Top 10 Best Books On Finance

There is a lot of interest in finance books. According to market research firm the NPD Group, sales of business and economics print books reached a 10-year ... read more...high, accounting for a quarter of all nonfiction unit volume, with a 10% increase from 2021. After religious books, business is the second most popular category in print publishing. We've compiled a list of the best books on finance, including a biography, how-on to's managing money and investments, a lively reference book about cryptocurrency, policies that affect economics, scandals and personalities exposed, and the thinking behind stock market and other decision-making, as well as the all-time best book on negotiating. These books, written by authors from various backgrounds, provide the most comprehensive picture and the most recent insights into the economy in these complicated and high-risk times, and will help you make better financial decisions.

-

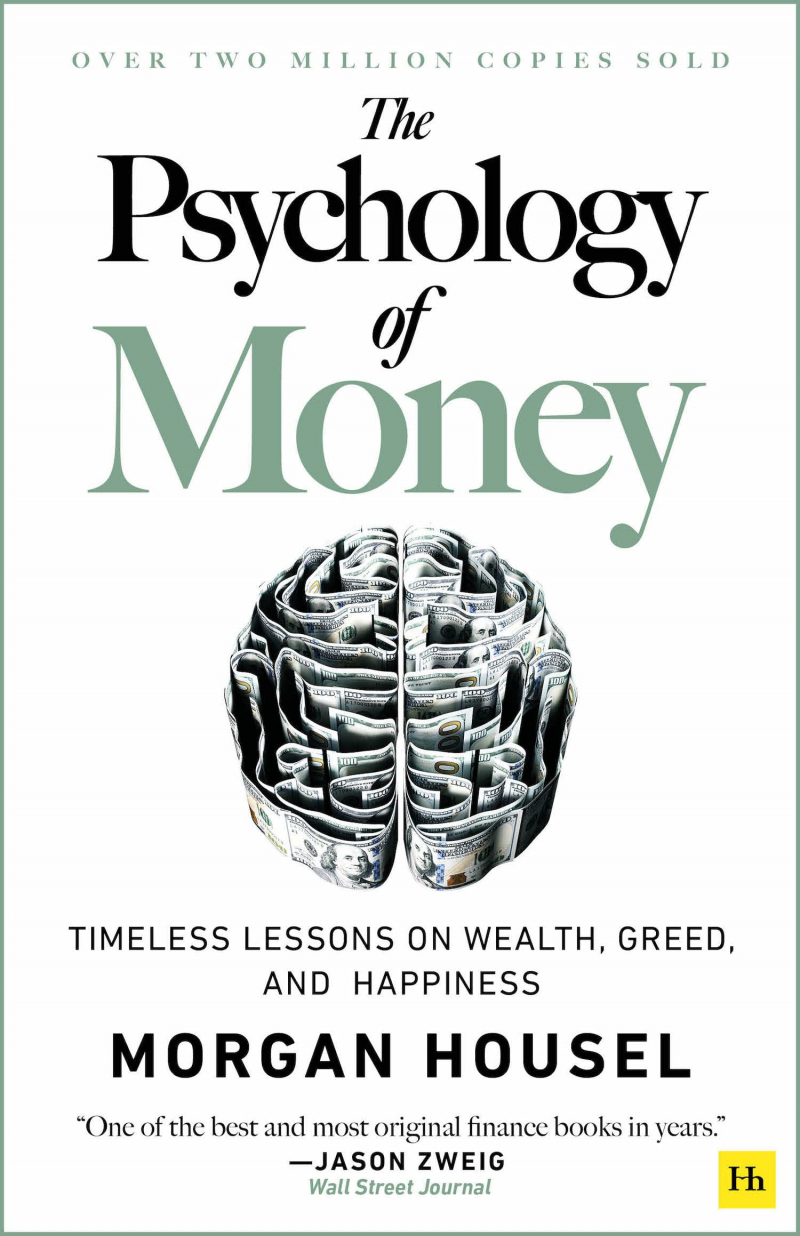

Morgan Housel is a partner at The Collaborative Fund and a former Motley Fool and Wall Street Journal columnist. He is a two-time winner of the Society of American Business Editors and Writers' Best in Business Award, a winner of the New York Times Sidney Award, and a two-time finalist for the Gerald Loeb Award for Distinguished Business and Financial Journalism.

