Top 10 Best Books On FinTech

Financial technology, also known as fintech, has become one of the world's fastest-growing industries. The term refers to a wide range of software, ... read more...technological innovations, and services that can be used for personal or professional investing and banking. For investors who want to learn more about the industry, here are the best books on fintech explaining what it is and how it is changing the financial services sector.

-

Susanne Chishti is the Founder and CEO of FINTECH Circle and the FINTECH Circle Institute, the leading peer-to-peer learning platform for fintech enterprise innovation, wealthtech, insurtech, artificial intelligence, and blockchain applications in finance, crypto-currencies, and startup methodologies.

Janos Barberis is a FinTech Millennial who has been named one of the top 35 global FinTech leaders. He founded FinTech HK, a thought leadership platform, and the SuperCharger, a FinTech Accelerator that uses Hong Kong as a strategic gateway to Asia.

The FINTECH Book is your primary resource for understanding the financial technology revolution, as well as the disruption, innovation, and opportunity it brings. This book, written by prominent thought leaders in the global fintech investment space, combines diverse industry expertise into a single informative volume, providing entrepreneurs, bankers, and investors with the answers they need to capitalize on this lucrative market. Key industry developments are thoroughly explained, and critical insights from cutting-edge practitioners provide first-hand knowledge and lessons learned.

Entrepreneurs, bankers, consultants, investors, and asset managers are all scrambling for more information as the financial technology sector booms: Who are the main characters? What is causing the rapid expansion? What are the dangers? This book compiles insights, knowledge, and advice from industry experts to provide answers to these and other questions.

- Learn about the most recent industry developments.

- Understand the 'fintech revolution' market dynamics.

- Recognize the sector's potential and its impact on other industries.

- Get expert advice on investment and business opportunities.

In 2014, the fintech market earned more than $14 billion, a threefold increase over the previous year. New startups are emerging at an increasing rate, and large banks and insurance companies are being forced to expand their digital operations in order to survive. The financial technology sector is thriving, and The FINTECH Book is the world's first crowd-sourced book on the subject, making it an invaluable resource for anyone working in or interested in this field.

Author: Janos Barberis and Susanne Chishti

Link to buy: https://www.amazon.com/dp/111921887X

Ratings: 4 out of 5 stars (from 112 reviews)

Best Sellers Rank: #817,977 in Books

#132 in Financial Services Industry

#283 in Business Finance

#519 in Computers & Technology Industry

https://www.olx.pt/

https://fintechnews.ch/ -

Brett King is widely regarded as the world's foremost authority on retail banking innovation. He received international acclaim for his best-selling book BANK 2.0, which topped bestseller lists in the United Kingdom, the United States, Germany, Japan, Canada, France, Russia, and Asia. King is the founder and CEO of Moven, a retail mobile money service, as well as the host of the BREAKING BANKS Radio Show. In 2012, he was named American Banker's Top Innovator of the Year.

Breaking Banks: Innovators, Rogues, and Strategists Rebooting Banking is a one-of-a-kind collection of interviews conducted from around the world in the Financial Services Technology (or FinTech) domain, highlighting the stories, case studies, start-ups, and emerging trends that will define this disruption.

The author's archived interviews with experts from around the world are featured, with a focus on the disruptive technologies, platforms, and behaviors that are threatening the traditional industry approach to banking and financial services.

Bitcoin's disruptive attack on currencies, P2P lending, Social Media, Neo-Banks reinventing the basic day-to-day checking account, global solutions for the unbanked and underbanked, and changing consumer behavior are all covered.

Breaking Banks is the only book of its kind, detailing the massive and dramatic shift that is taking place in the financial services industry today. It is considered one of the best books on fintech.

