Top 10 Largest Financial Service Companies in Croatia

In this post, let's take a look at the top 10 largest financial service companies in Croatia. Visit other related Toplist articles directly if you want to see ... read more...more of the largest financial companies in other regions ranked by market capitalization.

-

MasterCard Worldwide is a multinational corporation based in Purchase, New York, in the United States. This company's business is to make payments between the buyer's and seller's banks using "MasterCard-branded debit and credit cards for purchases. Since 2006, MasterCard Worldwide has been a publicly traded company. MasterCard Worldwide has been a membership organization owned by the 25,000+ financial institutions that issue its cards since its initial public offering.

Mastercard grants licenses to banks all over the world for the production of their cards and the hiring of contractors. (acquiring licenses). Mastercard is accepted by nearly 35 million contracting businesses, and there are approximately a million cash payment offices worldwide. (as of 2014).

Mastercard's market capitalization is $332.98 billion as of March 2023. By market capitalization, this places Mastercard as the 20th most valuable company in the world. According to Mastercard's most recent financial reports, the company's current revenue (TTM) is $22.23 billion. In 2021, the corporation generated $18.88 billion in revenue, up from $15.30 billion in 2020.

Founded: 1966

Headquarters: 2000 Purchase Street, Purchase, New York, U.S.

Website: mastercard.com

Screenshot via mastercard.com

Screenshot via mastercard.com -

With over 122 million private and corporate customers in more than 70 countries, the Allianz Group is one of the world's leading insurers and asset managers. Allianz customers have access to a wide range of personal and corporate insurance services, including property, life, and health insurance, as well as assistance services, credit insurance, and global business insurance. From 2021 to 2028, Allianz will be the Olympic and Paralympic Movements' worldwide insurance partner. They'll be sharing some exciting ways for the global Allianz community to get involved, in addition to providing insurance solutions and services to the Olympic and Paralympic movements.

Allianz is a global investor, managing approximately 683 billion euros on behalf of its insurance customers. In addition, their asset managers, PIMCO and Allianz Global Investors, oversee approximately 1.6 trillion euros in third-party assets. They are among the leaders in the insurance industry in the Dow Jones Sustainability Index due to their systematic integration of ecological and social criteria in their business processes and investment decisions. In 2022, the group's over 159,000 employees generated total revenues of 152.7 billion euros and an operating profit of 14.2 billion euros.

Founded: 1890

Headquarters: Munich, Germany

Website: www.allianz.com

Screenshot via allianz.com

Screenshot via allianz.com -

As a global financial firm with offices in over 45 countries, UBS provides you with access to the world’s leading financial centers. Plus, a choice of convenient UBS international banking centers ensures the geographic diversification of your wealth. UBS Asset Management is a large-scale investment manager with a presence in 22 countries. They offer investment capabilities and investment styles across all major traditional and alternative asset classes.

They distribute, trade, finance, and clear cash equity and equity-linked products. They also structure, originate, and distribute new equity and equity-linked issues. From origination and distribution to managing risk and providing liquidity in FX, rates, credit, and precious metals, they help clients realize their financial goals. They want to create superior value for their clients, shareholders, and employees. And they want to stand out as winners in their industry: for their expertise, advice, and execution; their contribution to society; their work environment; and their business success.

Founded: 1862

Headquarters: Zürich, Switzerland

Website: https://www.ubs.com/global/en.html

Image by USB via ubs.com

Screenshot via ubs.com -

UniCredit ranks 4th on the list of the largest financial service companies in Croatia by market cap. It is a pan-European commercial bank with a distinctive service portfolio in Italy, Germany, and Central and Eastern Europe. Their mission is to enable communities to progress by providing best-in-class services to all stakeholders and unlocking the potential of their clients and employees across Europe. They have over 15 million customers all over the world. They are central to everything they do in all of their markets. UniCredit is divided into four core regions and two product factories, Corporate Solutions and Individual Solutions. This allows them to be close to their clients while also leveraging the group's scale to develop and offer the best products across all of their markets.

Digitalization and their adherence to ESG principles are critical enablers of their service. They assist them in providing excellence to their stakeholders and in creating a sustainable future for their clients, communities, and people. UniCredit follows an organizational and business model that, while ensuring the autonomy of countries/local banks in specific activities to ensure greater proximity to customers and efficient decision-making processes, maintains a divisional structure for business/product governance, as well as global control over Digital and Operations functions.

Founded: 1998

Headquarters: Milan, Italy

Website: unicreditgroup.eu/en.html

Screenshot via unicreditgroup.eu UniCredit channel on youtube -

Erste Group began in Leopoldstadt, a Vienna suburb, in October 1819 as Erste österreichische Spar-Casse. Following the fall of communism, the company began a rapid expansion into Central and Eastern Europe, acquiring ten banks by 2008. It went public in 1997 and is now listed on the exchanges of Vienna, Prague, and Bucharest, as well as in the indices CEETX, ATX, and PX. Erste Group currently employs approximately 46,700 people who serve 15.9 million customers across seven Central and Eastern European countries. (Austria, Serbia, the Czech Republic, Slovakia, Hungary, Romania, Croatia).