It's not always about what you know when it comes to money. It's all about how you act. And teaching behavior is difficult, even for highly intelligent people.

Money investing, personal finance, and business decisions are typically taught as math-based subjects, with data and formulas telling us exactly what to do. People do not make financial decisions on spreadsheets in the real world. They are created at the dinner table or in a meeting room, where personal history, your own unique perspective on the world, ego, pride, marketing, and strange incentives are all scrambled together.

Morgan Housel, award-winning author, shares 19 short stories in The Psychology of Money that explore the strange ways people think about money and teach you how to make better sense of one of life's most important topics. It is among the best books on finance.

Author: Morgan Housel

Link to buy: https://www.amazon.com/Psychology-Money-Timeless-lessons-happiness/dp/0857197681/

Ratings: 4.7 out of 5 stars (from 29319 reviews)

Best Sellers Rank: #294 in Books

#1 in Budgeting & Money Management (Books)

#1 in Introduction to Investing

#1 in Wealth Management (Books)

https://www.amazon.com/

https://www.amazon.com/ -

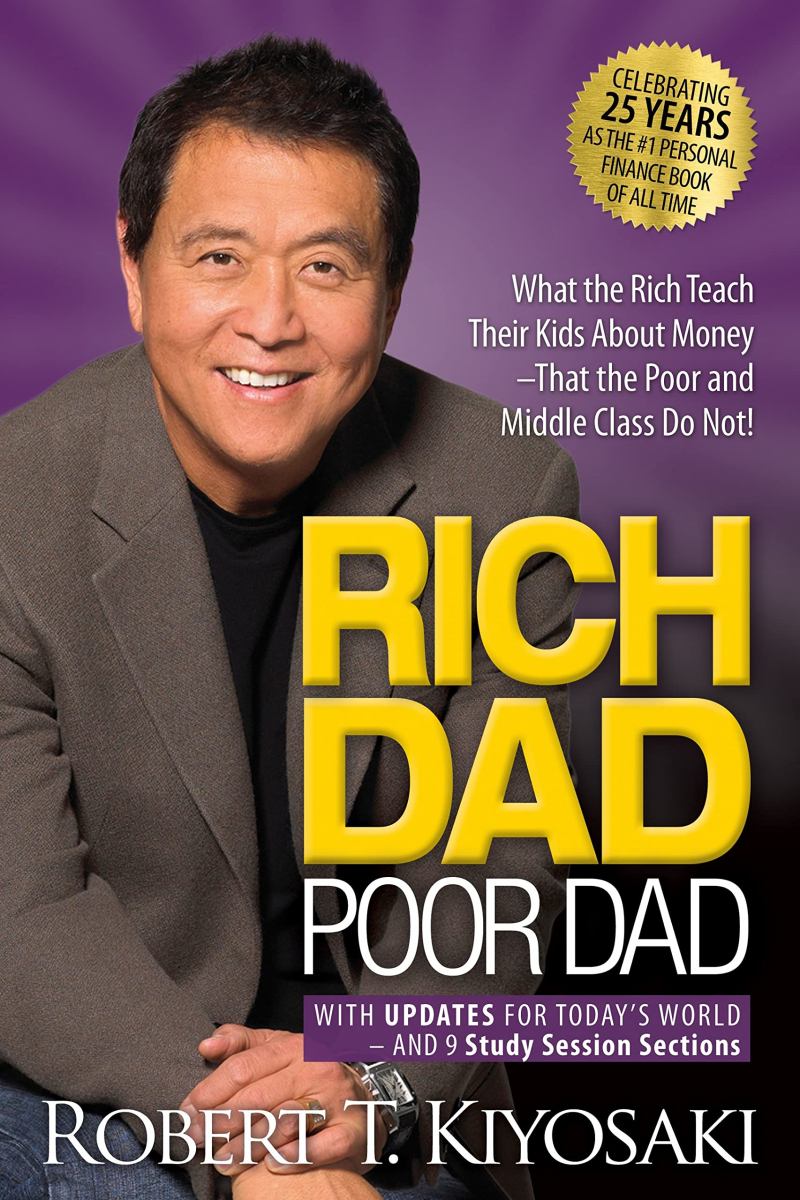

Robert Kiyosaki, best known as the author of Rich Dad Poor Dad, the best-selling personal finance book of all time, has challenged and changed the way tens of millions of people around the world think about money. He is an entrepreneur, educator, and investor who believes that each of us has the ability to change our lives, take control of our finances, and live the rich life we deserve.

Rich Dad Poor Dad is Robert's story about growing up with two fathers - his biological father and his best friend's rich father - and how both men shaped his views on money and investing. The book debunks the myth that you need a high income to be wealthy, and it explains the distinction between working for money and having your money work for you.

In this 20th anniversary edition, Robert provides an update on what we've seen over the last 20 years in terms of money, investing, and the global economy. Sidebars throughout the book will take readers "fast forward" - from 1997 to today - as Robert evaluates how his rich father's principles have stood the test of time.

The messages of Rich Dad Poor Dad, which were criticized and challenged two decades ago, are more meaningful, relevant, and important today than they were then. As usual, listeners can expect Robert to be candid, insightful, and to continue to rock a few boats in his retrospective.

- The myth that you need a high income to become wealthy is debunked.

- Shows parents why they can't rely on the school system to teach their children about money and challenges the belief that your house is an asset

- Defines an asset and a liability once and for all.

- Teaches you how to teach your children about money in order for them to be financially successful in the future.

Author: Robert T. Kiyosaki

Link to buy: https://www.amazon.com/gp/aw/d/1612681123/

Ratings: 4.7 out of 5 stars (from 77174 reviews)

Best Sellers Rank: #1,079 in Books

#13 in Personal Finance (Books)

