Top 10 Largest Financial Service Companies in Brazil

In this post, let's examine some of the largest financial service companies in Brazil, ranked by market capitalization. Go directly to other related articles ... read more...on Toplist if you want to see more of the largest financial service companies in other regions.

-

Ita Unibanco is a financial services provider with its head office in Sao Paulo, Brazil. Ita Unibanco was created in 2008 with the union of Banco Ita and Unibanco. It is the biggest bank in Brazil, the biggest in Latin America, and the 71st biggest bank in the entire globe. The bank is listed on the NYSE in New York and the B3 in Sao Paulo.

Ita Unibanco is active in the following countries: China, Hong Kong, Japan, the United Arab Emirates, and Argentina, Brazil, Chile, Colombia, Panama, Paraguay, the United States, and Uruguay in the Americas. It has more than 33,000 service locations worldwide, including 4,335 branches in Brazil, as well as almost 45,000 ATMs and 55 million customers.

Its parent firm is Itasa, a sizable Brazilian conglomerate that is included among the top 500 global corporations by Fortune magazine. Asuncion, Buenos Aires, Cayman Islands, Dubai, Hong Kong, Lisbon, London, Luxembourg, Montevideo, Nassau, New York City, Miami, Santiago, Shanghai, Tokyo, and Zurich are among the locations outside of Brazil where Ita Unibanco has offices. The bank was regarded as Brazil's most valuable brand in 2022.

Ita Unibanco's market cap was $44.57 billion as of March 2023. This places Ita Unibanco as the 367th most valuable company in the world according to market cap. The most recent financial reports from Ita Unibanco indicate that the company's current revenue (TTM) is $26.90 billion. The corporation generated $22.50 billion in revenue in 2021, an increase from $17.44 billion in revenue in 2020.

Founded: 4 November 2008

Headquarters: São Paulo, São Paulo, Brazil

Website: www.itau.com

Screenshot via www.itau.com

Screenshot via www.itau.com -

With its headquarters in So Paulo, Brazil, Banco Santander (Brasil) S.A. is the Spanish Santander Group's Brazilian affiliate. It is the largest division of the group outside of Europe and the fifth-largest banking institution in Brazil and Latin America as of 2019. By 2019, it will be responsible for about 30% of the group's global financial earnings. The bank is listed on the NYSE through ADRs and on the B3 in Sao Paulo.

After Ita Unibanco, Banco do Brasil, Banco Bradesco, and Caixa Econômica Federal as the fifth largest banks in the nation, Banco Santander, which was founded in 1982, expanded significantly in Brazil between 1997 and 2007. IWith a network of 3696 branches, service centers, and 18,312 ATMs, it works in all financial market areas and has more than 9 million customers.

The market capitalization of Bank Santander Brasil as of March 2023 is $37.98 billion. By market capitalization, Banco Santander Brazil is now the 453rd most valuable company in the world. The most recent financial reports from Bank Santander Brasil show that the company's current revenue (TTM) is $8.43 Billion. The company's revenue in 2021 increased from the $6.05 billion in 2020 to $9.07 billion.

Founded: 15 May 1857

Headquarters: Santander (legal headquarters) and Boadilla del Monte, Community of Madrid (operating headquarters), Spain

Website: http://www.santander.com.br/

Screenshot via http://www.santander.com.br/

Screenshot via http://www.santander.com.br/ -

The corporate headquarters of the Brazilian financial services firm are located in Osasco, in the state of Sao Paulo. It ranks as the 79th largest bank in the world, the third largest in Latin America, and the third largest banking institution in Brazil. It ranks among the top 50 banks in terms of value worldwide. The bank is traded on the New York Stock Exchange, the Madrid Stock Exchange, and the B3 in So Paulo, where it is a component of the ndice Bovespa.

Commercial banking is its main area of financial service, and it also provides savings bonds, insurance, pension plans, annuities, credit card services (including football club affinity cards for soccer enthusiasts), and Internet banking. The bank also offers leasing services in addition to personal and business loans. Through its 31,474 own ATMs and 5,549 of Banco24Horas, a Brazilian third-party ATM network, Bradesco is a pioneer in the use of the ATM biometric scanning system in Brazil, allowing clients to be identified using the vascular pattern of their palms as a complementary password.Bank of America's market capitalization as of March 2023 is $26.81 billion. By market capitalization, Banco Bradesco is now the 651st most valuable company in the world. The most recent financial reports from Banco Bradesco indicate that the company's current revenue (TTM) is $21.21 billion. The corporation generated $18.97 billion in revenue in 2021.

