Top 15 Best Books On Cryptocurrency

There are numerous approaches to creating digital currency. Cryptocurrencies are only one example. They are not interchangeable. The point of a cryptocurrency ... read more...is that its value is decided only by cryptography. A cryptocurrency, such as Bitcoin or Ethereum, is unrelated to anything. Its worth is established solely by the strength of mathematics, as its supporters argue. We give the best books on cryptocurrency for you to learn more about cryptocurrency.

-

Paul Vigna is a Wall Street Journal markets reporter who focuses on equities and the economy. He is a MoneyBeat columnist and anchor. Previously a writer and editor for DowJones Newswires' MarketTalk column, he has appeared on Fox Business Network, CNN, BBC, and the John Batchelor radio show. He has been interviewed by Bitcoin magazine and been on the Bitcoins & Gravy podcast, and he has 20 years of media experience in total.

Michael J. Casey is a Wall Street Journal columnist who covers global finance in his "Horizons" column. He contributes frequently to the Journal's MoneyBeat blog and co-writes the daily "BitBeat" with Paul Vigna.

Bitcoin became a household name overnight. It's a cyber-enigma with a rabid fan base that makes headlines and generates unending media debate. Although it appears that you may use it to buy anything from coffee to vehicles, few people seem to comprehend what it is. This begs the question, why should anyone be interested in bitcoin?

Wall Street writers Paul Vigna and Michael J. Casey provide the authoritative answer to this issue in The Age of Cryptocurrency. Cybermoney is ready to usher in a revolution, one that has the potential to reshape old financial and social systems while bringing billions of "unbanked" people into a new global economy. Cryptocurrency promises the promise of a financial system without a middleman, one that is controlled by the people who use it, and one that is immune to the devastation caused by a 2008-style crisis.

However, bitcoin, the most well-known of the cybermonies, has a reputation for insecurity, erratic fluctuations, and illegal activity; some think it has the potential to remove jobs and upend the concept of a nation state. Above all, it suggests massive and far-reaching change—for the better and for the worse. But it's here to stay, and you'd be foolish to ignore it.

Vigna and Casey explain the origins of bitcoin, its function, and what you need to know to navigate a cyber-economy. The world of digital currency will be quite different from the world of paper currency; The Age of Cryptocurrency will show you how to prepare.

Author: Michael J. Casey and Paul Vigna

Link to buy: https://www.amazon.com/dp/1250065631/

Ratings: 4.4 out of 5 stars (from 377 reviews)

Best Sellers Rank: #757,328 in Books

#125 in Financial Engineering (Books)

#597 in Money & Monetary Policy (Books)

#624 in Digital Currencies

https://www.amazon.com/

https://www.amazon.com/ -

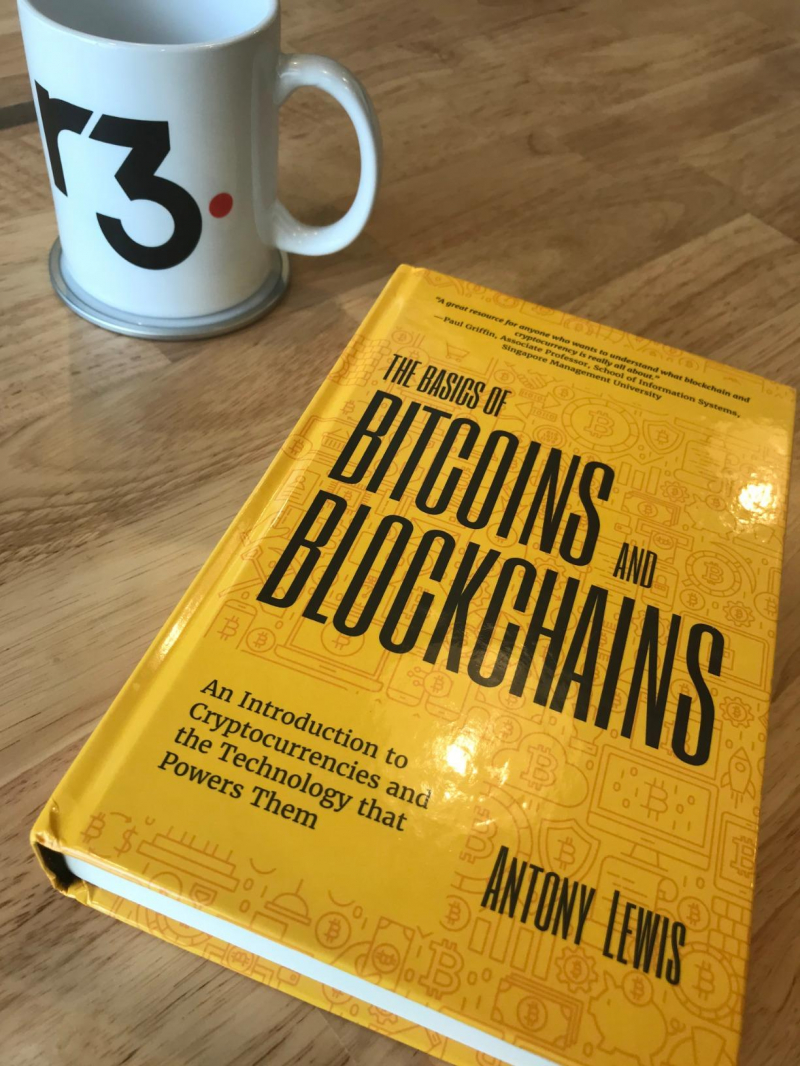

In 2013, Antony left a conventional banking profession in Singapore to join a small startup called itBit after attending a Bitcoin conference. itBit is a Bitcoin exchange and one of the first venture-capital-backed startups in the fledgling cryptocurrency market. Antony is now the author of The Basics of Bitcoins and Blockchains and blogs about cryptocurrencies and blockchains at www.bitsonblocks.net. As a Director at Temasek, he is in charge of bitcoin investments.

A lot has been written about bitcoin and blockchains. However, most of this information may be incomprehensible to the outsider. The Basics of Bitcoins and Blockchains is a concise introduction to this new money and the innovative technology that underpins it.

You will learn:

- Bitcoin, Ethereum, and other cryptocurrencies are examples of cryptocurrencies. Learn about a variety of Bitcoin subjects, such as the history of Bitcoin, the Bitcoin blockchain, and Bitcoin buying, selling, and mining. Learn how to make payments and how to value cryptocurrency and digital tokens.

