Top 10 Best Payroll Services for Small Business

Discover the ultimate guide to the Best Payroll Services for Small Businesses, meticulously compiled by Toplist. In this comprehensive review, we unveil the ... read more...most up-to-date and reliable solutions to streamline your business payroll needs.

-

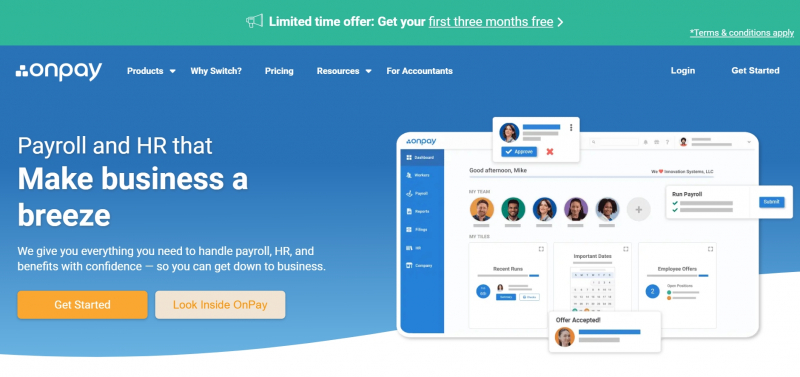

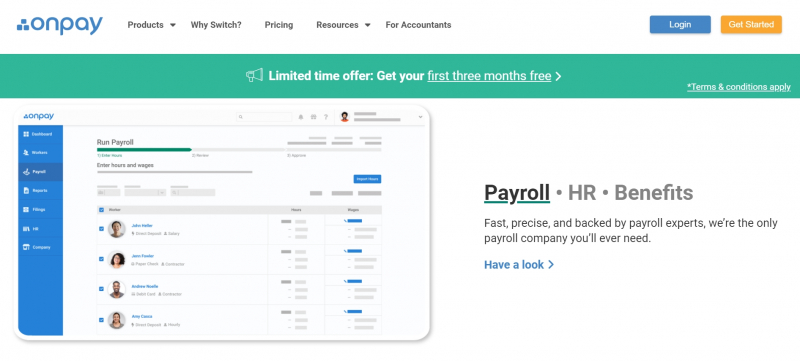

From a clean, easy-to-use interface to a unified pricing structure, Onpay provides an affordable yet customizable payroll platform for small and growing businesses. Onpay may not be the most extensive offering on the payroll market, but it offers incredible depth and features that make it easy for companies to optimize their payroll needs.

In terms of the payroll service itself, Onpay covers all the basics needed for small businesses. The platform helps you quickly calculate salaries for W2 employees and 1,099 contractors and handle HR benefits, compensated workers, and insurance through automated tax reporting and payments. For 50 states, Onpay also offers impressive integrations integrating time tracking and accounting software that syncs seamlessly with the platform. In addition to all of this, our customer support team is quick to respond and answer your questions timely.

