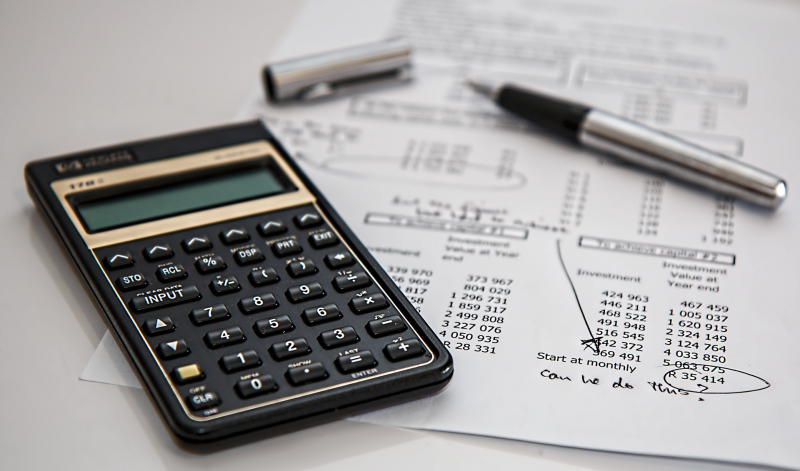

Top 9 Best Accounting Software for Business

Accounting software makes it simple for small business owners to maintain tabs on their finances, track their income and expenses, and prepare for tax season. ... read more...Toplist has listed the best accounting software for businesses because, with so many alternatives available today, picking the best one can be difficult.

-

Zoho Books is a user-friendly, cloud-based accounting software with a system for managing invoices, inventories, and projects. In addition to five membership packages priced between $15 and $240 per month, Zoho Books offers a free plan. The most advanced plans contain advanced features like purchase approvals, vendor portals, and custom modules in addition to allowing for more users and invoices.

You can connect to payment gateways and send customized invoices to consumers using Zoho, allowing them to pay for your goods and services online. Also, you will be able to connect one or more bank accounts to significant transactions and automatically classify them for quick and simple reconciliation. The dashboard will give you a clear view of your highest expenses, total receivables and payables, and sales. A wide range of financial reports for businesses is also possible, including cash flow statements, balance sheets, and profit and loss statements. You can also utilize a tax tool to calculate sales tax, set a default tax rate, and file 1099s for contractors.

Rating: 4.5 (on Forbes Advisor)

Price: $15-$240

Free trial: 14 days and a free forever plan

Pros:

- Free plan available

- Feature-rich accounting software

- Robust mobile app

- Impressive support options

Cons:

- Maximum of 10 users

- Must invest in higher-level plans for advanced features

- Limited integration

Image by Steve Buissinne from Pixabay

Image by Claudio_Scott from Pixabay -

If you manage a small business or a freelance job, you are probably used to managing several clients, payment due dates, invoices, and other details—always there's something else to remember. FreshBooks is an accounting software designed for solo business owners, freelancers, and sole proprietors. With the aid of the program, it is simple to stay organized, send invoices, take payments, and keep track of payments due and expenses incurred.

You can quickly create an invoice and collect payments with ACH transfers, PayPal, Stripe, credit and debit cards, and automated clearing house (ACH) transactions. The processing cost for credit cards is 2.9% plus 30 cents per transaction, which is common for the sector.FreshBooks is renowned for having a user-friendly, intuitive interface. It won't take long to start with the fundamentals and submit your first invoice if you're seeking for an easy way to arrange your company's accounting in one system. For accounts with just one primary user, FreshBooks works well. Users are charged $10 per month by the corporation for more team members, which is a sizable portion of the monthly fee for the lesser levels.

Rating: 4.4 (on Forbes Advisor)

Price: $15 to $55

Free trial: 30 days

Pros:

- Intuitive and easy to use

- Affordable prices at a lower tier

- Double-entry accounting reports feature

- Provides easy-to-use accounting software for freelancers, solopreneurs and small business owners

Cons:

- Not tailored for larger businesses

- Extra cost per month to add an additional team member

- Fewer customization options than other software

Image by Firmbee from Pixabay

Image by Steve Buissinne from Pixabay -

Entrepreneurs, freelancers, and business owners frequently spend a significant amount of time on administration and accounting. With plans starting at $12 per month, Xero is an economical cloud-based accounting software system designed for small and medium-sized enterprises that automates these processes.

