Top 11 Best Books On Taxes

You must understand taxation whether you are a financial consultant, a human resource expert, an entrepreneur, or a newcomer. Taxation books will help you ... read more...learn tax in-depth, and a handful of them are always useful, regardless of when they were published. The following is a list of some of the best books on taxes.

-

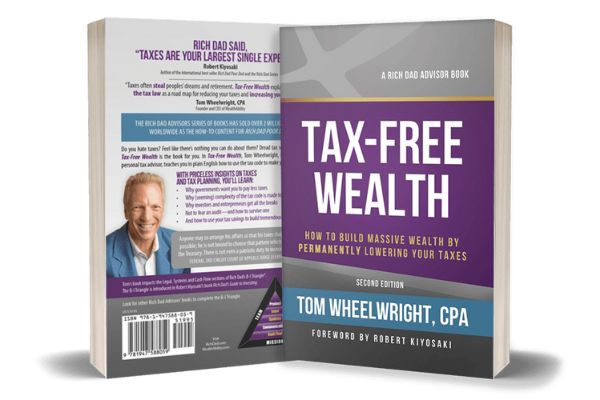

Tom Wheelwright is an entrepreneur, best-selling author, Rich Dad Advisor, CPA, and international authority on tax. He is the author of Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes. "My life objective is to make taxes entertaining, easy, and understandable!" he says.

The concept of tax planning is the focus of "Tax-Free Wealth", one of the best books on taxes. It's all about figuring out how to take advantage of your country's tax rules. Tom Wheelwright explains how the tax laws work in this book. And how they're designed to lower your taxes rather than raise them. You won't be terrified of the tax laws once you comprehend this basic notion. They are meant to assist you and your company, not to obstruct it.

The book will explain how your country's tax rules work and how you can take advantage of them. It outlines several tax planning techniques that can be utilized to lower tax liabilities. The author gives a high-level review of the numerous tax considerations and tactics you can use to take advantage of available tax benefits, such as specific tax treatment for real estate spending. He also discusses and explains numerous technical ideas, like as depreciation, estate planning, and so on, using concrete examples. The only flaw I can think of with the book is that it contains a lot of facts that are only relevant if you run a firm. Regardless, this book will undoubtedly improve your tax preparation tactics and assist you in accumulating more wealth.

"Tax-Free Wealth", which has over 200 reviews on Amazon and a rating of 4.3 out of 5 stars, teaches businesses, entrepreneurs, and real estate investors how to acquire large sums of wealth by employing practical and effective tax reduction strategies.