Best for: Small businesses and independent accountants

Price range: $40 per month + $6 per user

Benefits & HR: 401(k), worker’s comp, health insurancePros

- Extremely accessible and user-friendly

- Integrations with Quickbooks, time-tracking software, and more

- Automated tax filing

Cons

- Not ideal for larger businesses

- Limited to US-based businesses

Website: https://onpay.com/

Screenshot via https://onpay.com/

Screenshot via https://onpay.com/ - Extremely accessible and user-friendly

-

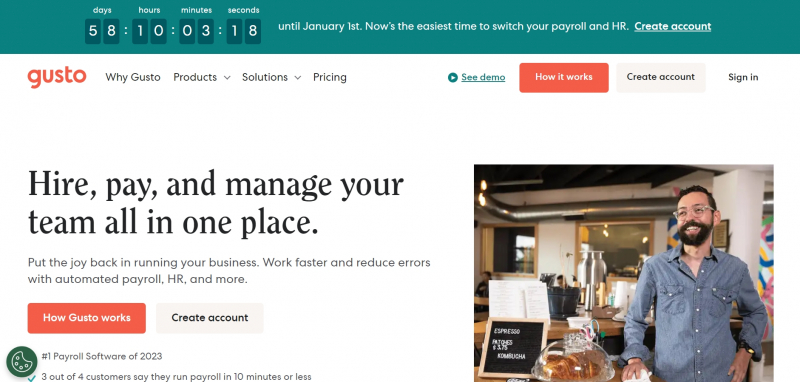

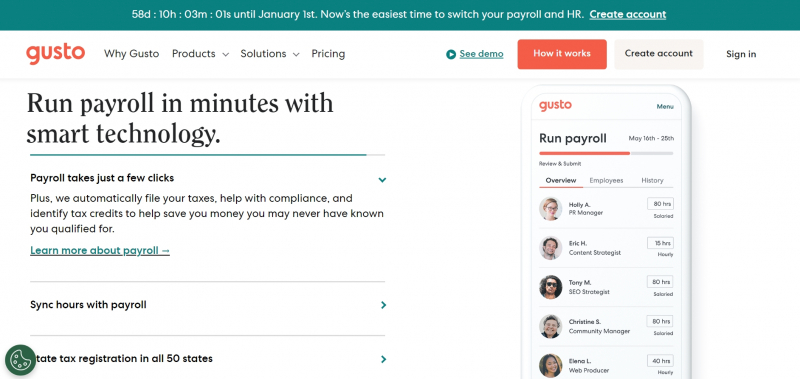

Gusto is one of the best payroll services for small businesses today and is an excellent choice for freelancers and contractors alike. With automatic tax returns, health, dental, vision, college funds, and the ability to maintain an unlimited list of employee benefits, including 401k and salaries, Gusto is a cost-effective way for businesses to optimize their monthly bills.

It's also nice that Gusto integrates with many other applications, including accounting programs like QuickBooks Online, Xero, and FreshBooks. You can also sync your time tracking app (such as Time Tracker or Homebase) with an expense management tool like Expensify to have a comprehensive database of your accounts.

Best for: SMBs, independent contractors, freelancers

Price range: From $6per month per person + $40 base month

Benefits & HR: Medical, dental, vision, 401k, commuter, 529Pros

- Loads of useful integrations

- Fully automates payroll and taxes

- Good for contractors and freelancers too

Cons

- No 24/7 customer support

- Not all HR benefits available in all states

Website: https://gusto.com/

Screenshot via https://gusto.com/

Screenshot via https://gusto.com/ - Loads of useful integrations

-

ADP is one of the oldest online and offline payroll services and will tell you a thing or two about the behind-the-scenes experiences of these employees. Offering a full range of HR benefits and services, payroll services, and time and attendance, ADP is a professional payroll service for businesses that need more than core software. From HR guidance, resources, and dedicated service managers to full tax compliance, reporting, and self-service capabilities, ADP offers an impressive array of features and services.

ADP automatically calculates your tax liability, withholds and pays taxes on your behalf, and handles all reports and issues, including W2 and 1099. Moreover, ADP is not limited to residents. This payroll service solves problems in over 140 countries worldwide.

Best for: Powerful payroll services mid-enterprise biz

Price range: From $79per month + $4 per employee

Benefits & HR: 401k, SIRA, SEP IRA, health, workers’ comp- Pros

- Professional, top-rated features and service

- Oldest payroll services online

- Full service, all-inclusive benefits & payroll

- Cons

- Not as cheap as some competitors

- No pricing plans for really small businesses

Website: https://www.adp.com/

Screenshot via https://www.adp.com/

Screenshot via https://www.adp.com/ - Pros

-

Paychex is a cloud-based payroll provider with plans for businesses of all sizes but is especially suited for small businesses with up to 50 employees. With Paychex Flex, an SMB-centric program, you can update your database, set up automatic rules, and execute payroll quickly and efficiently via your desktop or mobile dashboard. Paychex uses self-service, allowing employees to take most of the data entered on their shoulders fully.

Beyond payroll calculations, Paychex calculates, pays, and files all local taxes as federal taxes. Pay staff by direct wire transfer, paper check, or payment card, whichever is more convenient. The Paychex plan also includes features like onboarding for easy checkout, HR analytics, and an event calendar.

Best for: SMBs looking for more than just payroll

Price range: $39-plus per month, depending on company size and needs

Benefits & HR: Health, retirement, onboarding, managementPros

- User-friendly software anyone can run

- Great choice for small businesses

- Affordable without missing out on features

Cons

- Lots of reports options can be confusing

- New version launch takes getting used to

Website: https://www.paychex.com/

Screenshot via https://www.paychex.com/

Screenshot via https://www.paychex.com/ - User-friendly software anyone can run

-

Intuit's QuickBooks is another big name that has recently appeared in the payroll industry. Proven accounting software QuickBooks now offers payroll services that seamlessly sync across all your accounting software for 360-degree end-to-end service.

