Top 10 Largest Financial Service Companies in Norway

In this post, let's take a look at the top 10 largest financial service companies in Norway. Visit other related Toplist articles directly if you want to see ... read more...more of the largest financial companies in other regions ranked by market capitalization.

-

MasterCard Worldwide is a multinational corporation based in Purchase, New York, United States. This company's business is to make payments between the buyer's and seller's banks using "MasterCard" branded debit and credit cards for purchases.

Since 2006, MasterCard Worldwide has been a publicly traded company. MasterCard Worldwide has been a membership organization owned by the 25,000+ financial institutions that issue its cards since its initial public offering.

Mastercard grants licenses to banks all over the world for the production of their cards and the hiring of contractors. (acquiring licenses). Mastercard is accepted by nearly 35 million contracting businesses, and there are approximately a million cash payment offices worldwide. (as of 2014). Mastercard's market capitalization is $332.98 billion as of March 2023.

By market capitalization, this places Mastercard as the 20th most valuable company in the world. According to Mastercard's most recent financial reports, the company's current revenue (TTM) is $22.23 billion. In 2021, the corporation generated $18.88 billion in revenue, up from $15.30 billion in 2020.

Founded: 1966

Headquarters: 2000 Purchase Street, Purchase, New York, U.S.

Website: mastercard.com

Screenshot via mastercard.com

Screenshot via mastercard.com -

Wells Fargo & Company is an American multinational financial services firm with corporate headquarters in San Francisco, California, operational headquarters in Manhattan, and managerial offices around the world.

The corporation has operations in 35 countries and more than 70 million customers worldwide. It is regarded as a systemically important financial institution by the Financial Stability Board. The former Wells Fargo & Company and the Minneapolis-based Norwest Corporation merged in 1998 to form the current Wells Fargo.

Even while Norwest was technically still in business, the amalgamated company used the more recognizable Wells Fargo moniker and relocated to Wells Fargo's headquarters in San Francisco. At the same time, its banking division merged with Wells Fargo's banking division in Sioux Falls. Wells Fargo established itself as a coast-to-coast bank after purchasing Charlotte-based Wachovia in 2008.

As of March 2023, the market value of Wells Fargo was $141.56 billion. Wells Fargo is now the world's 77th most valuable company by market capitalization. According to Wells Fargo's most recent financial reports, the company's current revenue (TTM) is $73.78 billion. In 2021, the corporation generated $78.02 billion in revenue, up from $72.34 billion in 2020.

Founded: January 24, 1929

Headquarters:

- San Francisco, California, U.S. (corporate)

- New York, NY (operational)

Website: wellsfargo.com

Screenshot via rbc.com

Screenshot via rbc.com -

With over 122 million private and corporate customers in more than 70 countries, the Allianz Group is one of the world's leading insurers and asset managers. Allianz customers have access to a wide range of personal and corporate insurance services, including property, life, and health insurance, as well as assistance services, credit insurance, and global business insurance.

From 2021 to 2028, Allianz will be the Olympic and Paralympic Movements' Worldwide Insurance Partner. They'll be sharing some exciting ways for the global Allianz community to get involved, in addition to providing insurance solutions and services to the Olympic and Paralympic Movements.

Allianz is a global investor, managing approximately 683 billion euros on behalf of its insurance customers. In addition, their asset managers PIMCO and Allianz Global Investors oversee approximately 1.6 trillion euros in third-party assets.

They are among the leaders in the insurance industry in the Dow Jones Sustainability Index due to their systematic integration of ecological and social criteria in their business processes and investment decisions. In 2022, the group's over 159,000 employees generated total revenues of 152.7 billion euros and an operating profit of 14.2 billion euros.

Founded: 1890

Headquarters: Munich, Germany

Website: www.allianz.com

Screenshot via allianz.com

Screenshot via allianz.com -

Banco Santander, S.A., also known as Santander Group, is an international financial services firm headquartered in Madrid and Santander, Spain. Furthermore, Santander, the world's 16th largest banking organization, maintains a presence in all major financial centers. Although it is best known for its European banking operations, it has recently expanded into continental Asia as well as North and South America. This bank is regarded as having systemic importance by the Financial Stability Board.