https://www.amazon.com/

https://www.amazon.com/ -

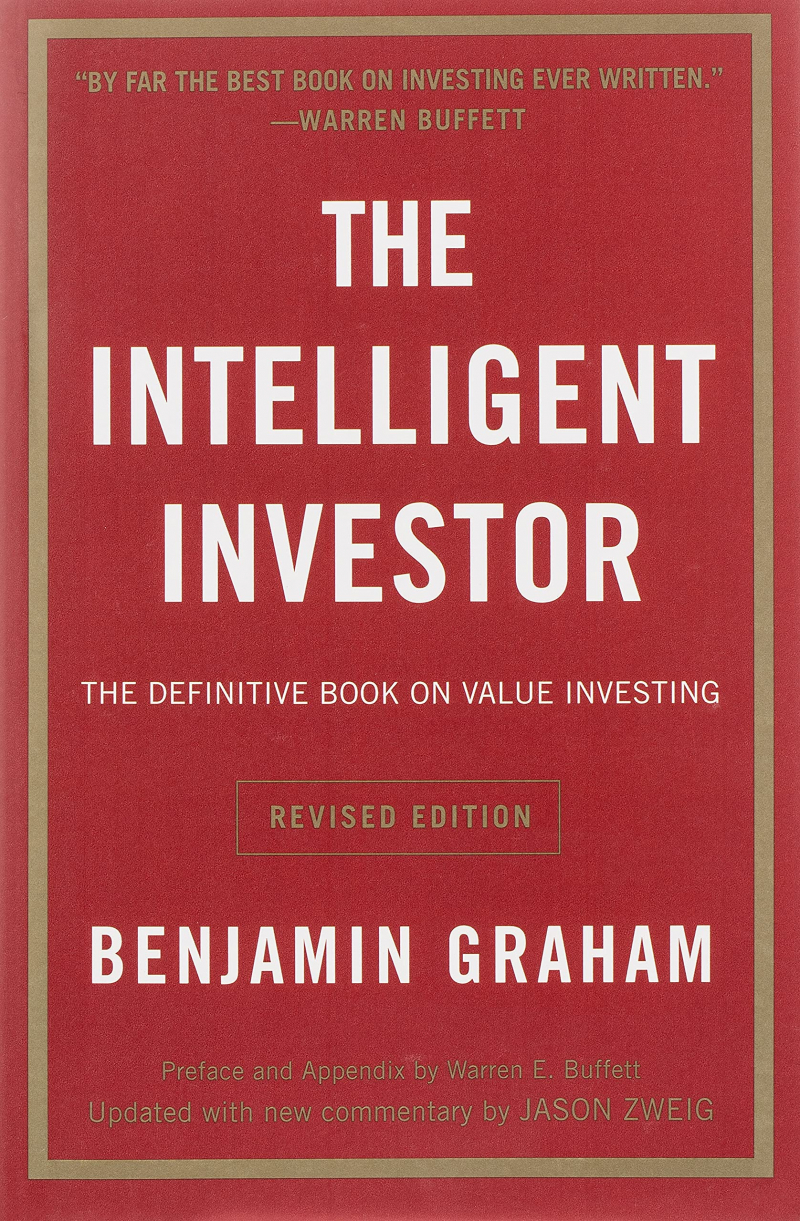

The father of value investing, Benjamin Graham (1894-1976), has served as an inspiration to many of today's most successful businesspeople. He is also the author of Securities Analysis and Financial Statement Interpretation.

This classic text has been annotated to bring Graham's timeless wisdom up to date for today's market conditions... Benjamin Graham, the greatest investment advisor of the twentieth century, taught and inspired people all over the world. Since its initial publication in 1949, Graham's philosophy of "value investing," which protects investors from significant error and teaches them to develop long-term strategies, has made The Intelligent Investor the stock market bible.

Market developments have proven Graham's strategies to be sound over time. While maintaining the integrity of Graham's original text, this revised edition includes updated commentary by noted financial journalist Jason Zweig, whose perspective incorporates today's market realities, draws parallels between Graham's examples and today's financial headlines, and provides readers with a more thorough understanding of how to apply Graham's principles.

The Intelligent Investor Rev Ed., HarperBusiness Essentials edition, is the most important book you will ever read on how to achieve your financial goals. It is regarded as one of the best books on finance.

Author: Benjamin Graham

Link to buy: https://www.amazon.com/Intelligent-Investor-Definitive-Investing-Essentials/dp/0060555661/

Ratings: 4.7 out of 5 stars (from 40128 reviews)

Best Sellers Rank: #623 in Books

#1 in Economics (Books)

#2 in Finance (Books)

#3 in Introduction to Investing

https://www.amazon.com/

https://www.amazon.com/ -

Jim Campbell is the host of Business Talk with Jim Campbell, a nationally syndicated radio show. He is known for his tough interviews with leading figures from business, politics, and sports. Campbell, known for "firsts," landed the first extensive interview with former New York Governor Eliot Spitzer following his resignation, the first interview with former Tyco CEO Denis Kozlowski following his release from prison, and the first broadcast interview with former stock analyst Roomy Kahn, a government informant in one of America's largest insider trading busts. He is the author of Madoff Talks.

No name is more associated with Wall Street's evils than Bernie Madoff's. Arrested for fraud in 2008, at the height of the global financial crisis, the 70-year-old market maker, investment advisor, and former chairman of the NASDAQ had orchestrated the largest Ponzi scheme in world history, defrauding thousands of investors worldwide for $65 billion. Questions linger to this day: What motivated him to do it? How long did he get away with it? What information did his family have? Who is the enigmatic Bernie Madoff?