One of the strengths of QuickBooks is its tax filing service. One of the best payroll service providers for 24/7 tax organizations. QuickBooks can automatically log all your taxes, process deductions, create your own tax categories, and track things like sales tax if you have an e-commerce store. This is a very convenient way to keep one of the key aspects of your business at its best.

Best for: Comprehensive general ledger-linked payroll

Price range: From $22.50per month + $4 per employee per month

Benefits & HR: Health benefitsPros

- Smooth onboarding support

- Extensive tax-filing features

- Fully integrates with your accounting software

Cons

- Not as customizable as competitors

- Not as many features included in basic plans

Website: https://quickbooks.intuit.com/

Screenshot via https://quickbooks.intuit.com/

Screenshot via https://quickbooks.intuit.com/ - Smooth onboarding support

-

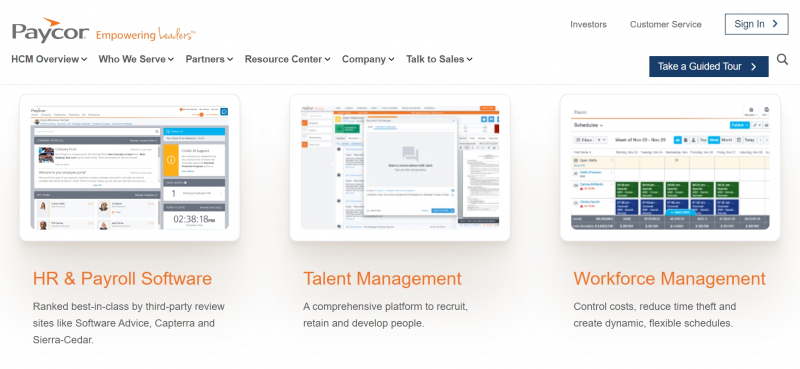

Paycor isn't as well known as big names like ADP and Gusto, but it has gained many fans. Because Paycor is a crazy, feature-rich payroll and HR service that delivers on its promises. Paycor offers features like direct deposit, a user-friendly mobile app, streamlined payroll processing, and customizable widgets, so you can do anything you want with the software.

Another thing businesses like about Paycor is that it comes with many more sophisticated features that advanced payroll providers offer at a much lower cost.