- The blockchain technology What is a blockchain, how does it function, and why is it important? The Basics of Bitcoins and Blockchains answers these and other questions. Discover notable blockchain platforms, smart contracts, and other critical aspects of blockchains and their role in the evolving cyber-economy.

- Things to consider when purchasing cryptocurrencies. Discover reliable and unbiased information about Bitcoin investing and other cryptocurrencies. Learn about the risks and mitigations, how to spot frauds, and how to use cryptocurrency exchanges, digital wallets, and legislation.

Discover more about:

- How Blockchain Technology Works

- The cryptocurrency market's operations

- Evolution and prospective consequences on worldwide enterprises of Bitcoin and blockchains

You should read The Basics of Bitcoins and Blockchains to properly comprehend the technology.

Author: Antony Lewis

Link to buy: https://www.amazon.com/dp/1633538001/

Ratings: 4.5 out of 5 stars (from 1947 reviews)

Best Sellers Rank: #38,791 in Books

#4 in Natural Resource Extraction Industry (Books)

#8 in Derivatives Investments

#19 in Futures Trading (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Daniel Drescher is a seasoned banking specialist who has worked at a variety of banks in electronic security trading. His recent activities have centered on security trading automation, machine learning, and big data. Daniel earned a doctorate in econometrics from the Technical University of Berlin and an MSc in software engineering from the University of Oxford, among other qualifications.

Matthew Boston is a New York-based actor who has worked in theater, cinema, television, and voice-over for over thirty years. He attended the Mason Gross School of the Arts, Shakespeare & Company, and the Lee Strasberg Institute for acting.

You will understand the fundamentals of blockchain technology in 25 short stages. There are no mathematical formulas, program code, or computer science jargon. There is no prerequisite knowledge in computer science, mathematics, programming, or cryptography. Terminology is explained using illustrations, analogies, and metaphors.

Blockchain Basics bridges the gap between exclusively technical blockchain publications and purely business-focused blockchain books. It accomplishes this by describing the technical elements that comprise the blockchain as well as their function in business-relevant applications.

What You'll Discover:

- What exactly is blockchain?

- Why is it required, and what problem does it solve?

- Why is there so much buzz about blockchain and its potential?

- The main components and their functions

- Limitations, why they exist, and what has been done to overcome them Limitations, how various components of the blockchain work and interact

- Significant application scenarios

The book is for everyone who wants to understand what blockchain technology is, how it works, and how it may transform the financial system as we know it.

Author: Daniel Drescher

Link to buy: https://www.amazon.com/Blockchain-Basics-Non-Technical-Introduction-Steps-ebook/dp/B06XNWF5GP

Ratings: 4.5 out of 5 stars (from 556 reviews)

Best Sellers Rank: #277,014 in Kindle Store

#4 in Data Storage & Retrieval

#9 in Expert Systems

#26 in Artificial Intelligence Expert Systems

fado.vn

amazon.co.uk -

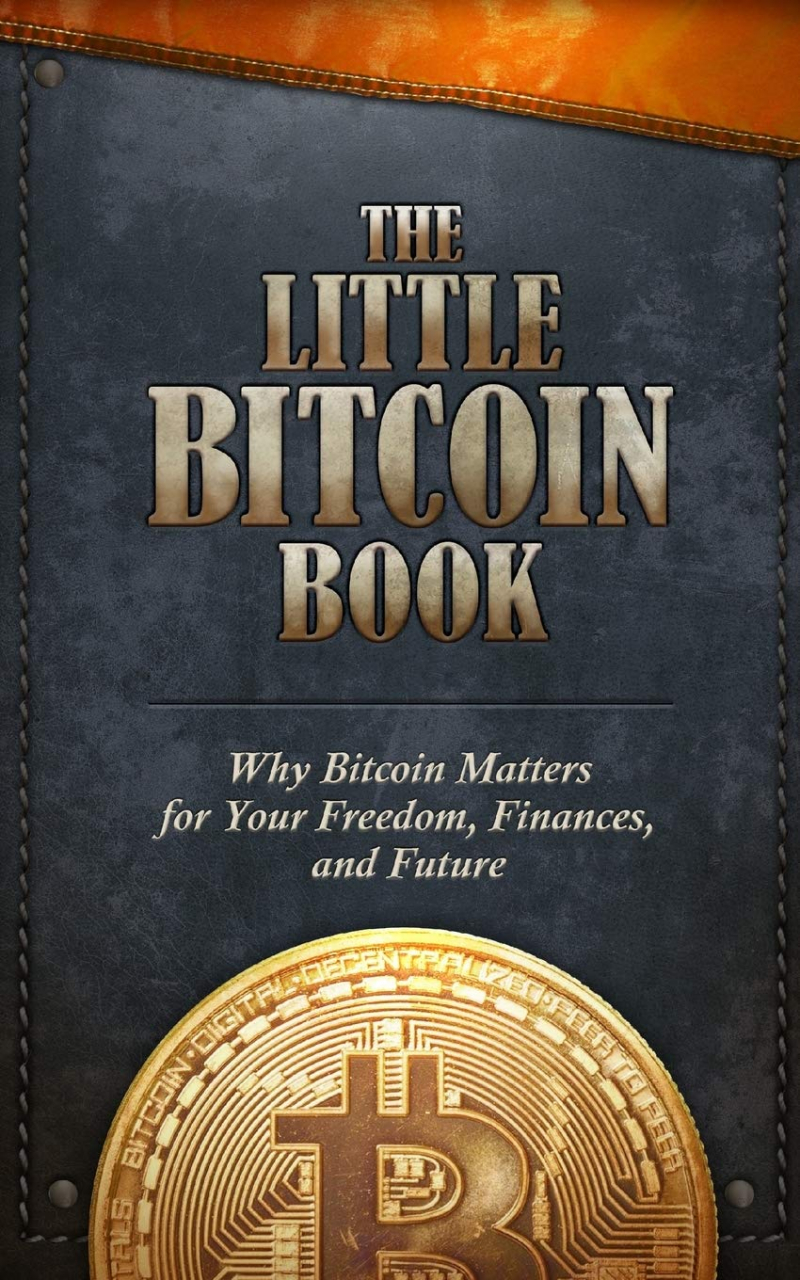

Jimmy Song is a Bitcoin Developer, Educator, and Entrepreneur. Jimmy is the author of The Little Bitcoin Book and Programming Bitcoin. He is also a Bitcoin Fellow at Blockchain Capital, a lecturer at the University of Texas, a speaker at Bitcoin conferences, an ardent open source contributor, mostly in Bitcoin, and the instructor of Programming Blockchain, a two-day class for programmers.