Author Jim Campbell presents the most comprehensive insider account of the Madoff saga to date in Madoff Talks. Based on exclusive interviews with all of the key players, including the Madoff family and their associates, Wall Street wheelers and dealers, an army of lawyers, analysts, and investigators, victims of the scheme, and Bernie Madoff himself, the book reveals:

- what motivated a respected financier to commit such a massive fraud―and why he thought he could get away with it

- how Madoff managed to keep the scheme hidden in plain sight―despite numerous SEC investigations

- the shocking failures of Wall Street oversight―and how it could happen again

- the true scale of the investment losses―and the victims’ ongoing fight for justice

- what Ruth Madoff and the rest of the family knew―and how it shattered their lives

Madoff Talks includes the author's first, and most likely only, interviews with Ruth Madoff and defense attorney Ira Sorkin, for which Bernie waived attorney-client privilege, as well as never-before-published details from the author's personal communications with Bernie Madoff while incarcerated. The book is a vivid, powerful piece of investigative reporting that takes us behind the headlines to show the true human cost of Madoff's crimes, as well as a cogent analysis of the reforms required to prevent it from happening again.

Author: Jim Campbell

Link to buy: https://www.amazon.com/dp/126045617X

Ratings: 4.2 out of 5 stars (from 278 reviews)

Best Sellers Rank: #212,054 in Books

#108 in White Collar Crime True Accounts

#166 in Wealth Management (Books)

#536 in Business Professional's Biographies

https://www.amazon.com/

https://www.amazon.com/ -

Allison Schrager is an economist, Quartz journalist, and co-founder of LifeCycle Finance Partners, LLC, a risk management firm. Allison broadened her experience by working in finance, policy, and media. She oversaw retirement product innovation at Dimensional Fund Advisors and advised international organizations such as the OECD and the IMF. She has also written for the Economist, Reuters, and Bloomberg Businessweek.

Is it worth swimming in shark-infested waters to catch a 50-foot career-high wave? Is it more dangerous to make an action film or a horror film? Should sex workers forego half of their earnings for added security, or take a chance and keep the extra cash?

Most people would not expect an economist to have an answer to these questions, or to questions about who to date or when to leave for the airport. But those people haven't met Allison Schrager, an economist and award-winning journalist who has spent her career researching how people manage risk in their personal and professional lives.

Every day, whether we realize it or not, we all take risks, big and small. Even the most cautious among us cannot avoid taking risks; the question is always which risks to take, rather than whether to take any at all. What most of us don't know is how to assess those risks and maximize our chances of achieving our goals in life.

Schrager equips readers with five risk-management principles in An Economist Walks Into a Brothel, principles used by some of the world's most interesting risk takers. For example, she interviews a professional poker player about staying rational when the stakes are high, a paparazzo in Manhattan about spotting different types of risk, horse breeders in Kentucky about diversifying risk and minimizing losses, and a war general who led troops in Iraq about preparing for what we don't see coming.

When you start looking at risky decisions through Schrager's new framework, you can increase the upside and better mitigate the downside in any situation.

Author: Allison Schrager

Link to buy: https://www.amazon.com/dp/0525533966

Ratings: 4.3 out of 5 stars (from 319 reviews)

Best Sellers Rank: #112,912 in Books

#95 in Theory of Economics

#164 in Business Decision Making

#247 in Decision-Making & Problem Solving

https://www.amazon.com/

https://www.amazon.com/ -

Ellen Carr has worked as a high-yield bond portfolio manager for over two decades, most recently at Barksdale Investment Management, a majority-women-owned institutional fixed-income investment management firm. She is also an adjunct finance professor at Columbia Business School, where she teaches credit markets and cash flow modeling. She writes for the Financial Times on occasion.

Katrina Dudley works for Franklin Templeton Investments, one of the world's largest asset management firms. She wrote the foreword to the Vault Career Guide to Mutual Funds (2016).

Diversification is a fundamental investing principle. However, money managers have not implemented it in their own ranks. Only about 10% of portfolio managers—the people most directly responsible for investing your money—are women, and the figures are even worse at the ownership level. What are the causes of this underrepresentation, and what are the consequences, including the bottom lines of firms and clients?