Best for: Businesses seeking scalability

Price range: $99 plus, $5 per employee

Benefits & HR: 401k, child support, healthPros

- Competitive pricing with room to scale

- Huge knowledgebase of human resources

- Strong reporting and analytics tools

Cons

- No pricing info published online

- Employee review process is clunky

Website: https://go.paycor.com/

Screenshot via https://go.paycor.com/

Screenshot via https://go.paycor.com/ - Competitive pricing with room to scale

-

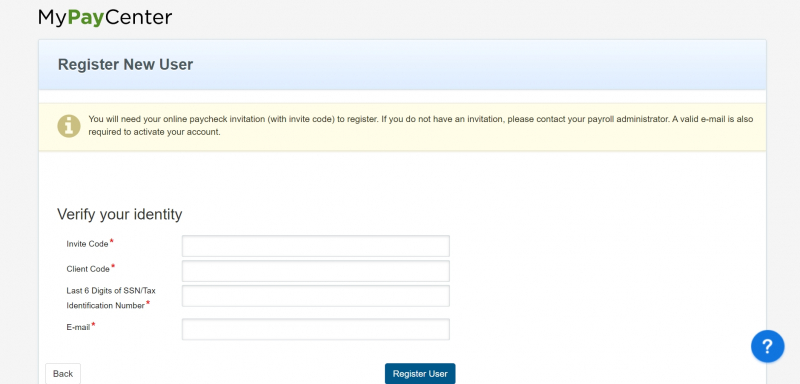

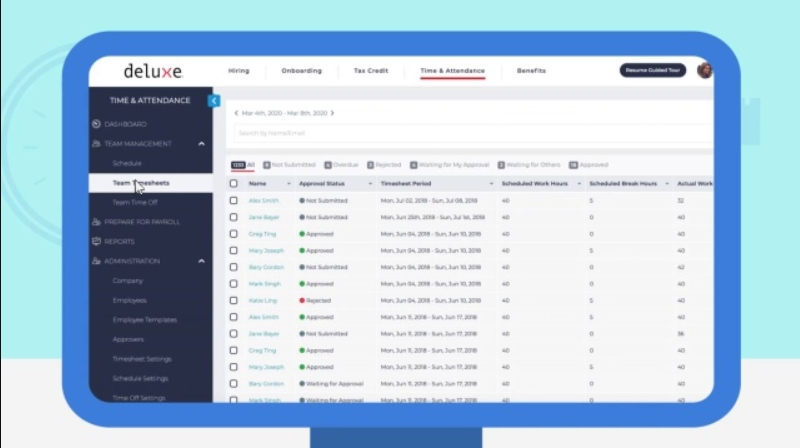

Deluxe has been around for over 100 years, and nearly 5 million businesses trust the brand's salaries for a reason. This is because Deluxe offers the industry's most comprehensive HR and payroll services and includes important features such as tax filing, digital adaptation, employee self-service, and employee payroll management.

Deluxe delivers flexible payment options such as direct deposit, debit card, or paper check. You can set up a regular billing cycle for automatic payroll processing. Employees will appreciate accessing their payroll reports that include deductions, expenses, and paid leave. Deluxe also offers online registration and personalized HR document management to manage your benefits.

Best for: SMBs, startups, enterprise corporations, restaurants, retail, healthcare, contractors

Price range: $45 per month plus $7 per employee

Benefits & HR: Works with all third-party benefits, including 401K, workers’ comp, unemployment insurance, garnishmentsPros

- Full service HR & payroll + tax filing

- Features like digital hiring and onboarding

- Workflow automation

Cons

- Confusing pricing plans

- No free trial

Website: https://mypaycenter.com/

Screenshot via https://mypaycenter.com/

Screenshot via https://mypaycenter.com/ - Full service HR & payroll + tax filing

-

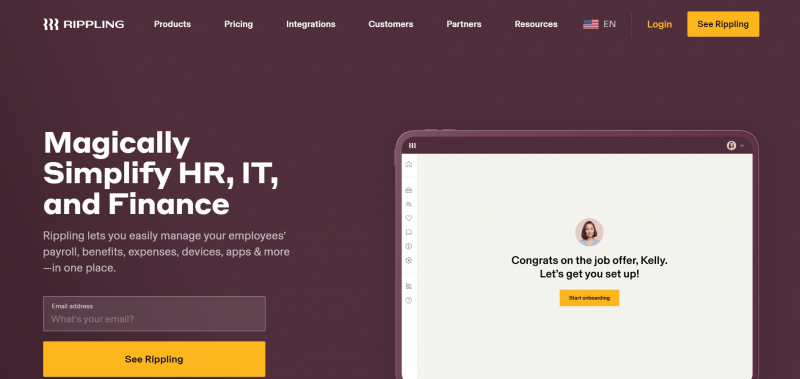

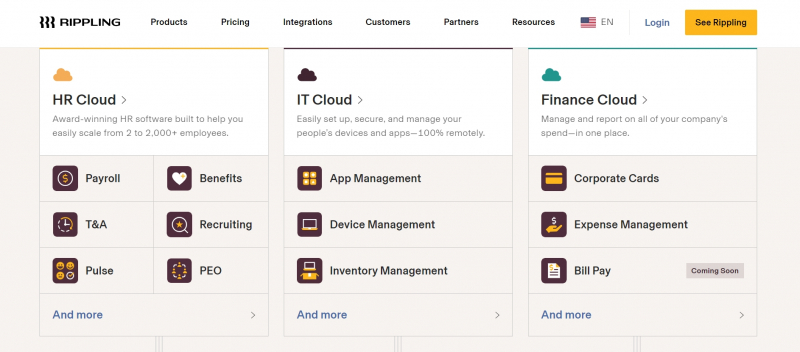

Ripling's payroll tool is a beneficial addition to the fully integrated employee benefits management module. The tool only supports checks and wire transfers, but for companies with more than 1,000 employees, it can support fast payroll payments in 90 seconds with a single click. Ripling can create custom quotes for prospects based on required modules and tasks.

Along with the HR Cloud, the Rippling Unified Workforce Platform offers a range of IT products and a Finance Cloud that combines payroll processing with spending management, corporate cards, and bill pay services. Rippling’s payroll and other services are designed to satisfy the demands of organizations with two to 2,000 employees working in the U.S. or overseas. Prices for the company’s services start at $8 a month per user.