Luis Buenaventura began working in the Bitcoin industry in 2014 and now focuses on producing practical crypto solutions for the developing world through his firm BloomX. In 2017, he published "Reinventing Remittances with Bitcoin," a collection of methods and anecdotes about the rapidly increasing Bitcoin remittance industry.

You've most likely heard about Bitcoin in the news or through your friends or colleagues. Why does the pricing continually changing? Is Bitcoin a worthwhile investment? What value does it have? Why are people still talking about it as if it will change the world?

The Little Bitcoin Book explains what's wrong with money today and why Bitcoin was created as an alternative to the present system. It explains what Bitcoin is, how it works, why it's important, and how it affects people's individual freedom and opportunity all across the world, from Nigeria to the Philippines to Venezuela to the United States. This book also includes a Q&A section with answers to some of the most often asked Bitcoin questions.

If you want to understand more about this new kind of money, which is gaining popularity and acceptance around the world, this book is for you.

Author: Jimmy Song and Luis Buenaventura

Link to buy: https://www.amazon.com/Little-Bitcoin-Book-Matters-Finances-ebook/dp/B07W957N7T

Ratings: 4.6 out of 5 stars (from 494 reviews)

Best Sellers Rank: #540,708 in Kindle Store

#523 in Digital Currencies

#727 in General Technology & Reference

#1,110 in Finance (Kindle Store)

https://www.amazon.com/

https://www.amazon.com/' -

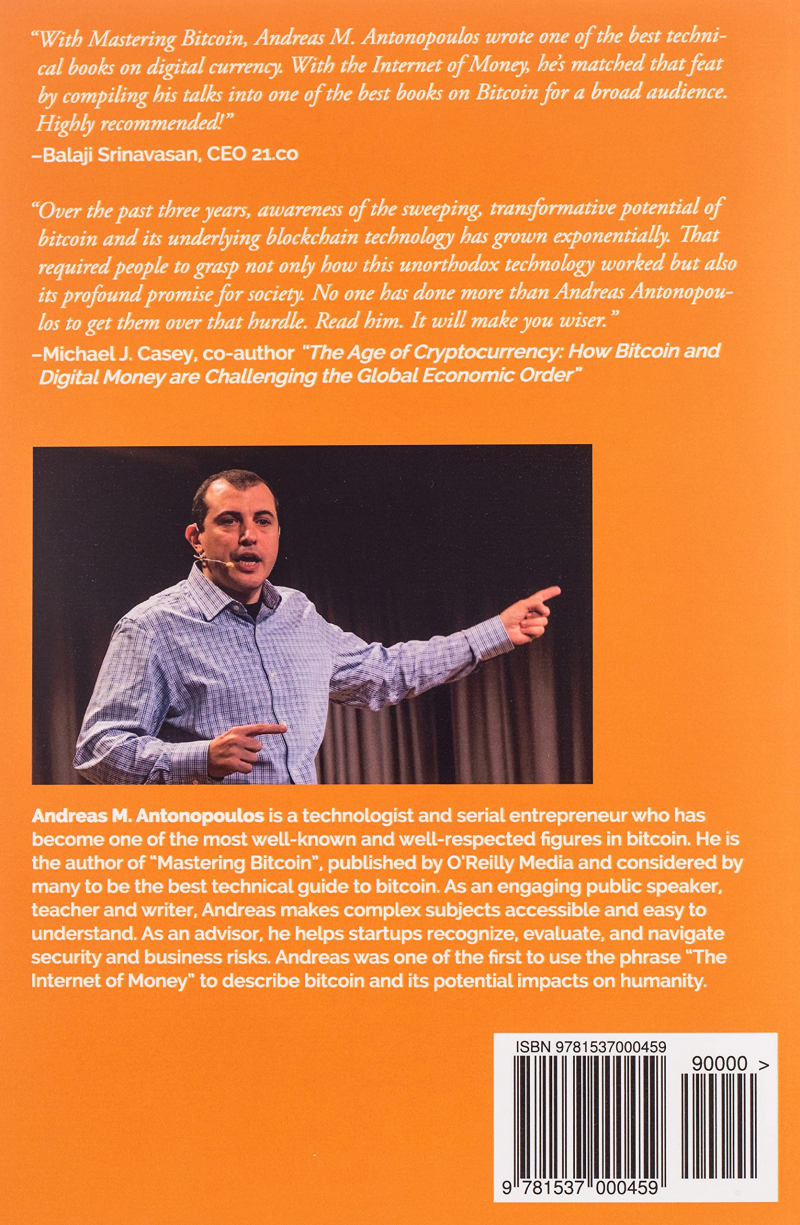

Andreas M. Antonopoulos is a serial entrepreneur and technologist who has become one of the most well-known and respected people in bitcoin. He is the author of Mastering Bitcoin, which was published by O'Reilly Media and is widely regarded as the greatest technical guide on bitcoin. Andreas makes complex issues approachable and understandable as an entertaining public speaker, teacher, and writer. As an advisor, he assists startups in identifying, evaluating, and navigating security and business issues.

While several publications explain how bitcoin works, The Internet of Money goes into why bitcoin works. Andreas M. Antonopoulos, acclaimed information-security expert and author of Mastering Bitcoin, discusses and contextualizes the significance of bitcoin in a series of essays covering the exciting growth of this technology.

Bitcoin, a technological innovation that was secretly introduced to the world in 2008, is revolutionizing much more than finance. Bitcoin is upending traditional sectors in order to provide financial independence to billions of people globally. Andreas demonstrates in this book why bitcoin is a financial and technological innovation with considerably greater potential than the moniker "digital currency."

Andreas goes beyond the technical aspects of the bitcoin network to illuminate the philosophical, social, and historical ramifications of bitcoin. As the internet has fundamentally changed how people interact around the world and has permanently impacted our lives in ways we could never have imagined, bitcoin, the internet of money, is fundamentally changing our approach to solving social, political, and economic problems through decentralized technology.