Author: Tom Wheelwright

Published: March, 2012

Language: English

Link to buy: amazon.com/Rich-Dad-Advisors-Tax-Free-Permanently/dp/B07PXTWQLL

Photo: WeathAbility

Photo: Tiki -

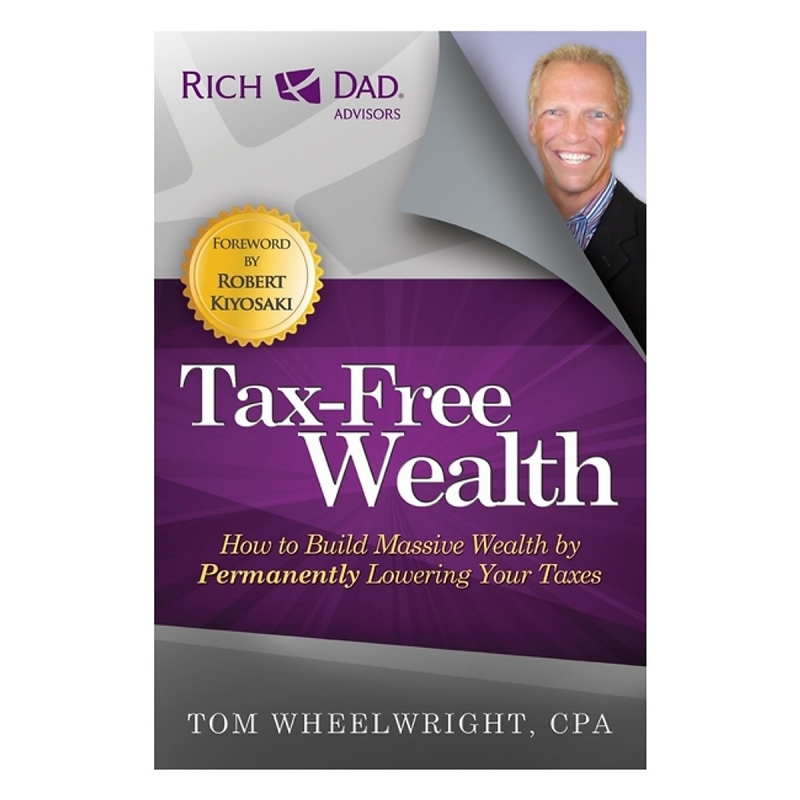

Jeff A. Schnepper, Esq., is a tax, accounting, and legal adviser for Estate Planning of Delaware Valley, a tax counsel for Haran, Watson & Company, a mobility view consultant, and runs a tax, accounting, and legal office in Cherry Hill, NJ. Schnepper was a tax specialist for Microsoft's MSN Money, an economics editor for USA Today, and a professor of accounting and finance at The American College in Bryn Mawr, Pennsylvania.

"How to Pay Zero Taxes" makes a lot of promises, but the principle is simple: with the appropriate information, tax time may be less of a burden, and you can save money like you've never saved before. The fascinating book by tax expert Jeff Schnepper will gently walk you through difficult facts without making you feel emotionally or financially strained. You'll also find helpful tips on everything from calculating child and elder care expenses to maximizing company deductions and surviving an IRS audit if you're one of the unlucky few the IRS decides to scrutinize.

This book is based on Internal Revenue Service (IRS)-approved deductions, credits, shelters, and exemptions that can be used by taxpayers to save money on taxes. The author begins the book by stating unequivocally that you may be paying significantly more in taxes than you should be owing to a lack of understanding of possible tax deductions. It also includes a historical description of tax deductions and credits, in addition to the current condition of the tax rules. Overall, it delivers in-depth knowledge of the tax code in an easy-to-understand and apply format.

"How to Pay Zero Taxes" 2020-2021 is written in plain English and contains everything you need to take advantage of the latest tax legislation and pay the IRS less than ever before. Schnepper reveals hundreds of IRS-approved deductions, shelters, credits, and exemptions, as well as exclusive tax advice.

Author: Jeff A. Schnepper

Publisher: McGraw Hill; 37th edition (December 13, 2019)

Language: English

Link to buy: amazon.com/How-Pay-Zero-Taxes-2020-2021/dp/126046170X

-

Attorney Barbara Weltman (Vero Beach, FL) is a nationally renowned expert in small business taxation. She is the president and creator of Big Ideas for Small Businesses, a firm dedicated to serving small businesses as a resource.

The nearly 30 million small companies in the United States form the backbone of the American economy. "Small Business Taxes": Your Complete Guide to a Better Bottom Line by J.K. Lasser assists business owners in saving as much money as possible on taxes. If you own a small business, this step-by-step guide will teach you how to rapidly assess your tax due and what types of tax relief are available to you, right down to the nitty gritty—even showing you where to claim deductions on IRS forms. Barbara Weltman, a nationally recognized expert in small business taxation, contributes her knowledge to this discussion. This manual is packed with tax facts and planning ideas to assist small business owners in making tax-advantaged business decisions.

The author has written "Small Business Taxes" in a plain and easy-to-read format. The book goes into great detail about the most recent tax laws, IRS rulings, available write-offs, related court decisions, and other topics that can assist you in developing tax planning techniques that can help you manage a tax-smart firm. In other words, it focuses on tactics that can help you maximize the other parts of small business taxes while leveraging the currently available tax deductions and credits to shelter firm income. It's a step-by-step guide that explains how your decisions today will affect your company's bottom line tomorrow in terms of taxes.

Author: Attorney Barbara Weltman

Publisher: Wiley; 1st edition (November 13, 2020)

Language: English

Link to buy: amazon.com/J-K-Lassers-Small-Business-Taxes/dp/1119740053

Video: Introduction to Business -

Mike Piper is the creator of the renowned blog Oblivious Investor and the author of several personal finance books (obliviousinvestor.com). He is a licensed CPA in Missouri. Mike's work has appeared in the Wall Street Journal, Money Magazine, AARP Magazine, Forbes, CBS News, MarketWatch, and Morningstar, among other publications.