Many features of Xero allow it to manage difficult accounting procedures for both small and medium-sized organizations and larger ones. Paying bills, claiming costs, accepting payments, tracking projects, managing contracts, storing files, and other tasks are all made simple by the software.With the help of Xero's invoicing features, you can create and modify an invoice for a client and then collect payments inside the invoice via bank transfer, credit card, or debit card. Account users have the option to put their logo on online invoices, collect payments instantaneously through the invoice, automate client payment reminders, and invoice directly from the Xero app. Via a payment gateway, such as Stripe, GoCardless, and others, Xero processes payments. Remember that these services charge a fee for handling payments (often 2.9% plus 25 cents per transaction, though this varies by the payment processor).

Rating: 4.4 (on Forbes Advisor)

Price: $13 per month

Free trial: 30 days

Pros:

- Offers a variety of plans so you can upgrade as your business grows

- Intuitive and user-friendly

- Send up to 20 quotes and invoices per month on its lowest-priced plan

- All plans allow for reconciling bank transactions

- 24/7 support

Cons:

- Must have its highest-tiered plan to deal in multiple currencies

- Payroll costs an extra $40 per month

Image by Steve Buissinne from Pixabay

Image by Steve Buissinne from Pixabay -

QuickBooks Payments is rated one of the top 10 best accounting software programs. The majority of people are familiar with QuickBooks as accounting and bookkeeping software for small and medium-sized enterprises that allows you to track invoices. QuickBooks Payments lets you accept payments for your business and is a particularly convenient way to keep all payments and accounting in one place for QuickBooks customers.

In addition to bank transfers and Apple Pay, QuickBooks Payments also accepts payments made using Visa, Mastercard, American Express, and Discover. Although there is no monthly fee for using QuickBooks Payments, you must have a QuickBooks Online account.Both the desktop and online versions of QuickBooks have advantages and disadvantages. The most affordable desktop version is a one-time download that you must pay for. It costs $299.99 per year ($199.99 for the first year) and includes three years of service. This cost ends up being more affordable over time for some programs.

Your data is stored in the cloud and is accessible from any device with an internet connection when using the online version. This makes it easier to switch between different team members and devices, such as accepting payments from your smartphone and managing invoices through your computer. Keep in mind that there are different payment processing fees for each, with the online version slightly higher.

Rating: 4.3 (on Forbes Advisor)

Price: $15 per month (for the first three months, then $30 per month)

Free trial: 30 days

Pros:- Comprehensive accounting software

- Offers phone support

- Track mileage

- Access via mobile app

- Integrates with other software and apps

Cons:

- Payroll features cost extra

- Pricing doubles after intro period

- It’s easy to accidentally create duplicate transactions

- Lacks e-commerce features

Image by Donate PayPal Me from Pixabay

Image by Lucia Grzeskiewicz from Pixabay -

NetSuite offers a cloud-based enterprise resource planning (ERP) platform with a comprehensive suite of applications, such as payroll, HR, CRM and e-commerce. It uses a software-as-a-service (SaaS) business model, making it an excellent choice if you want the flexibility to develop your company without having to worry about finding new infrastructure and employees.

You can easily adapt the platform to match your business goals and preferences thanks to NetSuite's SuiteCloud customization options. You can design your own user interfaces, produce and distribute papers with your logo on them, integrate with third-party programs, and more.

Moreover, NetSuite has powerful reporting features. You may generate reports on just about anything you want with its integrated reporting features. Role-based dashboards are another tool that can assist your management team and staff in making informed choices.

If you subscribe to NetSuite, you’ll pay an annual license fee, which allows your business to use the core platform, choose the number of users, and add on modules as you see fit. You can add more users and modules as your company expands to accommodate your changing requirements.Rating: 4.1 (on Forbes Advisor)

Price: Contact for quote

Free trial: No

Pros:- Offers a variety of compliance features

- Automatic reconciliation and journal entries

- Access your account from anywhere

- Integrates with other NetSuite products, such as HR, e-commerce, inventory and order management

Cons:

- Pricing isn’t transparent

Involves a learning curve

Image by Donate PayPal Me from Pixabay

Image by 200 Degrees from Pixabay -

MarginEdge is additional software that helps restaurants better manage expenditures, keep an eye on their inventory, and understand the intricacies behind their profit and loss (P&L) statements. The software isn’t for any business outside of the restaurant industry. You can get a solid overall picture of your sales, order invoices, vendors, labor and financial performance.

You don't have to worry about running out of the things you need every day because it is easy to upload vendor invoices and pay them from a mobile device. There are no pricing tiers with MarginEdge. Instead, the product team charges $300 per month for each location where you need to use the software. This price includes unlimited invoices and bills paid with no hidden fees and no costs to integrate with any software―ever.

