Top 9 Best Merchant Account Services for Credit Card Processing

There are several types of merchant accounts available including local, high risk, offshore, and direct. There are also multiple types of merchant services ... read more...that come bundled with the accounts such as check guarantee services, payment gateways, and cash advances. In this article, Toplist will introduce the best merchant account services you may know.

-

Leaders Merchant Services is one of the industry's best credit card processing services. It has been in business for 20 years, and its parent company is the well-known Paysafe Group Subsidiary. Leaders has many reasons for businesses to enjoy it, including some of the best credit card processing prices in the industry. We're talking about interest rates that start as low as 0.15 percent. Leaders also has a 98 percent approval rating. As a result, firms that are experiencing difficulty obtaining the green flag will find the Leaders' approach invigorating.

Furthermore, Leaders provides a $500 Assurance guarantee. This clause specifies that if the company cannot save you money within the first six months of your contract, you will be compensated $500. Leaders uses the dependable Clover point-of-sale system, which also connects with QuickBooks. The informative dictionary of words and 24/7/365 customer service for troubleshooting any issues would be appreciated by new SMBs. Leaders also provides value-added services such as business cash advances, loyalty programs, gift cards, check guarantee services, and point-of-sale systems.Advantages of Leaders service:

- $500 Assurance Program

- Integrates with QuickBooks

- Rates starting at 0.15%

View details: https://www.leadersmerchantservices.com/

Leaders Merchant Services

Leaders Merchant Services -

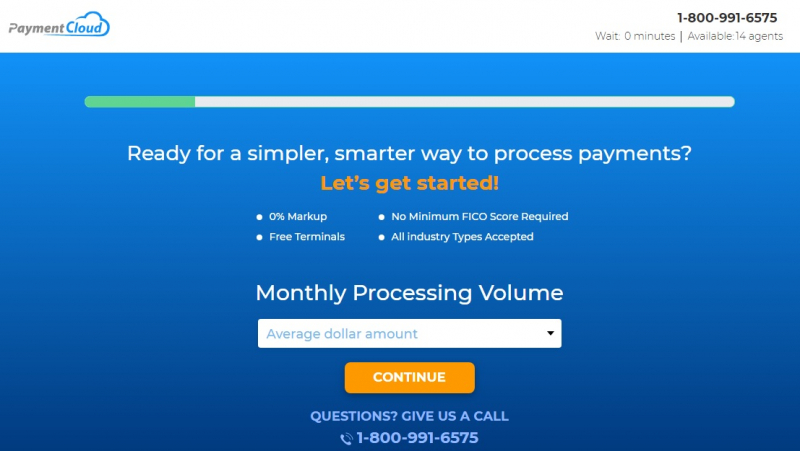

PaymentCloud is one of the best merchant services for small businesses, especially if you are in a high-risk industry because it offers a 98 percent acceptance rate, free pricing comparison, gateway setup, and account setup. Debt consolidation, tobacco firms, transportation services, E-commerce, and diet programs are examples of this. PaymentCloud accepts EMV, NFC, swipe, and contactless payments, making it simple to use for all sorts of merchants.

PaymentCloud's flexible user policies are appreciated by merchants. It's a popular choice because there are no cancellation costs, no setup fees, and next-day payments. You can get skilled same-day setup, as well as live tech assistance. PaymentCloud also interfaces with a wide range of business apps, including Volusion, Shopify, Magento, BigCommerce, WordPress Woo, and others, making it one of the top payment processors for companies looking for a simple, single-dashboard platform for all of their company needs.

Advantages of Payment Cloud service:

- No application or setup fees

- Good for high-risk industries

- Loads of integrations

View details: https://paymentcloudinc.com/

Payment Cloud

Payment Cloud -

Flagship, the #1 merchant account provider for the past 8 years, has payment solutions for any sort of business, including online, in-store, mobile, MOTO, and payment alternatives such as EMV, NFC, Apple Pay, Google Pay, and Samsung Pay. As a result, Flagship is also one of the best mobile credit card processing solutions. The company also provides no-commitment contracts and no cancellation costs.

When you open a merchant account with Flagship, you may choose a free hardware choice from the Clover Mini point of sale system or the EMV certified terminal. You can also obtain same-day funding, merchant cash advances of up to $150,000, and a reliable business management interface to manage all of your merchant services online. Furthermore, Flagship offers a processing rate guarantee. If the company is unable to deliver the lowest total processing charges, you will be compensated with a $200 American Express gift card.