The "Taxes Made Simple" discusses the most complex and important tax issues in the most straightforward manner possible. It avoids going overly complex and scholarly while covering the basics of deductions, credits, and retirement contributions. The book's size is its most remarkable feature: it's short, to-the-point, and doesn't waste any time. The author does a fantastic job of breaking down difficult subjects into easy-to-understand chunks. However, he avoids going into too much detail on the deductions and credits, and most of the queries are answered to the point. This book is essential reading for anyone interested in learning how to file taxes. It should be emphasized, however, that it will not transform you into a specialist because it does not provide advanced information on any of the areas. In short, if you're a complete beginner, it can be an excellent introduction to the world of taxes.

"Taxes Made Simple" is one of the best books on taxes and this book is for you if you know a little more about taxes than nothing, but not much more. From the differences between basic important words to how to make sure you qualify for the deductions and credits that will save you money in the long run, you'll discover everything you should have learned in personal finance class if you had been paying attention. You'll also learn which tax forms you need to fill out based on your occupation and personal information, as well as state-specific requirements. You'll be ready to perform your basic taxes - or to interview a possible accountant to ensure you're getting what you pay for.

Author: Mike Piper

Publisher: Simple Subjects, LLC (June 11, 2021)

Language: English

Link to buy: amazon.com/Taxes-Made-Simple-Income-Explained/dp/0981454216

-

Bernard B. Kamoroff is a certified public accountant with 30 years of expertise in small business. He is a lecturer at the University of California and the author of five books on business and taxation. He resides in the town of Willits, California.

"475 Tax Deductions for Businesses" which has been revised to reflect changes in tax law, not only details the various items that are deductible—from Internet domain name expenses to theft losses—but also explains where to enter them on your tax return. The author explains, "Tax law isn't easy, but this book is." The twelfth edition will be totally revised to include new tax law revisions, a chapter on home-based enterprises, and unique "jump out" highlights in the A-to-Z listings for any deduction with special restrictions for home-based firms.This important book covers a wide range of business tax topics, including cost categories. The book walks you through the process of filing your taxes, including tax deductions and credits. According to the author, it is your responsibility as a taxpayer to undertake basic research on possible tax deductions and give a list of applicable deductions to your CPA for processing. The basic notion is that if you don't claim the deductions, you won't get anything. If you have no idea what a tax deduction or credit is, this book can be a fantastic place to start. The answer is straightforward, to the point, and simple to comprehend.

"475 Tax Deductions for Businesses" does more than just teach you about the deductions you should take, such as for your website and any lost revenue. When it's time to file, it also shows you exactly where to put the information. A section on how to deduct costs related with working from home is also included.

Author: Bernard B. Kamoroff

Publisher: Lyons Press; Thirteenth edition (February 1, 2019)

Language: English

Link to buy: amazon.com/475-Deductions-Businesses-Self-Employed-Individuals/dp/1493040189

-

Barbara Weltman is an attorney and a nationally recognized specialist in small business taxation, as well as the author of a number of best-selling tax and finance books, including J.K. Lasser's Small Business Taxes.

1001 Deductions and Tax Breaks: Your Complete Guide to Everything" is a crucial tool for average taxpaying Americans since it properly explains and keeps track of the continuously changing tax law code. This popular book's fifth edition has been completely updated to reflect the most recent judgments and rules, allowing readers to quickly find the right deductions for their specific needs. In a concise and easy-to-understand manner, this reference answers the most common tax queries about deductions and credits.

This book will teach you all you need to know about taxes, as the title says. You would know everything about you and your family, your home, your car, your job or business, and even casualty and theft losses or insurance, as well as how to save money and the deductions available under these headings. The book is well-organized, making it easy to discover the right deduction for your case. "1001 Deductions and Tax Breaks" is only 480 pages long and it is also one of the best books on taxes. Everyone who wants to save money on taxes in 2016-17 should read this book. It will assist you in comprehending the purpose of taxation as well as where you might save money on taxes. This book contains information that is immediately applicable. So you won't need to hire a tax professional to figure out where you may save money on taxes.