Author: Brett King

Link to buy: https://www.amazon.com/dp/1118900146

Ratings: 4.2 out of 5 stars (from 61 reviews)

Best Sellers Rank: #1,515,230 in Books

#291 in Financial Services Industry

#977 in Digital Currencies

#1,214 in Banks & Banking (Books)

https://www.kobo.com/

https://www.amazon.co.uk/ -

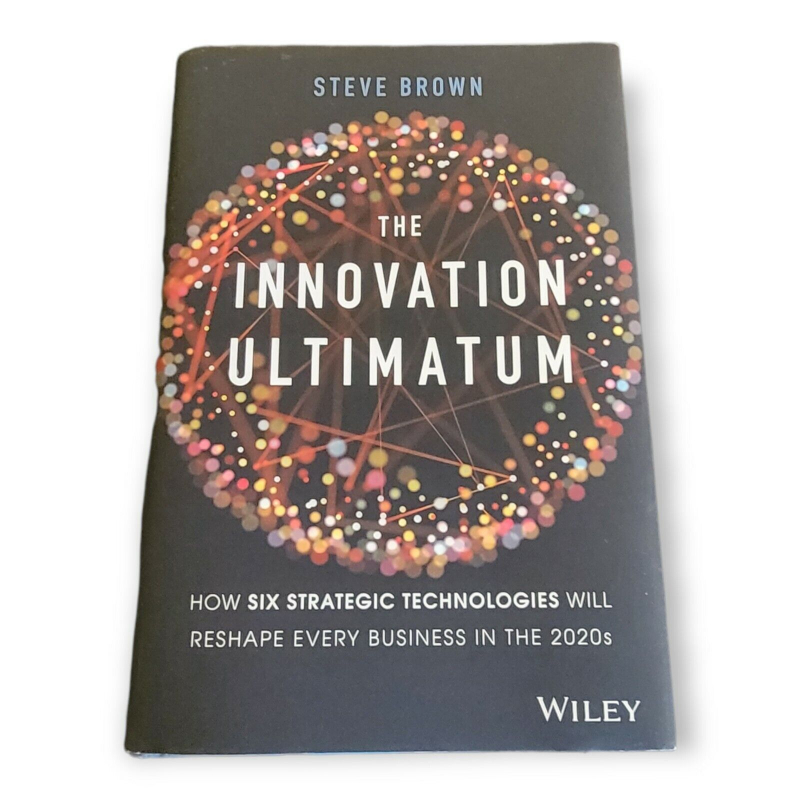

Steve Brown is a former Intel Corporation futurist. He now runs Possibility and Purpose, a speaking and consulting firm that assists leaders in imagining and constructing a better future. Steve encourages people to imagine how technology will reshape industries, alter how we live, and forever alter the workplace. He envisions a bright future in which businesses use cutting-edge technology to develop new products and services, optimize operations, empower employees, and delight customers. Steve has appeared on CNN, BBC, Bloomberg TV, The Wall Street Journal, and Wired magazine, among others.

The Innovation Ultimatum is an in-depth look at the technologies that will shape the new decade. Artificial intelligence (AI), distributed ledgers and blockchain, the Internet of Things (IoT), self-driving cars, virtual and augmented reality, and 5G communication will all provide significant opportunities for businesses across all industries.

Steve Brown employs simple, jargon-free language to help leaders understand the significance of key technologies. This resource provides a clear roadmap for leaders to prepare their organizations to best embrace technological-led disruption.

The world-renowned futurist shares compelling insights into how organizations can embrace the next wave of digital transformation to optimize operations, create value, and serve customers in new ways. This FinTech book's six technologies will have a significant impact on the FinTech industry.

Author: Steve Brown

Link to buy: https://www.amazon.com/Innovation-Ultimatum-strategic-technologies-business/dp/1119615429

Ratings: 4.5 out of 5 stars (from 99 reviews)

Best Sellers Rank: #594,536 in Books

#148 in Organizational Change (Books)