Author: Andreas M. Antonopoulos

Link to buy: https://www.amazon.com/Internet-Money-Andreas-M-Antonopoulos-ebook/dp/B01L9WM0H8

Ratings: 4.6 out of 5 stars (from 1211 reviews)

Best Sellers Rank: #76,889 in Kindle Store

#5 in Distributed Systems & Computing

#14 in Money & Monetary Policy (Kindle Store)

#37 in Computers & Technology (Kindle Store)

https://www.amazon.com/

https://www.amazon.com/ -

Bringing Down the House, written by BEN MEZRICH, earned 63 weeks on the New York Times bestseller list. His book The Accidental Billionaires: The Facebook Founding, a Tale of Sex, Money, Genius, and Betrayal debuted at #4 on the New York Times bestseller list and reached bestseller lists in over a dozen countries. The Social Network, based on the novel, was nominated for eight Academy Awards and won four Golden Globes, including Best Motion Picture.

The Accidental Billionaires, by Ben Mezrich, is the authoritative story of Facebook's founding and the foundation for the Academy Award-winning film The Social Network. Tyler and Cameron Winklevoss, identical twins, Olympic rowers, and foils to Mark Zuckerberg, are two of the story's most memorable characters. The story of the brothers' repentance and vengeance in the aftermath of their epic legal struggle with Facebook is told in Bitcoin Billionaires.

After their altercation with Zuckerberg, the brothers realize that no one will take their money as venture capitalists. While recuperating in Ibiza, they come across an eccentric character who informs them about a brand-new concept: cryptocurrency. Immersing themselves in what was then an esoteric and sometimes scary world, they begin to realize "crypto" is "either the next big thing or pure bulls—t," in their own words. There's nothing else to do but place a wager.

Bitcoin Billionaires will take us on a wild and surprising voyage while illuminating a fascinating economic future, from the Silk Road to the offices of the Securities and Exchange Commission. The Winklevoss brothers became the first bitcoin billionaires on November 26, 2017. Here's how they got there, as only Ben Mezrich could tell it.

Author: Ben Mezrich

Link to buy: https://www.amazon.com/Bitcoin-Billionaires-Genius-Betrayal-Redemption-ebook/dp/B07GN8HWZW

Ratings: 4.5 out of 5 stars (from 1868 reviews)

Best Sellers Rank: #86,211 in Kindle Store

#5 in E-Commerce (Kindle Store)

#6 in Venture Capital (Kindle Store)

#13 in E-Commerce (Books)

https://www.amazon.com/

https://www.amazon.com/ -

SAIFEDEAN AMMOUS, PHD, is a bitcoin-focused independent economist, author, and educator. On his website saifedean.com, he teaches bitcoin and economics classes in the Austrian school tradition.

In 2008, a pseudonymous programmer offered "a new electronic payment system that's totally peer-to-peer, with no trusted third party" to a small internet mailing group. Despite all odds, this upstart autonomous decentralized software presents an unstoppable and globally accessible hard money alternative to current central banks ten years later. The Bitcoin Standard examines the historical context of Bitcoin's growth, the economic qualities that have allowed it to grow rapidly, and the anticipated economic, political, and social repercussions.

While Bitcoin is a digital-age innovation, the problem it seeks to solve is as old as human society itself: transferring value across time and space. Author Saifedean Ammous takes the reader on a fascinating tour through the history of money-making technology, from early trading networks using limestones and seashells to metals, coins, the gold standard, and present government debt. Exploring what gave these technologies their monetary role, and how most of them lost it, gives the reader a good idea of what makes for sound money, and sets the stage for an economic discussion of its implications for individual and societal future-orientation, capital accumulation, trade, peace, culture, and art. Ammous convincingly demonstrates that the loftiest achievements of humanity have occurred in cultures that have benefited from sound monetary systems, and that monetary collapse has frequently accompanied civilizational collapse.

With this foundation established, the book proceeds to explain the working of Bitcoin in a functional and intuitive manner. Bitcoin is a decentralized, distributed piece of software that converts electricity and processing power into undeniably correct records, letting its users to use the Internet to fulfill traditional monetary activities without having to rely on or trust any physical authorities or infrastructure. As a result, Bitcoin is best understood as the first effectively deployed type of digital cash and hard money. With an automated and perfectly predictable monetary policy, as well as the ability to perform final settlement of large sums across the globe in a matter of minutes, Bitcoin's true competitive advantage may simply be as a store of value and network for the final settlement of large paymentsa digital form of gold with a built-in settlement infrastructure.

Ammous' excellent understanding of both technological potential and historical realities of monetary evolution makes for an intriguing investigation of the repercussions of voluntary free market money. Bitcoin, by challenging the most sacrosanct of government monopolies, pushes the pendulum of sovereignty away from governments and toward individuals, allowing us the enticing potential of a world where money is completely free of politics and borders.

The book's last chapter delves into some of the most frequently asked topics about Bitcoin: Is Bitcoin mining an inefficient use of resources? Is Bitcoin used by criminals? Who owns Bitcoin, and can they modify it whenever they want? How can Bitcoin be eradicated? And what to make of the dozens of Bitcoin forks and ostensibly useful implementations of Bitcoin's "block chain technology"? The Bitcoin Standard is a must-read for anybody interested in the growth of the Internet's decentralized, apolitical, free-market alternative to state central banks.

Author: Saifedean Ammous

Link to buy: https://www.amazon.com/Bitcoin-Standard-Decentralized-Alternative-Central/dp/1119473861

Ratings: 4.7 out of 5 stars (from 4966 reviews)

Best Sellers Rank: #2,245 in Books

#1 in Business Entrepreneurship

#1 in Banking (Books)

#2 in Money & Monetary Policy (Books)

fado.vn

crypto.news -

MATTHEW LEISING is a leading blockchain reporter who has been covering the new technology for Bloomberg News since 2015. His mastery of the underlying processes enables him to transform complex themes into simple narratives, whether it's about the connection between blockchain and Wall Street or the numerous frauds and questionable behaviors that plague crypto. Out of the Ether arose from his 2017 Bloomberg Markets Magazine piece "The Ether Thief."

