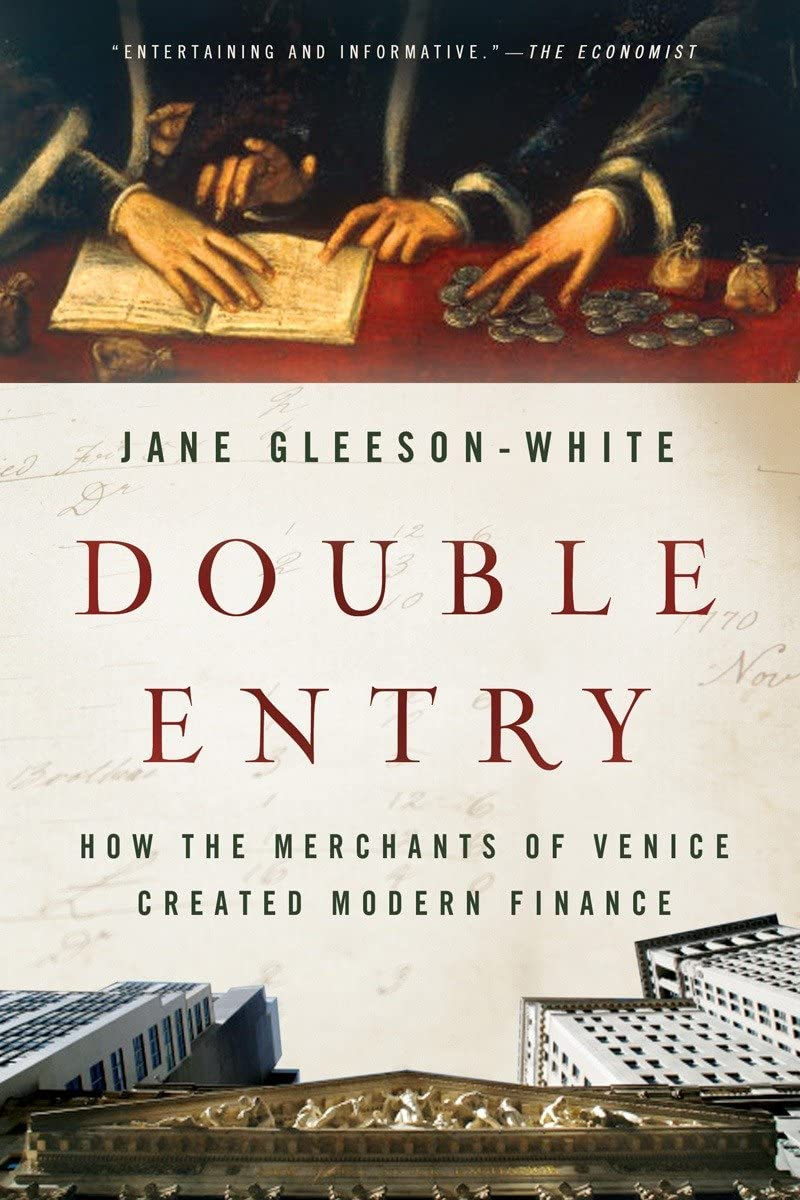

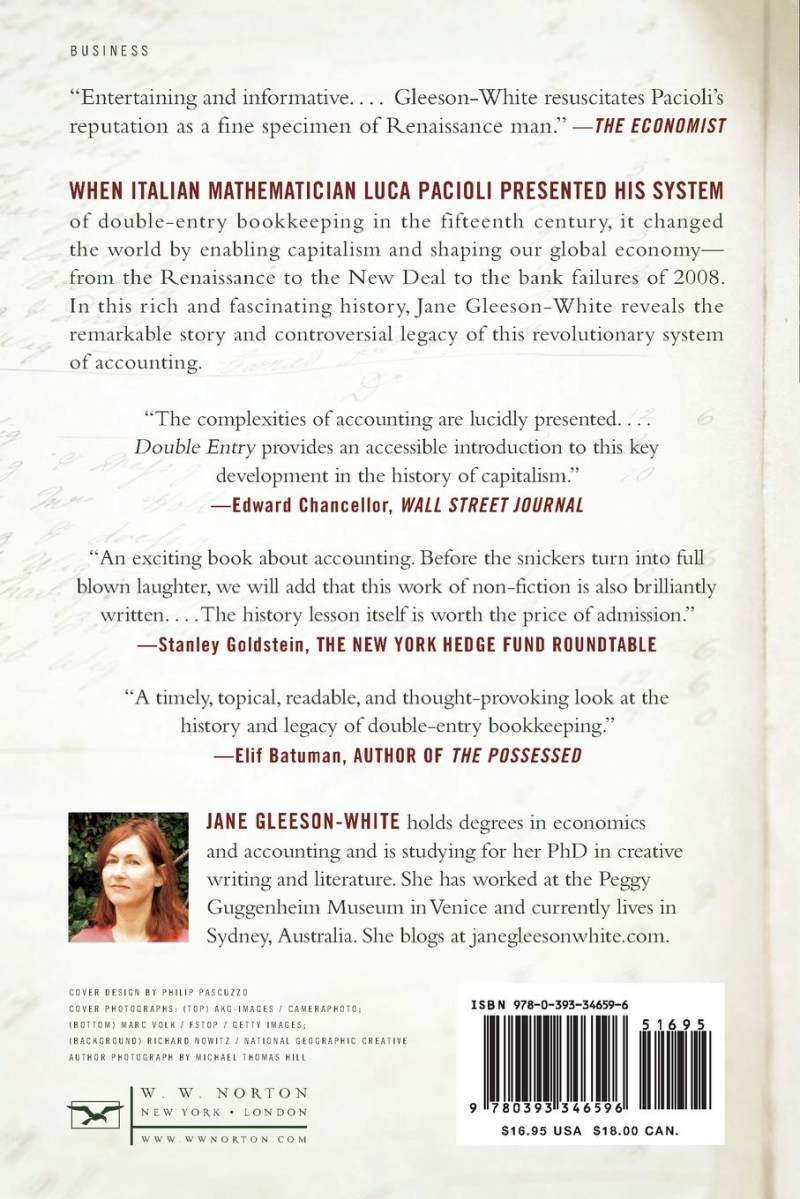

Double Entry by Jane Gleeson-White won the Waverley Library Award for Literature in 2012. Gleeson-White graduated from the University of Sydney with degrees in economics and literature.

Double Entry: How the Merchants of Venice Created Modern Finance, which received glowing reviews from The New Yorker, Publishers Weekly, and The Wall Street Journal, became an instant best book after winning the Nib Waverly Library Award2 for Literature in 2012. Double Entry, written by lifelong journalist and novelist Jane Gleeson-White, is a must-read for anyone who wants to better understand how those of us in the United States and Europe got up with the flavor of capitalism that we have now.

The fact that a book about the history of accounting won a literary award should tell you everything you need to know about Gleeson-skill White's as a storyteller. The plot begins around 7,000 B.C. and concludes with the 2008 financial crisis. If that seems like a lot to cover in one book, you'd be right; but, Gleeson-White manages it with such ease that it undercuts the intricate story being conveyed. Double Entry is an essential work of historical and economic significance, and its depiction of our economy's tremendous advancement over time provides enough of food for thought for those in and out of the accounting profession.

Author: Jane Gleeson-White

Link to buy: https://www.amazon.com/Double-Entry-Merchants-Created-Finance/dp/0393346595/

Ratings: 4.1 out of 5 stars (from 177 reviews)

Best Sellers Rank: #187,453 in Books

#145 in Financial Accounting (Books)

#156 in Small Business Bookkeeping (Books)

#256 in Italian History (Books)

https://www.amazon.com/

https://www.amazon.com/