Advantages of Flagship service:

- Excellent reputation

- Lowest rates guarantee

- Month-to-month contracts

View details: flagshipmerchantservices.com/apply

Flagship

Flagship -

ProMerchant may be an excellent place to start if you're seeking the finest payment processor for small businesses. This is due to the fact that it has month-to-month commitments and no cancellation or setup costs, allowing you to test it out without remorse. In addition, when a new firm signs up with ProMerchant, it receives a free EMV terminal.

Businesses can opt for interchange-plus set percentage rates and a transaction cost, or interchange plus a flat monthly charge and a transaction fee. This option allows merchants to select the type of plan that is best suited to their revenue strategy. And, because it is a monthly contract, you can always modify it (good for seasonal businesses). ProMerchant provides same-day approval and can have you processing payments within 72 hours of your first contact.Advantages of ProMerchant service:

- Month-to-month contracts

- No public complaints

- Fast, same-day approval

View details: promerchant.com

ProMerchant

ProMerchant -

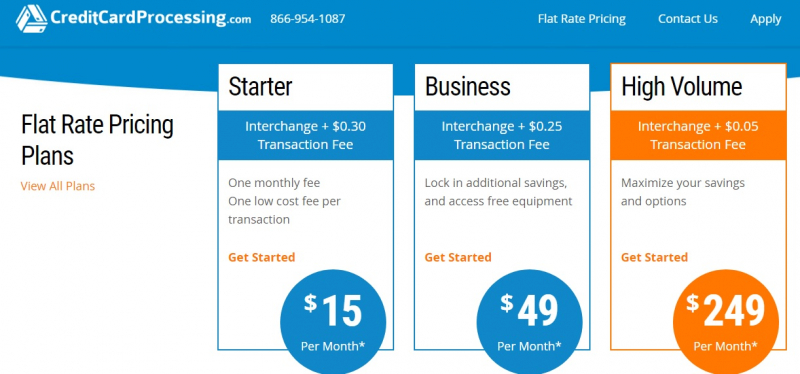

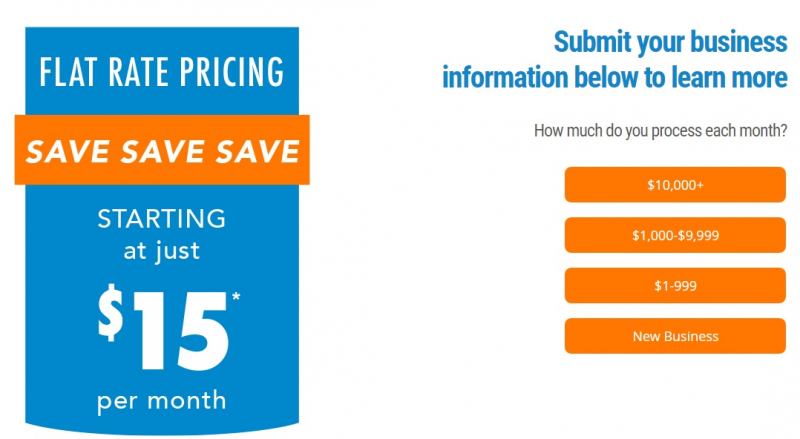

CreditCardProcessing.com is another Paysafe Group company, which naturally gives it credibility and street cred. However, the organization distinguishes itself with free equipment programs, simple online applications, and, most importantly, same-day deposits through its same-day funding program. CreditCardProcessing.com also provides same-day processing. As a result, businesses may begin accepting all forms of payments, including DMV, NFC, and contactless payments, immediately.

You can contact tech support at any time of day or night by dialing the toll-free number, or you can request a free quote for payment processing and merchant services. CreditCardProcessing.com also has no long-term contracts and no cancellation fees, making it one of the top credit card processing companies for businesses who are unsure about which CCP service to use.Advantages of CreditCard Processing.com service:

- No long-term contracts

- Same-day approval

- Same-day funding

View details: creditcardprocessing.com

CreditCard Processing.com

CreditCard Processing.com -

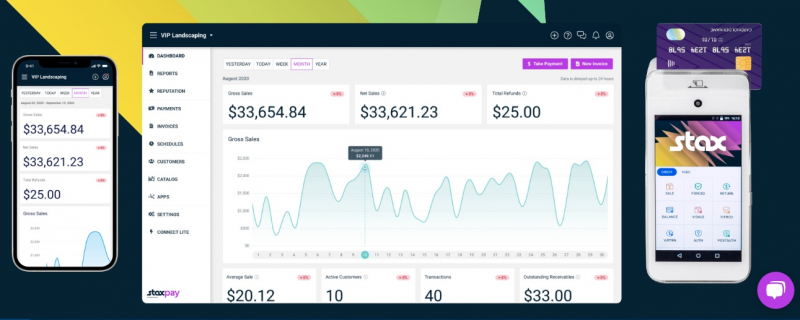

Small businesses can use Stax by Fattmerchant to process payments. It provides a monthly membership and does not charge percentage-based transaction fees. As a result, it may be a viable alternative for firms with high monthly transaction volumes.