If you don't know anything about taxes, this book is a great place to start. This isn't just a list of what you can deduct; it also explains how the law has changed recently, which forms of income are exempt from taxation, how to make accurate claims, and how to read your financial records like a pro.

Author: Barbara Weltman

Publisher: Wiley; 2nd edition (November 12, 2021)

Language: English

Link to buy: amazon.com/J-K-Lassers-1001-Deductions-Breaks/dp/1119838479

Photo: Big Ideas for Small Business

-

"Get What's Yours: The Secrets to Maxing Out Your Social Security" is written by Laurence J. Kotlikoff, Philip Moeller, and Paul Solman. Laurence J. Kotlikoff is the president of Economic Security Planning, Inc. and a professor of economics at Boston University. The Gerald Loeb Award for exceptional business and financial journalism was given to veteran writer Philip Moeller. The PBS News Hour's business and economics correspondent is Paul Solman.

"Get What's Yours" has proven to be the authoritative guide to navigating the perplexing maze of Social Security and obtaining the most benefits attainable. It's a fascinating manual of techniques and strategies authored by well-known financial analysts that can't be found anywhere else. You might try reading all 2,728 rules of the Social Security system (and the thousands of explanations), but Kotlikoff from academics, Moeller from the popular press, and Solman from public television all describe the system in a much more thorough and understandable way. Furthermore, they show how ignorance can be costly: incorrect decisions about which Social Security benefits to apply for cost individual retirees tens of thousands of dollars in lost income each year. (Some of them are even mentioned in the book)

"Get What's Yours" is a book that explains Social Security benefits using simple tactics and compelling stories. It addresses the most common benefit scenarios that married retirees, divorced retirees, and widows and widowers experience. It describes what to do if you're a retired parent with dependent children, disabled, or a working eligible recipient. It considers the tax ramifications of your decisions as well as the financial implications of other investments. It accomplishes all of this and more.

Authors: Laurence J. Kotlikoff, Philip Moeller, and Paul Solman

Publisher: Simon & Schuster; Revised, Updated ed. edition (May 3, 2016)

Language: English

Link to buy: amazon.com/Get-Whats-Yours-Revised-Security/dp/1501144766

Photo: Medium.com

Photo: www.amazon.co.uk -

Sally M. Jones is an emeritus professor of accounting at the University of Virginia's McIntire School of Commerce, where she taught undergraduate and graduate tax courses. She's written for the Journal of Taxation, The Tax Adviser, and the Journal of the American Taxation Association, among others. Sandra Renfro Callaghan is an associate professor of accounting at Texas Christian University's Neeley School of Business. Shelley Rhoades - Catanach is an associate professor of accounting and a certified public accountant at Villanova University.

"Principles of Taxation for Business and Investment Planning", which is considered as one of the best books on taxes, going into a specific exception, planning focuses on the role of taxes in company and investment decisions, providing the general roles of taxation and examining their consequences for all tax-paying businesses. The advantage of this technique is that students have a good understanding of the fundamental ideas that underpin taxation rules: pupils understand the framework of the tax system, making future changes to the tax code-however numerous they may be-easier to comprehend.Unlike traditional introductory publications, "Principles of Taxation for Business and Investment Planning" avoids the technical jargon that can make taxation seem complicated and intimidating to business students. This book helps students understand the importance of taxes in business and investing decisions. In addition, before delving into the specifics of individual exclusions, the book discusses the general role of taxation and its consequences for all taxpaying companies. This method enables pupils to fully comprehend the fundamental concepts that form the basis for specific tax legislation. The students will get a better understanding of the tax system's framework, even if specific tax legislation change from year to year.

Authors: Sally M. Jones, Sandra Renfro Callaghan, and Shelley Rhoades - Catanach

Publisher: McGraw Hill; 25th edition (March 29, 2021)

Language: English

Link to buy: amazon.com/Principles-Taxation-Business-Investment-Planning/dp/1260734536

-

Mindy Herzfeld is an associate with Ivins, Phillips & Barker, Chartered, a tax and employee benefits law firm in Washington, DC.