Out of the Ether: Ethereum's Amazing Story and the $55 Million Heist That Almost Destroyed It It All presents the incredible story of the disappearance of $55 million in cryptocurrency ether in June 2016. It also follows the development of the Ethereum blockchain from its inception in the thoughts of founder Vitalik Buterin to the motley crew he collected around him to establish the second-largest crypto world after Bitcoin.

Matthew Leising, a well-known journalist and author, presents the entire tale of one of the most remarkable episodes in cryptocurrency history. He also discusses the aftermath of the robbery, emphasizing the tremendous measures taken by the victims of the theft and the Ethereum creators to mitigate the harm. The book has three covers:

- Ethereum's inception

- An explanation of the blockchain and cryptocurrency technologies

- The exploits of a diverse group of hackers, coders, investors, and robbers

Out of the Ether is a story of genius and greed that is so unbelievable that you may choose not to believe it. It is perfect for anyone with even a passing interest in the world of modern fintech or daring electronic heists. The book is considered one of the best books on cryptocurrency.

Author: Matthew Leising

Link to buy: https://www.amazon.com/Out-Ether-Amazing-Ethereum-Destroyed-ebook/dp/B08HSRLSCB

Ratings: 4.4 out of 5 stars (from 211 reviews)

Best Sellers Rank: #564,392 in Kindle Store

#154 in Online Trading

#222 in Banks & Banking (Kindle Store)

#341 in Online Trading E-commerce

amazon.co.uk

Photo: Trader Merlin's Youtube Channel -

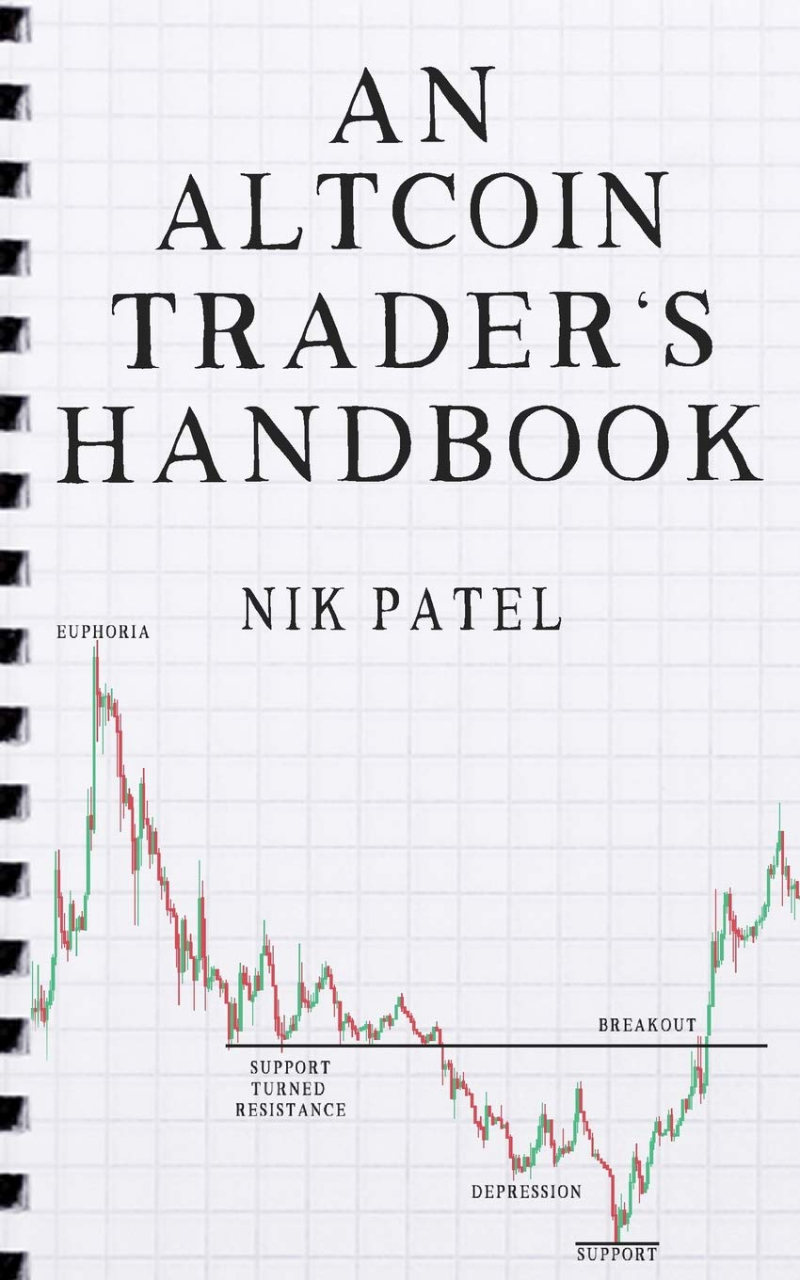

Nik Patel is a full-time cryptocurrency trader, investor, writer, and advisor. He has been interested in altcoin speculating since 2013, and has since amassed a sizable Twitter following, where he tweets his market insights alongside annotated charts and the occasional piece of shitposting. Okay, there was some shitposting. He enjoys Guinness and stimulating talk.

No doubt you saw or heard about the fervor that surrounded cryptocurrencies in 2017, and many of you may have dismissed them as a legitimate asset class; many may have felt a quiet interest but looming fear; and others undoubtedly felt drawn to the allure of cryptocurrencies and altcoins (and any of the other innumerable names) but lacked the framework required to tame this volatile and novel market. Toplist present to you An Altcoin Trader's Handbook.

The cryptosphere's exponential rise over the last half-decade has resulted in a multitude of life-changing speculative chances. Whereas traditional financial markets appear inaccessible and ineffective due to the prevalence of high fees and low returns, the emergence of a global market of decentralized alternatives to Bitcoin provides those unable (or unwilling) to navigate the often-slippery world of hedge funds and investment banks with the opportunity to achieve financial freedom.

Of course, this is no easy road, and this book makes no claim to be a get-rich-quick program of any kind. An Altcoin Trader's Handbook, on the other hand, combines nearly five years of tragicomic yet enlightening anecdotes about the ever-changing dynamics of the cryptosphere with a thorough technique for profitable altcoin speculation. The book focuses on maximizing capital's upside potential while minimizing downside risks, both of which are attainable with speculation on so-called'microcap' and 'lowcap' altcoins when adequate risk management is used. Above all, the reader will be informed in great detail about the three-stage method of inquiry, collection, and dissemination that has been the foundation of my own success in the sector. The road will be intense, at times arduous, but it will culminate in an individual who is best suited to capitalize on the world's greatest abundance of financial opportunity.