#381 in Computers & Technology Industry

#416 in Social Aspects of Technology

ebay.com

ebay.com -

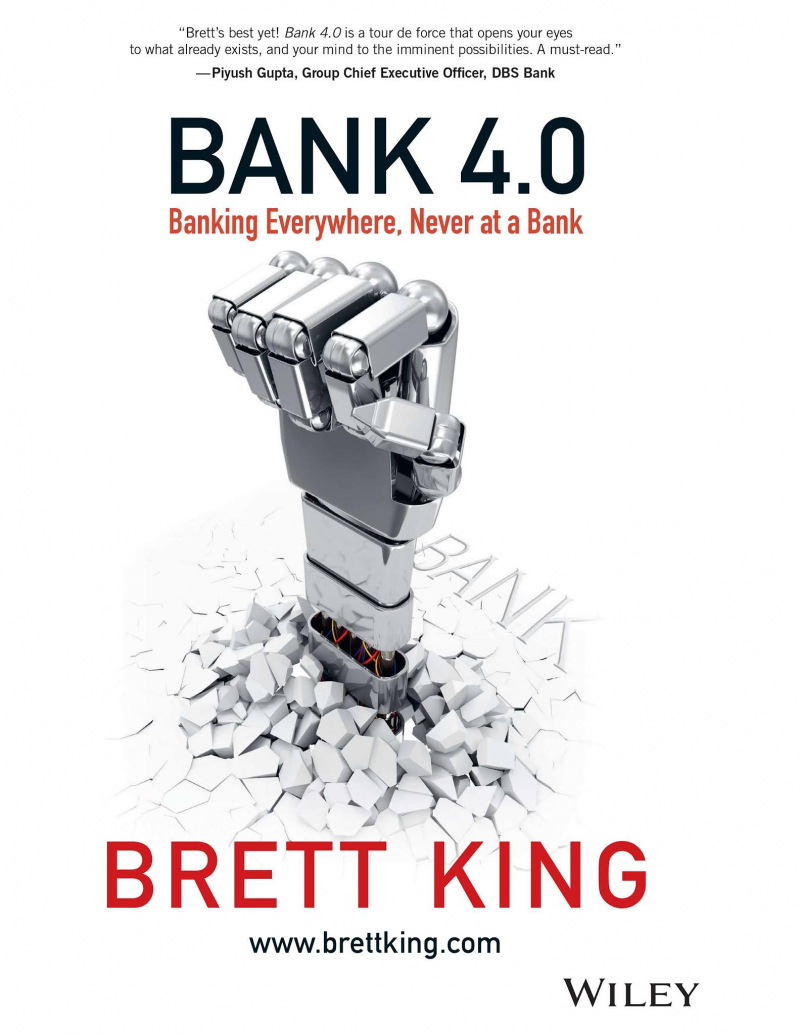

Brett King is an international bestselling author, renowned commentator, and well-known business futurist. He has spoken to over a million people in over 50 countries about how technology is disrupting business, changing behavior, and influencing society. He advised the Obama White House, the Federal Reserve, and the National Economic Council on the future of banking in the United States, and he consults with governments and regulators worldwide. He frequently appears on US television networks such as CNBC, where he contributes on Future Tech and FinTech.

Bank 4.0 investigates the radical transformation that is already occurring in banking and follows it to its logical conclusion. What will the banking industry look like in 30 years? 50 years? The world's best banks have been forced to adapt to changing consumer behaviors; regulators are reconsidering friction, licensing, and regulation; and Fintech start-ups and tech titans are redefining how banking fits into consumers' daily lives. Banks must develop new capabilities, jobs, and skills in order to survive. The future of banking is embedded in voice-based smart assistants like Alexa and Siri, as well as soon smart glasses, which will guide you on daily spending and money decisions. In the coming Bank 4.0 era, your bank will either be technologically embedded in your world or it will cease to exist.

In this final volume of Brett King's BANK series, we investigate the future of banks in the face of technological evolution and discover a revolution already underway. Bank 4.0 demonstrates that we are no longer on Wall Street, with re-engineered banking systems, selfie-pay, and self-driving cars. Bank 4.0 will assist you in the following ways:

- Recognize the historical precedents that point to a fundamental shift in banking.

- Discover low-friction technology experiences that undermine today's products.

- Consider the evolution of identity, value, and assets as cash and credit cards become obsolete.

- Learn how Fintech and tech "disruptors" are reshaping banking economics through behavior, psychology, and technology.

- Examine how blockchain, artificial intelligence, augmented reality, and other cutting-edge technologies are laying the groundwork for the future of banking systems.

If you look at individual technologies or startups disrupting the space, you may miss the most important signs of the future, as well as the fact that most of what we've learned about banking over the last 700 years is no longer relevant.

When the world's largest bank isn't any of the names you'd expect, branch networks are a burden rather than an asset, and advice is the domain of Artificial Intelligence, we may have to start from scratch. Bank 4.0 transports you to a world where banking is instant, smart, and ubiquitous, and where you must adapt faster than ever before in order to survive.