Several subsidiaries, including Abbey National, have been renamed Santander. The company is a component of the Euro Stoxx 50 stock market index. In May 2016, Forbes Global 2000 ranked Santander as the 37th largest public company in the world. Santander is Spain's largest bank.

Ana Patricia Botn-Sanz de Sautuola O'Shea is the granddaughter and daughter of previous chairs Emilio Botn-Sanz de Sautuola y Garca de los Ros and Emilio Botn-Sanz de Sautuola López.Santander's market capitalization as of April 2023 is $61.48 billion. Santander is now the world's 246th most valuable corporation by market capitalization. According to Santander's most recent financial reports, the company's current revenue (TTM) is $54.62 billion. In 2021, the corporation generated $56.32 billion in revenue, up from $54.12 billion in 2020.

Founded: 15 May 1857

Headquarters: Santander, Spain

Website: www.santander.com

Screenshot via www.santander.com

Screenshot via www.santander.com -

Nordea is the largest financial services group in the Nordic region, as well as one of Europe's largest banks. They have a presence in 17 countries, including their four Nordic home markets of Denmark, Finland, Norway, and Sweden, which together have the world's tenth largest economy. They have lofty goals for Nordea, and together they are shaping the future of banking.

Their industry is being challenged. Their customers' requirements are changing. They are evolving. That is why they require enthusiastic individuals who enjoy learning and growing. Because whether you want to be a leader or a specialist in technology, finance, or compliance, transformation happens through small changes every day.

As part of Nordea, you’ll be supporting individuals, families, small start-ups and big companies and institutions. You’ll experience that together they play an important part in society and that their choices – big or small – really matter. Their vision is to be a strong and personal financial partner for their customers, and they are all here to create value for them.

They are a Nordic universal bank with 200 years of experience in the industry. Their business performance is directly related to the engagement of their employees. Every day, their people are their most valuable asset in front of their customers. They must make sound decisions and provide customers with appropriate solutions. The formula is simple: happy people make happy customers.

Founded: 1820

Headquarters: Helsinki, Finland

Website: www.nordea.com

Screenshot via www.nordea.com

Screenshot via www.nordea.com -

SEB ranks 6th on the list of the largest financial service companies in Norway by market cap. It is a bank built to empower people with ideas, and always standing by them, in good times, and bad. They take responsibility for how they conduct their business and how they affect their customers, employees, shareholders and society at large. They support their customers in the transition to a more sustainable future and they contribute to the development of the communities in which they operate.

All customers have their individual needs, but smart digital solutions and personal relationships are key building blocks within all their four main customer segments. Their customers are looking for a partner who is proactive, provides a long-term perspective and can offer objective advice in order for them to reach their goals. They serve approximately 1,100 financial institutions and act as an intermediary between Nordic and global financial markets.

They offer their services to pension funds and asset managers, hedge funds, insurance companies, state-owned investment funds as well as other banks and SSAs (sovereigns, supranationals and agencies). They have a strong position in the Nordic markets and also serve customers internationally with capital market access, custody services and advice on capital, sustainability and asset management matters.

Founded: 1972

Headquarters: Munich, Germany

Website: https://sebgroup.com/

Screenshot via sebgroup.com

Screenshot via sebgroup.com -

Swedbank is a modern bank with its roots firmly planted in the history of Sweden’s savings banks and the cooperative agricultural bank tradition. They have relationships with 7 million private customers and 554 000 corporate customers. Swedbank offers loans, payments and savings to simplify everyday life for individuals and companies. Swedbank has its roots in the Swedish savings bank movement, which dates back to 1820.

In the Digital Banking organization at Swedbank, the Tech Stream team is responsible for the backend systems that drive online channels such as Internet banking and mobile banking. Mostly made up of software engineers, the team also includes an enterprise architect and continuous integration / continuous delivery (CI/CD) engineers.

The team provides the infrastructure to deliver data used by customers and bank clerks, so they work with the application developers that create the user interfaces. They also work with the core banking team to provide a data layer that delivers data to the end-user apps. In their highly competitive industry, they continually look for ways to build out their architecture to ensure performance, scalability, reliability, and agility.