Author: Nik Patel

Link to buy: https://www.amazon.com/Altcoin-Traders-Handbook-Nik-Patel/dp/198617011X

Ratings: 4.5 out of 5 stars (from 468 reviews)

Best Sellers Rank: #350,427 in Books

#58 in Financial Engineering (Books)

#197 in Online Trading E-commerce

#305 in Money & Monetary Policy (Books)

https://www.amazon.com/

https://www.amazon.com/ -

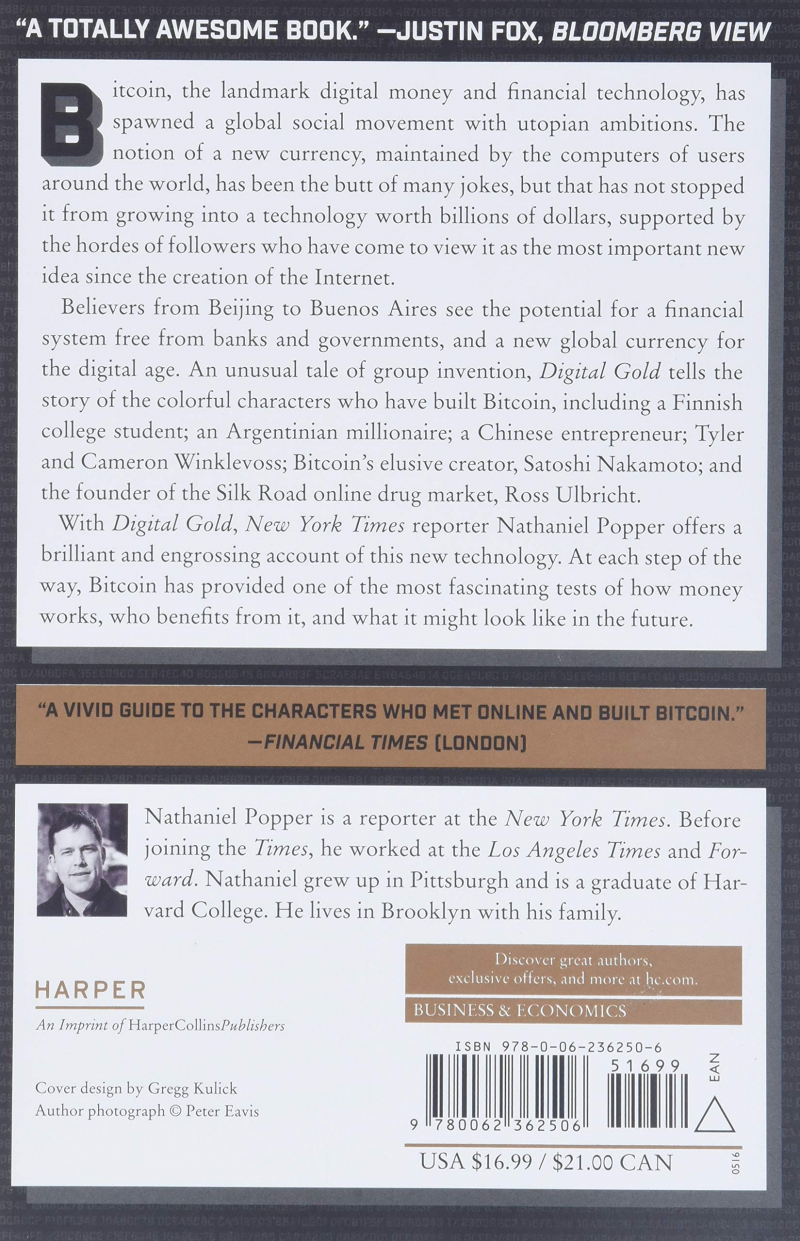

Nathaniel Popper is a New York Times reporter. He formerly worked at the Los Angeles Times and the Forward. Nathaniel was born in Pittsburgh and attended Harvard College.

A New York Times technology and business writer follows Bitcoin's meteoric development and the fascinating people working to create a new global currency for the Internet age.

Digital Gold is Nathaniel Popper's insightful and enthralling history of Bitcoin, the seminal digital currency and financial technology that created a global social movement. The book is regarded as one of the best books on cryptocurrency.

Many jokes have been made about the idea of a new currency maintained by the computers of users all over the world, but that hasn't stopped it from growing into a technology worth billions of dollars, supported by hordes of followers who have come to regard it as the most important new idea since the creation of the Internet. From Beijing to Buenos Aires, believers see the promise for a financial system free of banks and governments. Bitcoin has threatened to decentralize some of society's most basic institutions, making it more than just a tech sector fad.

Digital Gold is an unusual story of group invention that follows the rise of Bitcoin technology through the eyes of the movement's colorful central characters, including an Argentinian millionaire, a Chinese entrepreneur, Tyler and Cameron Winklevoss, and Bitcoin's enigmatic creator, Satoshi Nakamoto. Bitcoin has already resulted in unimaginable riches for some and prison sentences for others.

Author: Nathaniel Popper

Link to buy: https://www.amazon.com/Digital-Gold-Bitcoin-Millionaires-Reinvent/dp/006236250X

Ratings: 4.6 out of 5 stars (from 789 reviews)

Best Sellers Rank: #35,269 in Books

#30 in Digital Currencies

#37 in Money & Monetary Policy (Books)