It is recognized as an institution that, in addition to providing traditional products and services, strives to continuously develop in accordance with the demands of the modern market. Erste Group offers its customers security and trust, as well as high-quality products and services. Aside from retail operations, Erste Group offers corporate clients financing as well as consulting services related to investment and access to international capital markets, public sector financing, and interbank market operations.

Founded: 2008

Headquarters: Vienna, Austria

Website: erstegroup.com/en/home

Screenshot via erstegroup.com/ Erste Group channel on youtube -

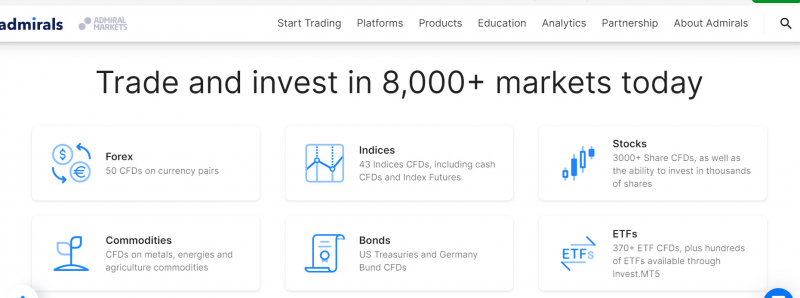

As a global FinTech community, Admirals has always stood for the values that connect people and cultures all around the world. Financial freedom is one of the next great objectives of humankind, and they believe that it should be within reach for everybody and everywhere. Their aim is to be a trustworthy financial partner on that journey.

Their vision is to be the global pioneer in financial inclusion that lets people access effortless, affordable, and secure financial products and services through an ecosystem that meets their needs. This vision does not only speak about the future but also describes today’s simultaneous development and execution of a strong strategy as a global financial hub. They are fast, flexible, and courageous, which is what their record results last year speak for.

According to the CEO of Admiral Markets AS, the company expanded its global presence to South Africa and Canada, and today the company is trusted by customers on all continents. They have created a strong cross-cultural team that operates in 18 different locations around the world. They are a global company with a local focus. They are constantly making sure that Admirals offers existing and future customers the best mix of products and experiences across all geographies and channels.

One of the milestones in their success is their app, which is a unique, secure, and customer-friendly tool to navigate the vast world of finance in 10 different languages. Their newly launched in-house native trading and investing platform will define future success. Their business is back to full scale as it was in the pre-pandemic times.They are strongly focused on the development of IT and infrastructure, making sure that continuous R&D investments provide them with tools for further growth. They keep pace with the endless integration of AI possibilities and the development of machine learning that will allow their high performance to succeed at new levels. Their systems are fully trouble-proof while functioning securely and to the highest possible standards.

Founded: 2001

Headquarters: Tallinn, Estonia

Website: https://admiralmarkets.com/

Screenshot via admiralmarkets.com

Screenshot via admiralmarkets.com -

OTP Group is the fastest-expanding banking group in Central and Eastern Europe, with in-depth knowledge and a long-term commitment to the region. OTP Group is working with integrity and drive to help the Central and Eastern European area develop into the continent's growth engine. They seek to provide exceptional financial services by leveraging digital innovation, artificial intelligence, and data-driven insights. They leverage their group's synergies and serve as a catalyst for the region's digital development.

OTP Group is a modern, diverse, and inclusive European workplace. They prioritize the development of their employees in order to enhance their intellectual capital for the benefit of their teams, customers, and partners. They build group-wide financial literacy programs while trying to allow sustainable regional development. They employ their financial and technological resources to benefit all of their stakeholders with dedication and skill. They have what it takes to complete the task.The diversity of their countries, cultures, and people contributes to the strength of the OTP Group. Through socially responsible operations, supporting social inclusion, and financial education, they are committed to contributing to the financial and social advancement of their local communities. They create value for all of their stakeholders in this way. Their customers and colleagues motivate them to constantly innovate and expand, instilling in them a strong feeling of shared purpose that has propelled them to the top of the financial services industry in Central and Eastern Europe. But their aims are much higher: OTP Group aspires to be the digital era's premier bank, assisting approximately 16 million customers with fast, convenient, and secure financial solutions that leverage the power of cutting-edge technology innovation.

