Top 7 Best Online Risk Management Courses

Are you wondering which remote classroom to attend? You have spare time and want to broaden your horizon about a specific field of study whilst just staying at ... read more...home. Thus, to satisfy the burgeoning demand for online yet qualifying courses, Toplist has complied a rundown of the Best Online Risk Management Courses for who in need!!!

-

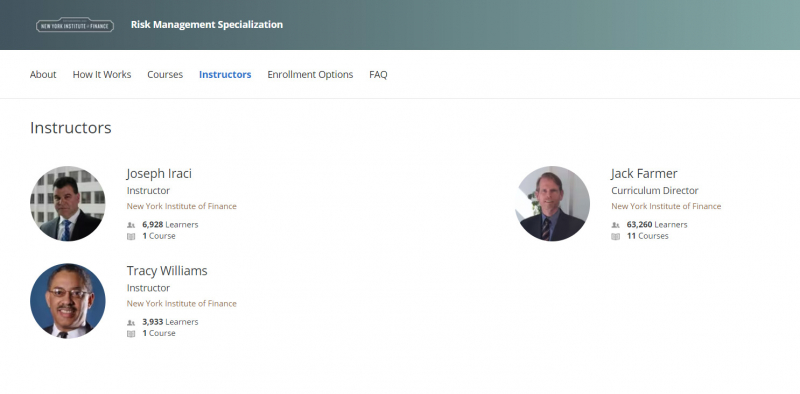

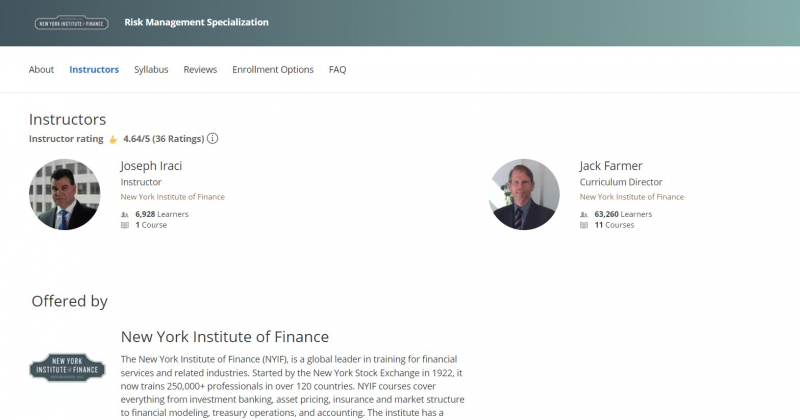

The first online course Toplist would like to introduce to you in this list of the Best Online Risk Management Courses is the Risk Management Specialization. The New York Institute of Finance (NYIF) offers a four-course Specialization for STEM undergraduates, finance practitioners, bank and investment managers, corporate managers, regulators, and policymakers. This Specialization will teach you how to identify, measure, and manage risk within your company. You will know how to set up a risk management process utilizing multiple frameworks and tactics offered throughout the program by the end of the Specialization.

This program is designed for those who have a basic understanding of risk management principles. You need to have a basic understanding of statistics and probability, as well as experience with financial instruments, to effectively complete the tasks in the program (stocks, bonds, foreign exchange, etc). It's a plus if you've worked with Microsoft Excel before.

This course is offered by the New York Institute of Finance. The New York Institute of Finance (NYIF) is a worldwide leader in financial services and associated industry training. The New York Stock Exchange was founded in 1922, and it today trains over 250,000 professionals in more than 120 countries. Investment banking, asset pricing, insurance, and market structure are all covered in NYIF courses, as well as financial modeling, treasury operations, and accounting. The institute boasts an industry-leading faculty and offers self-study, online courses, and in-person classes as well as a variety of program delivery options.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level: Familiarity with financial instruments (stocks, bonds, foreign exchange, etc.); basic knowledge of statistics and probability

- Approximately 6 months to complete: Suggested pace of 2 hours/week

- Subtitles: English

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/specializations/risk-management

coursera.org

coursera.org -

This is one of the Best Online Risk Management Courses. This course will introduce you to the various types of business and financial risks, their causes, and risk measurement best practices. This course will teach you how to assess different risk categories and set risk limits, as well as how to identify the essential elements that drive each type of risk and how to use probability distributions to estimate risk. You will learn about the history and evolution of risk management as a science, as well as the financial and business trends that have affected risk management practice. You will have the necessary knowledge to measure, assess, and manage risk in your business by the end of the course.

You should have a basic understanding of statistics and probability, as well as experience with financial instruments, to succeed in this course (stocks, bonds, foreign exchange, etc). It is a plus if you have worked with Microsoft Excel before.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Course 1 of 4 in the: Risk Management Specialization

- Beginner Level: Familiarity with financial instruments (stocks, bonds, foreign exchange, etc.); basic knowledge of statistics and probability

- Approx. 16 hours to complete

- Subtitles: English

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/learn/introduction-to-risk-management

coursera.org

coursera.org -

This course will teach you how to use risk assessment methodologies and how to put a variety of solutions in place to ensure asset protection. The relationship between assets, vulnerabilities, threats, and risks will be discussed. You'll also be exposed to a number of current industry case studies that will help you understand the topic. You will exit the course with threat modeling and business continuity planning abilities that you can apply immediately in your present or future work.