#115 in E-commerce Professional (Books)

https://www.amazon.com/

https://www.amazon.com/ -

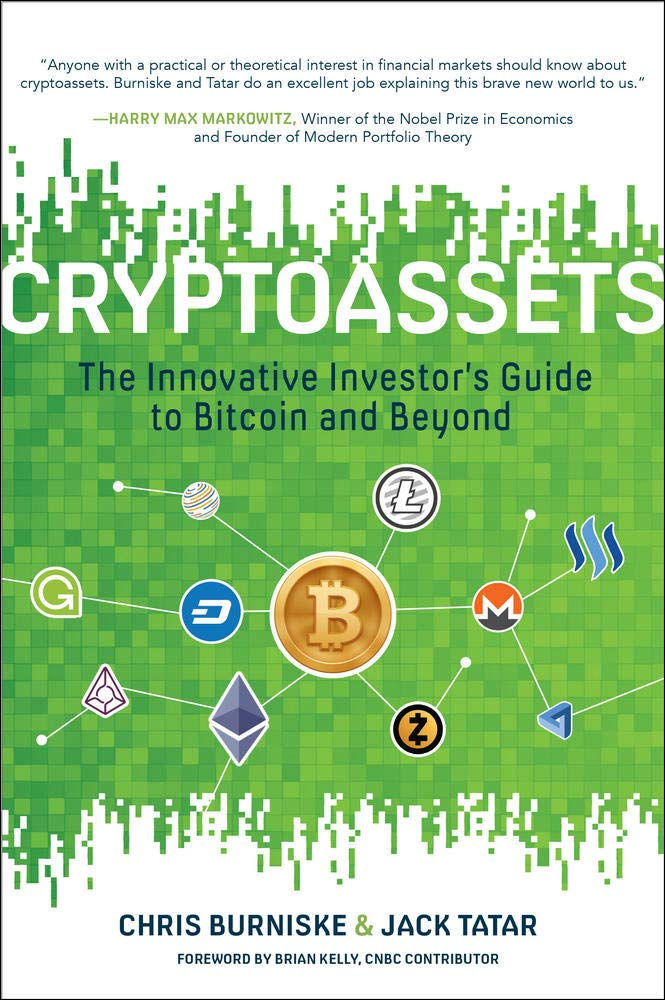

Chris Burniske is a cofounder of Placeholder Ventures, a cryptoasset-focused New York firm. Prior to joining Placeholder, he was the driving force behind ARK Investment Management's Next Generation Internet strategy, which helped the business become the first public fund manager to invest in bitcoin. He subsequently shifted his focus to cryptoassets solely, clearing the door for Wall Street to acknowledge it as a new asset class. His opinions have appeared in national media venues such as CNBC, the Wall Street Journal, the New York Times, and Forbes.

Jack Tatar is a cryptoasset angel investor and business counselor who frequently speaks and publishes about the subject. He was one of the first financial experts to acquire accreditation from the Digital Currency Council, despite having almost two decades of expertise in the industry.

The inventive investor's guide to an altogether new asset class—from two cutting-edge specialists

With the emergence of bitcoin and blockchain technology, investors now have access to the most exciting investment opportunity since the Internet. Bitcoin was the first cryptoasset, but there are now over 800, including ether, ripple, litecoin, monero, and others. This clear, succinct, and approachable book from two industry insiders demonstrates how to navigate this scary new blockchain world'and how to invest in these developing assets to ensure your financial future.

Cryptoassets provides you with all of the necessary tools:

- A practical methodology for researching and valuing cryptoassets.

- Portfolio management strategies for maximizing profits while minimizing risk

- Historical perspective and advice on how to avoid inevitable bubbles and manias

- Practical instructions to exchanges, wallets, capital market vehicles, and initial coin offerings (ICOs).

- Predictions on how blockchain technology will impact existing investments

This authoritative book will help you understand how these assets were developed, how they work, and how they are evolving amid the blockchain revolution, in addition to providing smart investment suggestions. The authors create a clear and unique cryptoasset taxonomy that includes cryptocurrencies, cryptocommodities, and cryptotokens, as well as insights into how each subgroup is mixing technology and markets. There are numerous ways to invest in digital assets, including global exchanges that trade 24 hours a day, as well as initial cryptoasset offerings (ICOs). Cryptoassets will offer you with a complete grasp of the cryptoasset market and the prospects that await the inventive investor by systematically building on the themes of each prior chapter.

Cryptoassets are the money and market of the future. This book will serve as your guide to that future.

Author: Jack Tatar and Chris Burniske

Link to buy: https://www.amazon.com/gp/aw/d/1260026671/

Ratings: 4.6 out of 5 stars (from 774 reviews)

Best Sellers Rank: #95,358 in Books

#72 in Online Trading E-commerce

#110 in Digital Currencies

#111 in Money & Monetary Policy (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Andreas M. Antonopoulos is a well-known technologist and serial entrepreneur who has become one of bitcoin's most well-known and respected leaders. Andreas makes complex issues approachable and understandable as an entertaining public speaker, teacher, and writer. As an advisor, he assists startups in identifying, evaluating, and navigating security and business issues.

Mastering Bitcoin is required reading for anyone interested in studying the fundamentals of bitcoin, its technical operation, or whether you're developing the next big bitcoin killer app or business. This book will help you construct money, from using a bitcoin wallet to buy a cup of coffee to running a bitcoin marketplace with hundreds of thousands of transactions to collectively inventing new financial breakthroughs that will revolutionize our understanding of currency and credit. You're going to open the door to a new economy. This book holds the key.

This book will teach you everything you need to know about decentralized digital currency, one of the most exciting technological revolutions in decades. Decentralized digital money, in the form of crypto-currencies, has the potential to revolutionize the foundations of money, credit, and financial services, just as the Internet has transformed dozens of industries ranging from media and entertainment to shopping, travel, and many more. It also has the potential to revolutionize other social activities and institutions that aren't often associated with money, such as businesses, government, voting, and the law.

Bitcoin is the ideal starting point for everyone interested in decentralized digital money, its ramifications, and applications because it was the first successful digital currency. Among the best books on cryptocurrency, Mastering Bitcoin delves into the technical foundations of bitcoin and other cryptographic currencies, covering everything from key and address cryptography to the data structures, network protocols, and consensus mechanism ("mining") that support bitcoin. User stories, elegant analogies and examples, and code snippets illustrating crucial concepts are used to explain each technical topic. The first two chapters provide a broad and accessible introduction to bitcoin aimed at a wide range of audiences, from new non-technical users to investors and business executives looking to better grasp bitcoin. The remainder of the book delves into the technical details of bitcoin's operation and is intended for professional developers, engineers, software and systems architects, systems administrators, and technically savvy individuals interested in the inner workings of bitcoin and comparable crypto-currencies. Mastering Bitcoin is a reference book for technical professionals, a self-study guide for bitcoin businesses, and a textbook for university courses on bitcoin and digital currencies.