In Undiversified, experienced practitioners Ellen Carr and Katrina Dudley investigate the gender imbalance in investment management and propose solutions to address it. They explore the barriers that subtly but effectively discourage women from entering and staying in the industry at each point in the pipeline. At the entry level, the lack of visible role models discourages students from considering the field, and those who do embark on an investment management career face many obstacles to retention and promotion. Carr and Dudley emphasize the importance of informal knowledge about career paths, without which women are at a disadvantage in an industry that values confidence. They showcase a diverse constellation of successful female portfolio managers to demystify the profession.

Undiversified makes a compelling case for increasing the number of women in active investment management at a time when it is under threat from passive strategies and technological innovation, based on extensive research, interviews with prospective, current, and former industry practitioners, and the authors' own experiences.

Author: Katrina Dudley and Ellen Carr

Link to buy: https://www.amazon.com/dp/B08NFK2GDX

Ratings: 4.6 out of 5 stars (from 20 reviews)

Best Sellers Rank: #931,514 in Kindle Store

#141 in Investing Portfolio Management

#353 in Investment Portfolio Management

#593 in Women & Business (Kindle Store)

https://www.amazon.com/

https://www.amazon.com/ -

James E. Hughes Jr. is a retired attorney who has written or co-written several books on the dynamic preservation of true family wealth, including Family Wealth: Keeping It In The Family, Family: The Compact Among Generations, and Cycle of the Gift: Family Wealth & Wisdom.

Susan E. Massenzio, PHD, is a psychologist and co-founder of the think tank and consultancy Wise Counsel Research. She has extensive experience advising senior executives and assisting leaders in developing effective succession plans.

Keith Whitaker, PHD, is a co-founder of Wise Counsel Research and an educator. He has extensive experience advising leaders of enterprising families on succession planning, developing next-generation talent, and communicating about estate planning.

Complete Family Wealth: Wealth as Well-Being, the second edition of this foundational work, provides proven tools and best practices for wealthy families to use in maturing, maintaining, and managing personal and legacy wealth for the long term. The book is divided into three sections: the "what"—what is meant by family, wealth, and enterprise; the "who"—the people who are critical to the success of family businesses; and the "how"—specific practices that families can use to enhance and grow family wealth.

The second edition of this work prioritizes the health and well-being of individual members of the family unit in all aspects covered in the book. The increased awareness of the social complexities of wealth that have come to the fore in recent years is a natural result of this focus, and the team of expert authors here address the responsibility of private wealth to the public good. Furthermore, the second edition of Complete Family Wealth includes:

- A new chapter on "the big reveal," with suggestions for encouraging positive, life-affirming reactions to the disclosure of present or future wealth.

- A new chapter on preserving the cherished family vacation home

- Two new appendices: "Fiduciary Course Curriculum," devoted to improving trustee and beneficiary education, and "Key Practices for Families During Challenging Times," a response to the pandemic but applicable to all trying times for families.

- Examples that make these practices accessible to a wide range of income levels.

Among the best books on finance, Complete Family Wealth's second edition is essential reading for high-net-worth families and their financial advisors, having shaped the language used by families and their advisors in the first edition. It will also appeal to family offices, fund managers, and private investors.

Author: Keith Whitaker, James E. Hughes Jr. and Susan E. Massenzio

Link to buy: https://www.amazon.com/dp/1119820030

Ratings: 4.5 out of 5 stars (from 83 reviews)

Best Sellers Rank: #104,011 in Books

#28 in Estates & Trusts Law

#78 in Wealth Management (Books)

#730 in Investing (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Dr. Moira Somers is a pioneer in the field of financial psychology and financial change. Dr. Somers, a neuropsychologist, professor, and executive coach, combines the science and art of giving advice with practical wisdom and wit. She works with financial professionals and organizations all over the world to equip them with easy-to-implement advice that captures clients' hearts and minds through her popular keynote addresses and follow-up seminars.

The advice is sound, and the client appears eager, but then... Nothing occurs! This is all too often the experience that financial professionals have on a daily basis. When good recommendations are not followed through on, clients' well-being suffers, opportunities are lost, and the professional relationship becomes strained.