Author: Brett King

Link to buy: https://www.amazon.com/Bank-4-0-Banking-Everywhere-Never/dp/1119506506

Ratings: 4.6 out of 5 stars (from 369 reviews)

Best Sellers Rank: #193,804 in Books

#3 in Banking (Books)

#51 in Business Planning & Forecasting (Books)

#127 in Banks & Banking (Books)

https://www.ifb-ebook.com/

ebay.com -

Pavlo Sidelov, an internationally recognized author, public speaker, and the CTO of SDK.finance, wrote The World Of Digital Payments.

The book is an extremely informative and compelling introduction to the world of digital payments. Pavlo Sidelov distills his 15+ years of FinTech industry experience into this hands-on practical course to help foster innovation in the payments sector.

In this FinTech book, the author describes current payment instruments in detail and explains how to integrate them using examples from various markets, currencies, and business sectors.

This book will point you in the right direction whether you are a developer learning the ABCs of digital payments or an entrepreneur looking for the right strategy to monetize your business. It is regarded as one of the best books on fintech.

Pavlo Sidelov's unique insights stem from his in-depth industry knowledge. The author has founded several successful businesses, the most notable of which is the award-winning payment platform provider SDK.finance.

The World of Digital Payments, a FinTech book, answers the following fundamental questions:

- How do you collaborate with electronic sales channels?

- How do you create a payment-accepting IT project?

- How can customer service be improved?

- How do you figure out what keeps visitors from becoming customers?

- Finally, how should a business monetization strategy be chosen?

Author: Pavlo Sidelov

Link to buy: https://www.amazon.com/dp/B07CRWTYX7

Ratings: 4.5 out of 5 stars (from 8 reviews)

Best Sellers Rank: #173,707 in Kindle Store

#5 in Financial Services

#22 in Financial Services Industry

#117 in E-commerce Professional (Kindle Store)

https://www.amazon.com/

https://www.amazon.com/ -

Susanne Chishti is the CEO of FINTECH Circle, Europe's first Angel Network focused on fintech investments, as well as the Founder of the FINTECH Circle Institute, the leading fintech learning platform that offers Innovation Workshops to C-level executives as well as fintech and entrepreneurship courses.

Tony Craddock is the founder and director general of the UK's largest payments trade association, the Emerging Payments Association. Robert Courtneidge is a Payments Lawyer and the CEO of Moorwand, Ltd, a global payment services provider.

Markos Zachariadis is a Full Professor and Chair in Financial Technology (FinTech) and Information Systems at the University of Manchester's Alliance Manchester Business School, a member of the World Economic Forum's Council, and a FinTech Research Fellow at the University of Cambridge.

Money movement between individuals, organizations, and governments is critical to the global economy. The payments industry has undergone massive transformation as a result of new regulations, technologies, and consumer demands, which have resulted in significant changes to payment tools, products, and use cases, as well as lucrative opportunities for entrepreneurs and FinTech professionals. Companies and investors are increasingly favoring PayTech innovation due to improved customer experience, increased revenues, and manageable risks as payment technologies become faster and more efficient. The PAYTECH Book brings together a diverse group of industry experts to help entrepreneurs, financial services professionals, and investors capitalize on the highly profitable PayTech market.

This informative volume, written by leaders in the global FinTech and payment sectors, explains key industry developments and provides valuable first-hand insights from prominent industry practitioners. Contributors include payment and financial services industry advisors and consultants, entrepreneurs and business owners utilizing cutting-edge PayTech capabilities, academic researchers investigating the social-political-economic impact of PayTech, and many others. Security, regulation and compliance, wholesale payments, and how payment systems currently work and how PayTech can improve them are all covered in detail. This publication:

- PayTech is defined and its key players are identified.

- Discusses how PayTech can transform developed markets and help emerging economies grow faster.

- Describes the role of PayTech in the larger FinTech ecosystem.

- Examines the future of PayTech and its potential as a social change and financial inclusion agent.

- Provides various perspectives on PayTech investment and what consolidation and expansion will look like.

The PAYTECH Book: The Payment Technology Handbook for Investors, Entrepreneurs, and FinTech Visionaries is a must-have resource for FinTech investors and entrepreneurs, managers from payments companies and financial services firms, and executives in government, corporations, public sector organizations, retailers, and users of payments.