Bitcoin is still in its early stages, yet it has already produced a multi-billion dollar global economy that is expanding at an exponential rate. Bitcoin is being accepted as a payment mechanism by both new and existing businesses, and investors are backing a flurry of new bitcoin and related enterprises. Understanding Bitcoin can help you become a part of this thriving new economy. The time has come to get started.

Author: Andreas M. Antonopoulos

Link to buy: https://www.amazon.com/Mastering-Bitcoin-Unlocking-Digital-Cryptocurrencies/dp/1449374042/

Ratings: 4.7 out of 5 stars (from 200 reviews)

Best Sellers Rank: #390,312 in Books

#85 in E-Commerce (Books)

#150 in Business Entrepreneurship

#171 in Web Encryption

amazon.ca

ebay.com -

Paul Vigna is a Wall Street Journal markets reporter who focuses on equities and the economy. He is a MoneyBeat columnist and anchor. Previously a writer and editor for DowJones Newswires' MarketTalk column, he has appeared on Fox Business Network, CNN, BBC, and the John Batchelor radio show.

Michael J. Casey is a Wall Street Journal columnist who covers global finance in his "Horizons" column. He contributes frequently to the Journal's MoneyBeat blog and co-writes the daily "BitBeat" with Paul Vigna.

Bitcoin became a household name overnight. It's a cyber-enigma with a rabid fan base that makes headlines and generates unending media debate. Although it appears that you may use it to buy anything from coffee to vehicles, few people seem to comprehend what it is. This begs the question, why should anyone be interested in bitcoin?

Wall Street writers Paul Vigna and Michael J. Casey provide the authoritative answer to this issue in The Age of Cryptocurrency. Cybermoney is ready to usher in a revolution, one that has the potential to reshape old financial and social systems while bringing billions of "unbanked" people into a new global economy. Cryptocurrency promises the promise of a financial system without a middleman, one that is controlled by the people who use it, and one that is immune to the devastation caused by a 2008-style crisis.

However, bitcoin, the most well-known of the cybermonies, has a reputation for insecurity, erratic fluctuations, and illegal activity; some think it has the potential to remove jobs and upend the concept of a nation-state. Above all, it indicates massive and far-reaching change, for better or bad. But it's here to stay, and you'd be foolish to ignore it.

Vigna and Casey explain the origins of bitcoin, its function, and what you need to know to navigate a cyber-economy. The world of digital currency will be quite different from the world of paper currency; The Age of Cryptocurrency will show you how to prepare.

Author: Michael J. Casey and Paul Vigna

Link to buy: https://www.amazon.com/gp/aw/d/1250081556/

Ratings: 4.4 out of 5 stars (from 377 reviews)

Best Sellers Rank: #173,883 in Books

#28 in Financial Engineering (Books)

#169 in Money & Monetary Policy (Books)

#189 in Digital Currencies

https://www.amazon.com/

https://www.amazon.com/ -

Kiana Danial is the CEO of Invest Diva and a globally recognized expert in personal investment and wealth management. She has given workshops and seminars to firms, universities, and investing groups, and has been on Forbes and CNN. Wealth & Finance International named her the 2018 Personal Investment Expert of the Year.

While the cryptocurrency market is known for its volatility, which is typically connected to the industry's ever-changing legal framework, the total cryptocurrency market is predicted to hit $1 trillion this year. This book will show you how to get in on the action.

Among the best books on cryptocurrency, Cryptocurrency Investing For Dummies provides dependable advice on how to profit from trading and investing in the top 200 digital currencies, regardless of market mood. With the use of real-world examples that demonstrate how to maximize your cryptocurrency wallet, you'll learn how to navigate the new digital finance landscape and choose the correct cryptocurrency for different situations.

- Learn about the bitcoin market.

- Discover the best methods for selecting the finest cryptocurrency.

- Investigate new financial opportunities.

- Choose the best platforms for your investments.

This book delves into the hot themes and market-moving events influencing cryptocurrency values, as well as how to devise the best investment strategies depending on your individual risk tolerance.

Author: Kiana Danial

Link to buy: https://www.amazon.com/gp/aw/d/1119533031/

Ratings: 4.5 out of 5 stars (from 1746 reviews)

Best Sellers Rank: #41,749 in Books

#43 in Digital Currencies

#45 in Money & Monetary Policy (Books)

#139 in E-commerce Professional (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Ryan Derousseau began researching bitcoin in 2013, when it was supposed to be only a strange currency used by hackers. There wasn't much to invest in back then, but Ryan was convinced on the concept and continued to track bitcoin and other cryptocurrencies as they expanded to become the hottest investment of our time. Ryan's work on investment has been extensively read in Fortune, Money, CNBC, BBC, Fast Company, and US News & World Report, among many other national magazines, and he has over a decade of experience writing about it.

Cryptocurrency—a digital asset that uses cryptography to secure all of its transactions, making it nearly impossible to counterfeit—is entering the mainstream, with coverage from major financial websites such as Forbes and Bloomberg, increased attention from serious financial institutions, and increased availability in trusted markets such as the Chicago Mercantile Exchange.

As the price of Bitcoin and other cryptocurrencies continues to fluctuate and news stories about cryptocurrency hackers emerge, investors must be more aware of the market's enormous prospects and significant hazards. Understanding the risks and rewards of cryptocurrencies is essential for anyone looking to profit from this fascinating new form of investing.

The Everything Reference to Investing in Cryptocurrency is a thorough and authoritative guide that will help you safely enter the lucrative world of e-commerce. You will discover:

- The several major cryptocurrencies, such as Bitcoin, Litecoin, and Ethereum

- Where to buy and sell cryptocurrency in a safe and secure manner

- Creating and administering your cryptocurrency wallet

- Analyzing their investments properly

Take the plunge into cryptocurrencies with a thorough awareness of what you're getting into. With The Everything Guide to Investing in Cryptocurrencies, you'll maximize your profits while minimizing your risks in this exciting new frontier.

Author: Ryan Derousseau

Link to buy: https://www.amazon.com/Everything-Guide-Investing-Cryptocurrency-Currencies/dp/1507209320

Ratings: 4.5 out of 5 stars (from 232 reviews)

Best Sellers Rank: #206,110 in Books

#192 in Money & Monetary Policy (Books)

#209 in Digital Currencies

#289 in Wealth Management (Books)

https://www.amazon.com/

daraz.pk - The several major cryptocurrencies, such as Bitcoin, Litecoin, and Ethereum