Founded: 1949

Headquarters: Budapest, Hungary

Website: https://www.otpgroup.info/home

Image by OTP Bank via otpgroup.info OTP Bank Magyarország channel on youtube -

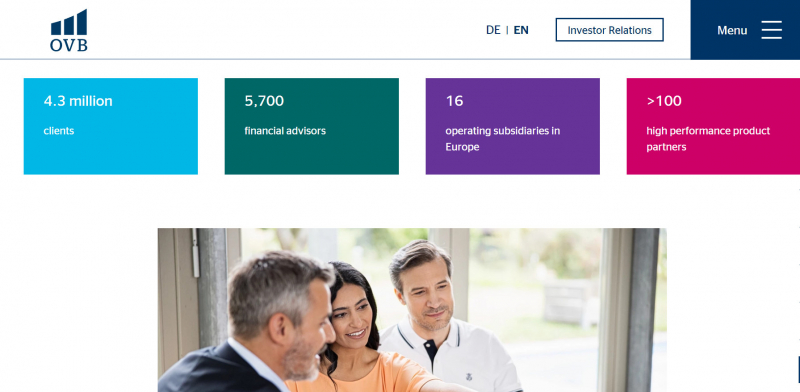

Most customers are quickly overwhelmed when it comes to finance. As a result, the need for financial advice at their organization is increasing. In an era of demographic shift and rising elderly poverty, it is more vital than ever to address one's own private pension plan and plan for financial hazards. This is where OVB comes in: with years of experience, financial brokers are there to support their customers and thereby provide an important social function.

Only devoted and highly qualified financial advisors consult with commitment and knowledge at OVB. Each cross-thematic consultation is conducted in three steps, in a systematic manner. This is how clients and consultants can work together to identify the optimal solution, simply and transparently. The recommended financial items have been carefully selected and meet high quality criteria. OVB collaborates with respected industry companies.

In Europe, there are several providers of financial and insurance products. Their active product management guarantees that their clients have access to an appealing product selection that is appropriate for the general market conditions of the relevant national market. They devised the premium-select strategy to attain this goal. Product quality and the quality of product partners are inextricably linked. This provides their consumers with security and substantial benefits.

Committed consultants, carefully chosen financial solutions with a favorable cost-benefit ratio, and a system that has demonstrated its usefulness for many years are all critical components for their success. However, finding opportunities is what will allow them to be on the market for the next half-century and effectively transfer their business model to an even larger number of countries. They are constantly focused on maintaining the industry and their clients, as well as developing strategies for responding to new conditions and needs.

Founded: 1970

Headquarters: Cologne, Germany

Website: ovb.eu/english/company-ovb.html

Screenshot via ovb.eu

Screenshot via ovb.eu -

The EBRD is dedicated to advancing "market-oriented economies and the promotion of private and entrepreneurial initiative." This has been its guiding philosophy since its inception in the early 1990s, and it will remain so in the future, despite new challenges and the addition of additional countries to the EBRD family. 71 countries, as well as the European Union and the European Investment Bank, own the EBRD. The Board of Governors, which has overarching power over the Bank, comprises representatives from each shareholder.

The European Bank for Reconstruction and Development (EBRD) invests in the transformation of people's lives. They are doing more than ever before across three continents through their projects, business services, and involvement in high-level policy reform. In terms of climate funding, they are world leaders. From the end of 2022, all of their activities will be in line with the Paris Agreement, and they intend to be a majority green bank by 2025.They operate in about 40 economies on three continents, from the Southern and Eastern Mediterranean to Central and Eastern Europe and Central Asia. Their political engagement: EBRD personnel regularly collaborate on policy change with governments, business leaders, and regional officials, assisting in the development of policies and initiatives that improve economic circumstances and people's lives.

Founded: 1991

Headquarters: London, United Kingdom

Website: ebrd.com/home

Screenshot via ebrd.com

Screenshot via ebrd.com -

The World Bank Group ranks 10th on the list of the largest financial service companies in Croatia by market cap. The World Bank Group is a major source of finance and information for developing countries around the world. Its five institutions are all dedicated to decreasing poverty, increasing shared prosperity, and fostering long-term development.

The World Bank Group is a unique global partnership: five organizations working for sustainable solutions that reduce poverty and generate shared prosperity in developing nations. It has 189 member countries, workers from more than 170 countries, and offices in over 130 places. Their core principles encapsulate what is most important to them as an organization, as well as how they interact with one another, their clients, and their partners. They influence their judgments and actions in carrying out their objectives.

IBRD and IDA work together to establish the World Bank, which offers finance, policy advice, and technical help to governments in developing countries. IBRD aids middle-income and creditworthy poorer countries, whereas IDA concentrates on the world's poorest countries. Despite the fact that each of their five institutions has its own country membership, governing boards, and articles of agreement, they work together to assist their partner countries.Today's development difficulties can only be met with the participation of the private sector. However, the public sector lays the foundation for private investment to thrive. Because of their institutions' complementary missions, the World Bank Group has a unique ability to connect global financial resources, knowledge, and innovative solutions to the needs of developing countries.

Founded: 1944

Headquarters: Washington, D.C., USA

Website: worldbank.org/en/home

Screenshot via worldbank.org

Screenshot via worldbank.org