Author: Susanne Chishti, Robert Courtneidge, Tony Craddock and Markos Zachariadis

Link to buy: https://www.amazon.com/gp/aw/d/1119551919/

Ratings: 4.3 out of 5 stars (from 62 reviews)

Best Sellers Rank: #278,781 in Books

#172 in Digital Currencies

#467 in E-commerce Professional (Books)

#1,618 in Entrepreneurship (Books)

Photo: The Paytech Book's Facebook

Photo: The Paytech Book's Facebook -

Agustn Rubini, financial guru, author, and advocate, pursues his many interests with passion and zeal. Agustn is passionate about the world of finance and the future of financial services, having spent many years as a financial industry strategist. Agustn spends a significant amount of time speaking and writing about fintech, as well as advising businesses on innovation and digital transformation. Agustn wrote Fintech in a Flash, a best-selling guide to financial technology, to help others understand the complexities of the financial services industry.

Fintech is all around us, and ignoring it could mean falling behind! The financial services technology industry is booming, with more than $20 billion invested in the last year alone. Financial technology has the potential to change the way we manage our money online, disrupting the landscape of the financial services industry.

Over 70 in-depth interviews with Fintech Founders provide lessons from some of the most successful fintech entrepreneurs, assisting you in understanding the challenges and opportunities of applying technology and collaboration to solve some of the financial services industry's most pressing problems.

Among the best books on fintech, this book is for entrepreneurs, people working in large organizations, and anyone else interested in learning the secrets of successful entrepreneurs. Rubini gathers advice from a wide range of financial services niches, including financing, banking, payments, wealth management, insurance, and cryptocurrencies, in this advice-filled resource to help you harness the insights of thought leaders. Those working in the financial services industry and those interested in working in or starting up businesses in the financial services industry will learn valuable lessons on how to move an idea forward, find the right business founders, seek funding, learn from early mistakes, and define and reposition your business model.

- If you purchase this book right now, you will receive: Fintech insights from all continents

- The author's perspective on the future of each fintech sector: financing, banking and savings, payments, SMEs, investment, insurance, data and analytics

- Lessons from founders who have collectively raised more than $10 billion

- 75 interviews with the people who are driving fintech disruption

Author: Agustín Rubini

Link to buy: https://www.amazon.com/Fintech-Founders-Inspiring-Entrepreneurs-Changing-ebook/dp/B08295NZ2T/

Ratings: 4.4 out of 5 stars (from 26 reviews)

Best Sellers Rank: #806,764 in Kindle Store

#1,313 in Finance (Kindle Store)

#1,760 in Entrepreneurship (Kindle Store)

#4,022 in Professional & Technical

https://www.amazon.com/

https://www.amazon.com/ -

Karen G. Mills served as Administrator of the United States Small Business Administration from 2009 to 2013. She was a member of President Barack Obama's Cabinet. She was awarded the Distinguished Public Service Award by the United States Department of Navy for her contributions to American competitiveness, entrepreneurship, and innovation. She is the President of MMP Group and has a long history of investing in startups as a venture capitalist.

Small businesses are the lifeblood of the American economy. They are the largest employers and provide a path to the American Dream. However, many people find it difficult to obtain the capital they require to operate and succeed. Access to capital for small businesses froze during the Great Recession, and as a result, many community banks closed their doors, and other lenders who had weathered the storm turned to more profitable avenues. Many small businesses faced bleak prospects for years after the financial crisis. But then came a new era of financial technology, or "fintech."

Beginning in 2010, new fintech entrepreneurs identified gaps in the small business lending market and revolutionized the small business owner customer experience. Instead of Xeroxing a stack of paperwork and waiting weeks for a response, small businesses filled out applications online and received responses within hours, if not minutes. Banks rushed to catch up. As technology companies such as Amazon, PayPal, and Square entered the market, new opportunities for even more transformative products and services emerged.

Karen G. Mills, former U.S. Small Business Administrator and Senior Fellow at Harvard Business School, focuses on the capital needs of small businesses and how technology will transform the small business lending market in Fintech, Small Business & the American Dream. This is a thorny market: lenders struggle to determine which small businesses are creditworthy, and borrowers frequently don't know how much money or what type of loan they require. New data streams have the potential to shed light on the murky nature of a small business's finances, making it easier to weather turbulent cash flows and providing more transparency to potential lenders.