This course is offered by the University of California. The University of California, Irvine, has combined the assets of a large research university with the benefits of an unrivaled Southern California location since 1965. UCI's unwavering dedication to rigorous academics, cutting-edge research, and leadership and character development positions the university as a catalyst for innovation and discovery that benefits our local, national, and worldwide communities in a variety of ways.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Course 2 of 3 in the: Introduction to Cybersecurity & Risk Management Specialization

- Approx. 10 hours to complete

- Subtitles: English

Enroll here: https://www.coursera.org/learn/risk-management-threat-modeling

coursera.org

coursera.org -

You will be exposed to the field of cybersecurity through the world of security governance and risk management in this case-based Specialization. Creating security plans that correspond with a company's goals and objectives; Applying risk assessment methodologies to real-world scenarios; Implementing effective security education, training, and awareness programs are some of the core principles you will practice throughout this program.

You will complete a series of case studies in this program, which will require you to apply the principles and techniques provided in the video lectures to real-world problems faced by cybersecurity practitioners. These case studies address a wide spectrum of cybersecurity dangers, including those posed by emerging IoT technology, ransomware assaults, and social engineering schemes.

This course is offered by the University of California. The University of California, Irvine, has combined the assets of a large research university with the benefits of an unrivaled Southern California location since 1965. UCI's unwavering dedication to rigorous academics, cutting-edge research, and leadership and character development positions the university as a catalyst for innovation and discovery that benefits our local, national, and worldwide communities in a variety of ways.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level: No prior experience required

- Approximately 3 months to complete: Suggested pace of 2 hours/week

- Subtitles: English

Enroll here: https://www.coursera.org/specializations/information-security

coursera.org

coursera.org -

This specialization is a prerequisite for the Certificate in Applied Project Management. The most effective approach to delivering products within cost, schedule, and resource restrictions has been demonstrated to be project management. This rigorous and hands-on series of courses will teach you how to finish projects on time and on budget while providing the end customer with the result they expect. You will get a good working knowledge of project management fundamentals and be able to apply that knowledge to effectively manage work projects right away.

Learners will complete a series of projects and assignments that will help them identify and manage the product scope, create a work breakdown structure, create a project plan, create a project budget, define and allocate resources, manage project development, identify and manage risks, and comprehend the project procurement process.

You'll be able to identify and manage the product scope, construct a work breakdown structure, create a project plan, create a project budget, define and assign resources, manage project development, identify and manage risks, and comprehend the project procurement process at the end of the course.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level: No prior experience required

- Approximately 5 months to complete: Suggested pace of 1 hour/week

- Subtitles: English, Croatian, Arabic, French, Portuguese (European), Italian, Catalan, Portuguese (Brazilian), Vietnamese, Afrikaans, German, Russian, Thai, Spanish, Ukrainian, Hungarian, Greek, Japanese

Enroll here: https://www.coursera.org/specializations/project-management

coursera.org

coursera.org -

This specialization is designed for prospective learners and professionals who want to improve their quantitative finance skills. It will cover derivative pricing, asset allocation, portfolio optimization, and other financial engineering applications such as real options, commodities and energy derivatives, and algorithmic trading throughout the course of five courses. These financial engineering subjects can help you solve relevant difficulties in the academic and industrial realms. Learners will apply their knowledge and abilities to a variety of financial engineering challenges, including pricing futures, stocks, interest rates, and credit derivatives, delta hedging, mean-variance portfolio creation, and model fitting and optimization.

This course is offered by Columbia University. Columbia University has been a national and international leader in higher education for more than 250 years. The dedication to recruiting and engaging the brightest minds in pursuit of better human understanding, pioneering new discoveries, and service to society is at the heart of our vast range of academic investigations.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Intermediate Level: Intermediate knowledge of probability, statistics, linear algebra, and calculus. Proficient with Excel and working knowledge of Python

- Approximately 7 months to complete: Suggested pace of 3 hours/week

- Subtitles: English, Korean

Coursera Rating: 4.5/5

Enroll here: https://www.coursera.org/specializations/financialengineering

coursera.org

coursera.org -

The final course in the Risk Management specialty will introduce you to the various responsibilities in risk governance as well as the advantages of implementing an operational risk management program at your own company. This course will highlight the major features of an operational risk management framework and assist you in determining which parts should be included in your own program. You'll be able to capture, report, and investigate operational risk occurrences, generate relevant key risk indicator (KRI) data and trend analysis, measure organizational risk appetite, and establish an Operational Risk Control and Self-Assessment program by the end of the course.

You should have a basic understanding of statistics and probability, as well as experience with business operations, to succeed in this course. It's a plus if you know how to use MS Excel and Python.

This course is offered by the New York Institute of Finance. The New York Institute of Finance (NYIF) is a worldwide leader in financial services and associated industry training. The New York Stock Exchange was founded in 1922, and it today trains over 250,000 professionals in more than 120 countries. Investment banking, asset pricing, insurance, and market structure are all covered in NYIF courses, as well as financial modeling, treasury operations, and accounting. The institute boasts an industry-leading faculty and offers self-study, online courses, and in-person classes as well as a variety of program delivery options.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Course 4 of 4 in the: Risk Management Specialization

- Beginner Level: Familiarity with financial investments (stocks, bonds, foreign exchange, etc.); basic knowledge of statistics and probability

- Approx. 6 hours to complete

- Subtitles: English

Enroll here: https://www.coursera.org/learn/operational-risk-management

coursera.org

coursera.org