Advice that Sticks addresses the issue of financial noncompliance. This book, written by a neuropsychologist and financial change expert, examines the five major factors that influence whether a client will follow through on financial advice. Individual client psychology, as well as sociocultural and environmental factors, general advice characteristics, and specific challenges pertaining to the emotionally charged domain of money, all play a role in non-adherence. Perhaps most surprising is the degree to which advice-givers themselves can sabotage implementation. A large portion of noncompliance is the result of avoidable errors made by financial professionals and their teams.

Her extensive clinical and consulting experience is combined with research findings from positive psychology, behavioral economics, neuroscience, and medicine. What emerges is a thoughtful, humorous, but most importantly practical guide for anyone who makes a living by providing financial advice. It will become a must-have resource for anyone working with clients at all levels of wealth.

Author: Moira Somers

Link to buy: https://www.amazon.com/gp/aw/d/1788602382/

Ratings: 4.4 out of 5 stars (from 92 reviews)

Best Sellers Rank: #2,409,896 in Books

#471 in Financial Services Industry

#1,752 in Wealth Management (Books)

#3,386 in Popular Applied Psychology

https://www.amazon.com/

https://www.amazon.com/ -

Burton G. Malkiel is Princeton University's Chairman's Professor of Economics Emeritus. He was previously a member of the Council of Economic Advisers and the dean of the Yale School of Management. He currently resides in New Jersey. He is the writer. With over 1.5 million copies sold, it is the best investment guide money can buy, and it has been fully revised and updated.

Burton G. Malkiel's reassuring, authoritative, and perennially best-selling guide to investing is more needed than ever in today's daunting investment landscape. A Random Walk Down Wall Street has long been considered the first book to buy when beginning a portfolio. This new edition includes updated information on exchange-traded funds and emerging market investment opportunities; a brand-new chapter on "smart beta" funds, the latest marketing gimmick in the investment management industry; and a new supplement that delves into the increasingly complex world of derivatives.

Consider getting a week-long investing lesson from someone with Benjamin Franklin's common sense, Milton Friedman's academic and institutional knowledge, and Warren Buffett's practical experience. That's what you'll find in the latest edition of Burton Malkiel's must-read.

Author: Burton G. Malkiel

Link to buy: https://www.amazon.com/dp/0393352242

Ratings: 4.6 out of 5 stars (from 991 reviews)

Best Sellers Rank: #245,876 in Books

#321 in Retirement Planning (Books)

#690 in Budgeting & Money Management (Books)

#713 in Introduction to Investing

tiki.vn

https://www.amazon.com/ -

Michelle Singletary is a Washington Post syndicated columnist whose award-winning column, The Color of Money, appears twice a week in dozens of newspapers across the country. She is a frequent NPR contributor and can be seen on CNN's New Day, CNN Newsroom, and The Situation Room with Wolf Blitzer on weekends. She has also appeared on Today on NBC and The Early Show on CBS. She hosted her own national television show, Singletary Says, on TV One for two years.

Life is full of financial setbacks, from pandemics to recessions, bear markets to energy crises. The harsh reality is that the question is not whether another economic downturn will occur, but when. The crucial question is: how do you keep a crisis from escalating into a full-fledged disaster?

Michelle Singletary, an award-winning personal finance columnist, shares her expert advice for dealing with a financial storm. In What To Do With Your Money When Crisis Hits, she addresses the most pressing issues that arise when money becomes scarce, such as:

- Which bills must be paid first?

- When is it appropriate to dip into savings?

- What are the most effective ways to reduce spending?

- How do you keep calm when the stock market is falling?

- Is this "opportunity" a disguised scam?

This practical guide addresses debt concerns, credit card issues, cash-flow issues, and a variety of other common financial issues. It is among the best books on finance. Whether you're in the midst of a crisis or preparing for one, this book gives you the tools you need to protect your wealth and your future.

Author: Michelle Singletary

Link to buy: https://www.amazon.com/dp/0358719216

Ratings: 4.6 out of 5 stars (from 102 reviews)

Best Sellers Rank: #882,738 in Books

#2,020 in Budgeting & Money Management (Books)

#8,833 in Success Self-Help

https://www.carousell.com.my/

https://www.carousell.com.my/