Best for: Automatic filling of tax benefits and payroll processing

Price range: $35/month plus $8 PEPM

Benefits & HR: Yes. Benefits tracking through sync with HR managementPros

- Integrates with HRM component

- 90-second one-click payroll

- Automatic tax filing

Cons

- Check and bank support only

- Separate subscription to HRM

Website: https://www.rippling.com/

Screenshot via https://www.rippling.com/

Screenshot via https://www.rippling.com/ - Integrates with HRM component

-

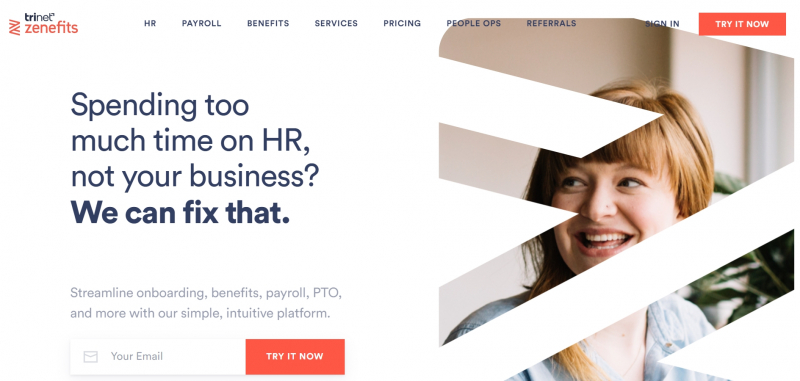

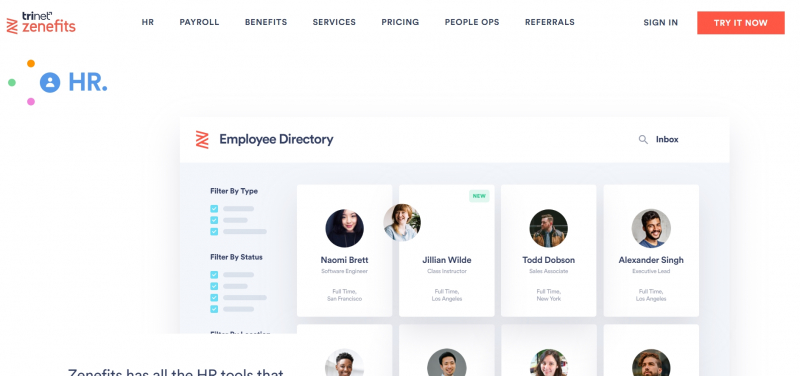

Zenefits is a user-friendly payroll service that provides self-service by default for an easier and faster user experience. The payroll service is excellent, too, but Zenefits excels in the employee benefits department. Get everything from employee health, dental, and vision insurance to life and disability insurance, 401k retirement funds, FSA and HSA accounts, commuting benefits, and more.

Just because Zenefits has a reliable online payroll service doesn't mean they don't. Payroll is reliable and straightforward. Zenefits includes features such as unlimited payments, additional features, tip reports, and payments to contractors. You can also get dynamic mobile stubs with a handy app.

Best for: Employee benefits

Price range: From $8per month per employee

Benefits & HR: 401k, supplemental, FSHA HSA, commuterPros

- Extensive employee benefits

- Easy to use self-service dash

- Powerful business intelligence reporting

Cons

- Can’t do everything from the mobile app

- Bit of a learning curve

Website: https://www.zenefits.com/

Screenshot via https://www.zenefits.com/

Screenshot via https://www.zenefits.com/ - Extensive employee benefits

-

Square is among the best payroll services for small businesses of its class, especially if you are already using Square for retail. One of the most economical alternatives, Square deals with all your paychecks, comes with expected benefits like health insurance and a 401k, and offers many integrations to get the job done.

Square fully automates your payroll and allows you to calculate an unlimited number of monthly paychecks. Track employee time, bring timesheets and tips, and customize and forget your tax returns. Additionally, Square is available throughout the United States. This allows you to access these online payroll services from anywhere.

Best for: Hourly employees, retailers, SMBs

Price range: From $29per month + $5 per employee month

Benefits & HR: Health, 401k, workers comp, pre-taxPros

- Fast and easy software to use

- Run payroll multiple times per month

- Affordable and feature-rich

Cons

- Reporting feature is limited

- Doesn’t support all payment options

Website: https://squareup.com/

Screenshot via https://squareup.com/

Screenshot via https://squareup.com/ - Fast and easy software to use