The full recipe management system built into MarginEdge is one of the best features that eateries find useful. With the use of this system, you can maintain details on each dish that your restaurant utilizes, including a list of the materials, the cost, and even special instructions for your staff. This makes it easier to monitor food waste and control the price of product ingredients.Rating: 4.1 (on Forbes Advisor)

Price: $300 per month (per location)

Free trial: No

Pros:- Pay one fixed rate per month

- No contracts or set-up fees

- Integrates with your POS

- Recipe costing

- Bill pay

- Food usage report

Cons:

- As it’s built for restaurants, it’s not a good fit for other industries

- Doesn’t offer payroll

Image by Tumisu from Pixabay

Image by Megan Rexazin from Pixabay -

Sage accounting is a software program that allows small business owners to track their income and expenses in multiple currencies, as well as track inventory and manage invoices. This accounting software is suitable for microbusinesses and freelancers seeking a platform for keeping their accounts organized.

With Sage accounting software, you can take charge of the billing and bookkeeping processes, which can enhance your cash flow and speed up payment on a single platform. You can cancel your subscription to Sage Accounting software at any time. It offers two monthly subscription choices. The 30-day free trial is also available if you choose to upgrade your account.

With Sage accounting, you can create invoices, send them to customers, and track payments. The accounting software integrates with Stripe further to allow customers to choose their preferred payment methods. You can accept card payments from anywhere and have all of your financial records in one location thanks to these payments that connect with your bank accounts.

You’ll see sent invoices and pending payments, including the ones that are overdue. Sage accounting gives users the option to examine specific invoicing periods and automate payment notices. Also, you get access to editable invoice templates.Rating: 4.0 (on Forbes Advisor)

Price: $10 per month

Free trial: 30 days

Pros:- It’s based in the cloud

- Good variety of available integrations

- Automatic bank reconciliation

- Supports multiple currencies

Cons:

- Its entry-level plan may be too basic for established businesses

- Payroll not included

- Limited phone support hours

Image by Mudassar Iqbal from Pixabay

Image by Gerd Altmann from Pixabay -

Although Neat, its parent firm, has been operating since 2002, the Neat accounting software was just introduced in 2021. The ability to immediately upload and match receipts via the mobile app is its standout feature, keeping you organized right away. Also, you may group every receipt into a category to make it easier to understand where your money is going.

With interactive charts that you can sort by date, it's simple to see your net cash flow based on your income and expenses. You may even run custom reports on costs, spending details, spending summaries, sales tax, and tax categories, as well as dashboards that display your top expense categories and cash balance. Neat no longer offers separate subscriptions for each of its three services; instead, everything is now included in a single monthly fee. If you pay annually, the cost of the range of Neat items is $288 ($24 per month x 12 months). It costs $29 per month if you choose a subscription.Rating: 3.8 (on Forbes Advisor)

Price: $200 per year

Free trial: No, but offers your first month for $17

Pros:- Unlimited file storage

- Expense tracking

- Unlimited email and chat support

- Collaboration and file sharing

- Filter and search for documents

Cons:

- Not as feature-robust as its competition

- Does not offer payroll

- Monthly billing is not available

Image by Steve Buissinne from Pixabay

Image by Oliver Menyhart from Pixabay -

Kashoo is a cloud-based accounting system for small businesses that want to manage their accounts on their own. Kashoo has been assisting small businesses with account management for over ten years. The software is user-friendly because it concentrates on streamlining accounting for small business owners so they won't need outside help.

You'll need Kashoo, which costs $30 per month, for sophisticated accounting, which includes detailed reporting, project cost tracking, customization choices, and the chance to work with an accountant or bookkeeper. Since Kashoo is completely encrypted, it safeguards you from money fraud. It supports an infinite number of users at no additional cost, and it connects you to more than 5,000 banks and credit unions so you may conduct numerous transactions in different currencies. With the automatic bank feed tool, you may access up to 90 days' worth of data, automate bank transactions, and send payment links along with invoices.Rating: 3.5 (on Forbes Advisor)

Price: Free; $20 per month

Free trial: 14 days

Pros:- Free plan available

- Easy to use

- Includes payroll

Cons:

- No document management

- Its highest-tiered plan doesn’t come with a visual reports dashboard

Image by Mudassar Iqbal from Pixabay

Image by Memed_Nurrohmad from Pixabay