Founded: 1978

Headquarters: Norwalk, Connecticut, USA

Website: https://www.factset.com/

Image by Swedbank via swedbank.com

Image by Swedbank via swedbank.com -

Danske Bank is a Nordic bank with strong local roots and bridges to the rest of the world. For more than 145 years, they have helped people and businesses in the Nordics realise their ambitions. Danske Bank has more than 19,000 employees in 16 countries around the world who serve their 3.4 million personal, business and institutional customers. In addition to banking services, they also offer life insurance and pension, mortgage credit, wealth management, real estate and leasing services.

Den Danske Landmandsbank, Hypothek- og Vexelbank I Kjbenhavn ("The Danish Farmers' Bank, Mortgage and Exchange Bank of Copenhagen"), often known as Landmandsbanken ("the Farmers' Bank"), was established on October 5, 1871. The bank's previous name was Den Danske Bank ("The Danish Bank") until 2000, when the current name was chosen.

Danske Bank's market capitalization was $17.22 billion in April 2023.

Danske Bank is the 964th most valuable corporation in the world based on market capitalization. According to the most recent financial reports from Danske Bank, the company's current revenue (TTM) is $6.30 billion. In 2021, the company generated $7.41 billion in revenue, up from $7.22 billion in 2020.

Founded: 1871

Headquarters: Copenhagen, Denmark

Website: danskebank.com

Screenshot via danskebank.com

Screenshot via danskebank.com -

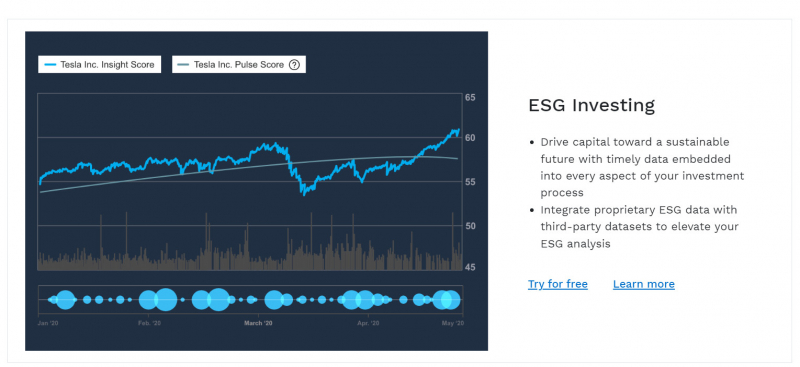

FactSet develops flexible, open data and software solutions for over 180,000 investment professionals worldwide, enabling them to access financial data and analytics at any time and from any location.

For almost 40 years, they have focused on providing great customer service despite market shifts and technical advancements. They're all working together to create value for their clients from more than 37 offices in 20 countries, and they're delighted that 90% of clients who use FactSet continue to use it year after year.

They are an inclusive community unified by the FactSet spirit of going above and beyond. Their best ideas can come from anyone, anywhere, at any time. They roll up their sleeves to solve tough problems together. They learn from their successes and their failures and continually push each other to do better. They continuously look ahead to advance the future of their industry. They relentlessly seek value for their clients because their success is their success.

Founded: 1978

Headquarters: Norwalk, Connecticut, USA

Website: https://www.factset.com/

Screenshot via factset.com

Screenshot via factset.com -

PRA Group isn't a household name among most investors, but it's found a niche that has been lucrative over time. As a leading player in the debt collection industry, PRA Group aims to make it easier for businesses that are having challenges collecting from customers, by offering them cash and then taking responsibility for the cumbersome task of going through the collection process.

Looking ahead, PRA Group thinks it will continue to enjoy a favorable environment for its business worldwide. By bulking up its capacity, the debt collector has been able to increase the size of its portfolio while still being able to handle collections efficiently. That combination has opened the door to further growth, and investors can expect PRA to keep exploring ways to take maximum advantage of the opportunities it has identified with the workforce the company has in place.

PRA Group's second-quarter results showed the fruits of the debt collector's labor. Revenue of $252.1 million was up 14% from year-ago levels, and it exceeded the roughly 11% growth rate that most of those following the stock were looking to see. Net income attributable to the company declined 5% to $18.6 million, but earnings of $0.41 per share topped the consensus forecast among investors for $0.36 per share.

Founded: 1996

Headquarters: Munich, Germany

Website: pragroup.com

Screenshot via pragroup.com

Screenshot via pragroup.com