Stax also offers a software dashboard called Stax Pay, which contains built-in analytics, an API, and e-commerce payment capabilities. Stax customers receive email assistance 24 hours a day, seven days a week, and there are no early termination costs.Advantages of Stax by FattMerchant service:

- No percentage-based transaction fees

- Includes swiped and keyed-in payments

- 24/7 customer support

View details: https://staxpayments.com/

Stax by FattMerchant

Stax by FattMerchant -

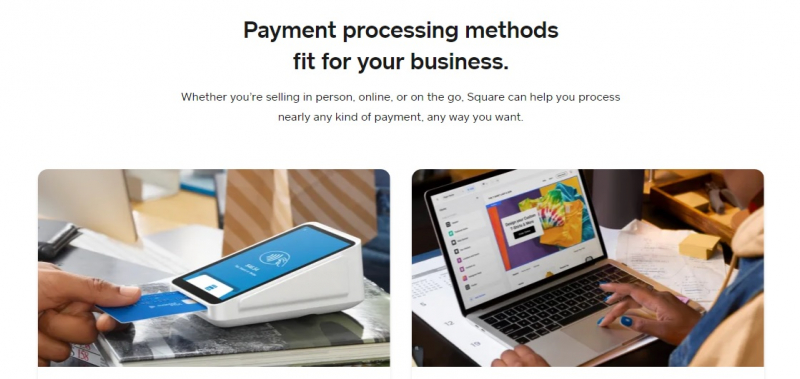

Square transformed the market by introducing a mobile, convenient, and economical point-of-sale system, even for small enterprises. Since then, the firm has continued to make enhancements and improvements, the most recent of which has earned Square a reputation as the best mobile credit card processing alternative available.

Square outperforms the competition by putting this convenient reader into a pocket-sized and surprisingly powerful piece of hardware that can process all types of payments, including EMV chip cards and contactless payments like NFC and e-wallets like Apple Pay and Google Pay. Square credit card processing includes a fixed charge for both dip and tap transactions, no additional fees, a wireless connection, and the capacity to process payments in just 2 seconds.Advantages of Square service:

- Extremely compact, mobile design

- Flat rate fees and no additional fees

- Fast processing

View details: https://squareup.com/

Square

Square -

National Processing is a credit card processing company that primarily serves low-risk retailers. Restaurants pay the least, shops pay somewhat more, and e-commerce platforms pay the most under its differentiated pricing structure. Larger companies can choose to pay higher or lower monthly fees in exchange for higher or cheaper per-transaction fees.

All price plans, as well as information about the many features included in your plan, are plainly shown on the National Processing website. Highlights include setup assistance, reprogramming of current equipment (if applicable), and a free mobile reader. Clover's payment terminals and readers are sold through National Processing, an authorized reseller.Advantages of National Processing service:

- Transparent fee structure

- Free reprogramming of existing equipment

- QuickBooks integration

View details: go.nationalprocessing.com/best-merchant-services/ni

National Processing

National Processing -

CardConnect Paradise is a subsidiary of First Data and is backed by Wells Fargo Bank, so you can be confident that you're working with a reputable service provider. CardConnect Paradise also provides some of the most robust security features in the industry, such as tokenization, P2PE, and full PCI compliance. As a result, CardConnect Paradise is one of the top credit card processing services for businesses concerned with secure financial transactions.

CardConnect Paradise provides payment processing and merchant services to retail, mobile, eCommerce, MOTO, B2B, and enterprise-level businesses—pretty much everyone. Merchants can accept credit and debit card payments, as well as mobile phone payments, virtual terminal payments, and POS equipment connections. CardConnect Paradise also offers strong reporting features, mobile optimization, and automatic reconciliation, making it one of the most well-rounded merchant services providers out there.Advantages of Cardconnect Paradise service:

- Lots of value-added services and features

- Strong security features

- Interchange plus pricing structure

View details: charge-it-now.com

Cardconnect Paradise

Cardconnect Paradise