Mills describes how fintech has changed and will continue to change small business lending, as well as how financial innovation and prudent regulation can re-establish a path to the American Dream. Fintech, Small Business & the American Dream is an ambitious book that grapples with the broad significance of small business to the economy, the historical role of credit markets, the dynamics of innovation cycles, and the policy implications for regulation. It is relevant to bankers, fintech investors, and regulators, as well as anyone interested in the future of small business in America.

Author: Karen G. Mills

Link to buy: https://www.amazon.com/dp/B07PMBFW1S

Ratings: 4.5 out of 5 stars (from 34 reviews)

Best Sellers Rank: #1,216,513 in Kindle Store

#442 in Business Production & Operations

#529 in Banks & Banking (Kindle Store)

#1,164 in Starting a Business (Kindle Store)

https://www.amazon.com/

https://www.amazon.com/ -

Paolo Sironi is the IBM Institute for Business Value's global research leader in banking and financial markets. He is one of the world's most respected fintech voices, offering business expertise and strategic thinking to a network of executives from financial institutions, startups, and regulators.

In Banks and Fintech on Platform Economies: Contextual and Conscious Banking, accomplished fintech professional and author Paolo Sironi provides an in-depth examination of how platform theory, which was born outside of financial services, will make its way inside banking and financial markets to radically transform the way firms do business.

You'll discover why the financial services industry must master the transition from selling business outputs to selling client outcomes. You'll also learn how to steer the industry toward new forms of digital transformation supported by Contextual Banking and Conscious Banking platform strategies that will benefit all stakeholders.

This essential book:

- Describes the mindset shift required to assist banks in strengthening and expanding the reach of their Banking-as-a-Service and Banking-as-a-Platform operations.

- Shows how a new interpretation of fundamental uncertainty inspires the use of exponential technologies to achieve architectural resilience and opens the reference theory to spring new business models centered on the antifragility of clients and ecosystems.

- The financial services industry can break free from a narrow value-generation niche to reclaim first place against bigtech rivals, enjoying greater flexibility and adaptability at lower digital costs.

Banks and Fintech on Platform Economies will also earn a place in the libraries of bankers seeking a firm grasp of the rapidly evolving outcome economy and a view on the industry's future.

Author: Paolo Sironi

Link to buy: https://www.amazon.com/Banks-Fintech-Platform-Economies-Contextual/dp/1119756979/

Ratings: 4.6 out of 5 stars (from 51 reviews)

Best Sellers Rank: #845,519 in Books

#48 in Banking (Books)

#670 in Banks & Banking (Books)

#840 in Economics (Books)

https://www.linkedin.com/

https://www.amazon.com/ -

Steven O'Hanlon, president and CEO of Numerix, LLC, was named the FinTech Person of the Year in 2016. Susanne Chishti is the CEO of FINTECH Circle, the world's largest FinTech community focused on FinTech investments, corporate innovation strategies, and courses.

This comprehensive, hands-on guide is your one-stop shop for everything you need to confidently navigate the ever-changing landscape of this thriving industry. Among the best books on fintech, FinTech For Dummies will shed light on this rapidly changing landscape, making it an invaluable resource for anyone working in or interested in this field. Steve O'Hanlon and Susanne Chishti, industry experts, provide insights, knowledge, and guidance in this book on the following topics:

- Gaining knowledge of the financial markets' fastest growing market segment

- Learning the fundamental decision-making processes required to carry out a growth strategy

- Obtaining knowledge of the world's fastest growing fintech companies

- Getting Around the Fintech World

- The elements that go into creating a FinTech company

The financial services technology industry is booming, and this hands-on guide is jam-packed with information to help you understand what's going on and navigate this rapidly changing landscape with confidence. Numerix and FINTECH Circle industry experts share their knowledge and advice to help you capitalize on this lucrative opportunity. Their expertise will assist you in establishing or expanding a profitable FinTech company. As a client, investor, or financial services professional in the global financial and technology industry, you can benefit from the FinTech boom.

Author: Steven O'Hanlon and Susanne Chishti

Link to buy: https://www.amazon.com/FINTECH-Dummies-Business-Personal-Finance/dp/1119427266/

Ratings: 4.2 out of 5 stars (from 79 reviews)

Best Sellers Rank: #486,695 in Books

#63 in Financial Services Industry

#357 in Banks & Banking (Books)

#513 in Investment Analysis & Strategy

https://www.amazon.com/

https://www.amazon.com/