"International Taxation in a Nutshell", which gives an introduction to US international taxes for both US and non-US students and practitioners, has been rewritten and updated to reflect the fundamental changes to US international tax regulations established by the 2017 tax act, as well as interpretation regulatory guidance. It also contains a discussion of how recent OECD developments affect U.S. taxpayers when it comes to the relationship between US tax rules and worldwide tax reforms. The book not only covers the technical standards, but it also delves into tax planning issues and how they've changed as a result of current U.S. and global events. The activities of foreign taxpayers in the United States, as well as the activities of U.S. taxpayers in other countries, are investigated. It is critical for anyone involved in business and investment activities to understand the tax implications of cross-border transfers in today's environment. The writers have worked in both academia and the private sector, and they've utilized their combined knowledge to reduce the intricacies of real-world tax issues into a concise, easy-to-understand exposition of fundamental international tax ideas."International Taxation in a Nutshell" is a fantastic book to add to your tax library. It has aided many students in not just learning international taxation but also in tax planning.

Author: Mindy Herzfeld

Publisher: West Academic Publishing; 12th edition (November 18, 2019)

Language: English

Link to buy: amazon.com/International-Taxation-Nutshell-Nutshells-Herzfeld/dp/1684673461

-

Following his retirement from Florida State University after 27 years, James R. Hasselback joined the faculty at Louisiana State University. In July 2010, Dr. Ephraim P. Smith, Ph.D., MS was named executive vice chancellor and chief academic officer for the CSU system. The Ernst & Young Professor of Accounting at the University of New Orleans is Dr. Philip J. Harmelink, Ph.D., CPA.

"Federal Taxation: Basic Principles" is a popular first-year tax textbook and one of the best books on taxes that explains the fundamental tax principles in a straightforward and comprehensive manner, including both tax planning and compliance. Basic Principles strikes the ideal compromise between the AICPA standard curriculum (which focuses on company taxes) and most teachers' requests (covering the fundamentals and building toward the complex). Because of its clarity and straightforward approach, the book is also a favorite in distance learning, and it is used in specialized programs such as CFP courses. Individual taxation, gross income, deductions, credits, property transactions, accounting systems and periods, deferred compensation, retirement plans, partnerships, corporations, trusts and estates, and tax planning for individuals are all covered in Basic Principles.

This is an excellent resource for kids who desire to excel in their exams. To learn more, read the review and greatest takeaways. Because this publication is intended for students, it will assist you in understanding the fundamental tax rules in a clear and concise manner. Students who have read this book have stated that if you only read one book on this subject, it should be this one. It has clearly stated everything; nonetheless, it is not wordy and does not stray from the subject matter while describing.

Authors: James R. Hasselback, Dr. Ephraim P. Smith, and Dr. Philip J. HarmelinkPublisher: Cch Inc (April 8, 2021)

Language: English

Link to buy: amazon.com/Federal-Taxation-Principles-Ephraim-Smith/dp/080805600X

Photo: www.slideserve.com -

Since starting his financial and legal planning profession in 1978, Tim has facilitated zero-tax planning for hundreds of business owners and executives. At Matsen Voorhees Mintz LLP, Tim is a principal partner. He also runs a family office that uses completely transparent multi-disciplinary planning ("MDP") standards to simplify transactions with referring advisers.

"The Best Zero Tax Planning Tools" serves a single purpose, hence it cannot be classified as a textbook. It is meant to educate you the secrets of wealth transmission and preservation. If you read this, you will be able to assure that your children and grandchildren will be able to benefit from the money you have built. It's also incredibly simple to read. This book could be finished in a few hours (just 133 pages book).

The merging of proven charitable and non-charitable methods is what Zero Tax Planning entails. Most taxpayers can benefit from such preparation by lowering taxes, increasing lifetime income, increasing transfers to family members, and increasing charitable giving. This book reveals a tried-and-true covenantal process that has been used to implement hundreds of zero-tax plans while also assisting clients in identifying additional planning resources, crystallizing their purpose statements, uniting their advisers, clarifying their values, selecting and customizing the best planning tools, and preparing heirs to leave a lasting legacy. Practical case examples are presented in the last chapters. The most prevalent tools, services, adviser roles, and planning questions are summarized in the appendices.

Author: Tim

Publisher: lulu.com (December 19, 2012)

Language: English

Link to buy: amazon.com/Best-Zero-Tax-Planning-Tools/dp/1105920526

Photo: SlidePlayer