Founded: March 10, 1943

Headquarters: Osasco, São Paulo, Brazil

Website: banco.bradesco

Screenshot via banco.bradesco

Screenshot via banco.bradesco -

A digital banking platform is provided by Nu Holdings Ltd., a business with its headquarters in Brazil. Spending, saving, investing, borrowing, and protecting are the five financial seasons that the company gives its consumers goods for. Using a personalized credit line or directly through a mobile device, its spending solutions are made to make it easier for clients to pay for products and services in their daily lives while earning loyalty points and incentives on eligible purchases.

Its savings solutions are made to make it easier for consumers to make deposits, manage their money, and save it in interest-bearing accounts with free debit cards. Customers can invest their money in investment services and goods with the help of the company's investing solutions. Its lending options are made to offer customers unsecured loans that are simple to get, handle, and repay. Customers can acquire life insurance and funeral benefits with the aid of its NuInsurance protective solutions.

Nu Holdings' market valuation as of March 2023 is $22.54 billion. By market cap, Nu Holdings is now the 761st most valuable business in the world. The most recent financial reports from Nu Holdings indicate that the company's current revenue (TTM) is $2.97 billion. The business generated $1.14 billion in revenue in 2021.

Founded: 2013

Headquarters: São Paulo, State of São Paulo, Brazil

Website: https://www.investidores.nu/

Screenshot via https://www.investidores.nu/

Screenshot via https://www.investidores.nu/ -

Brazilian financial services provider Banco do Brasil is based in the Brazilian capital city of Brasilia. John VI, King of Portugal, formed it on October 12, 1808. It is the oldest bank in Brazil and one of the oldest banks still in existence.

It is the seventh-largest bank in the world and the second-largest bank in Brazil, Latin America, and the entire planet. The Brazilian government controls Bank do Brasil, which is traded on the B3 stock exchange in Sao Paulo. Together with Ita Unibanco, Banco Bradesco, and Banco Santander, it has been one of the four most profitable Brazilian banks since 2000 and has a commanding lead in retail banking.

The market capitalization of Banco do Brasil was $21.45 billion as of March 2023. By market capitalization, Banco do Brazil is now the 795th most valuable firm in the world. The most recent financial reports for Banco do Brazil show that the company's current revenue (TTM) is $22.20 billion. The corporation generated $18.03 billion in revenue in 2021, a rise from $16.32 billion in revenue in 2020.

Founded: October 12, 1808

Headquarters: Brasilia, Federal District, Brazil

Website: bb.com.br

Screenshot via bb.com.br

Screenshot via bb.com.br -

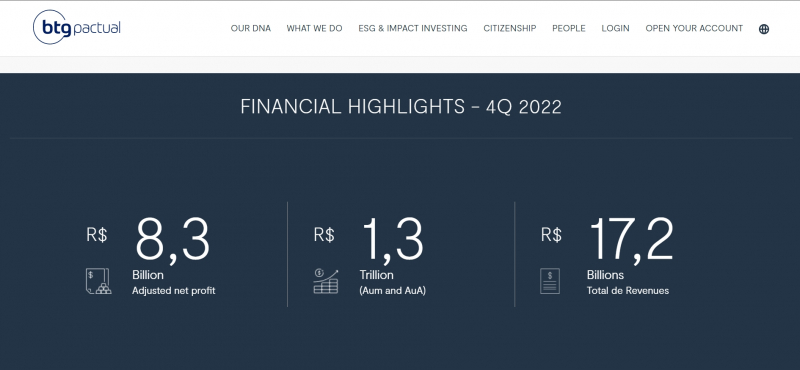

A Brazilian financial institution called BTG Pactual is active in the investment banking, wealth management, asset management, corporate loan, and sales and trade sectors. In addition to investment solutions and market assessments, it provides advice on mergers and acquisitions, wealth planning, loans, and financings. It ranks as the sixth-largest bank in Brazil, the sixteenth-largest in all of Latin America, and the biggest investment bank in the region's Caribbean region.

The bank started out as a brokerage enterprise in 1983 in Rio de Janeiro and now has offices in both that city and So Paulo. BTG Pactual, which has $72.6 billion in assets and shares that are traded on the B3 and NYSE Euronext, has offices in major cities around Latin America and in major financial centers.

The owners of BTG Pactual include André Esteves, Eduardo Henrique de Mello Motta Loyo, Nelson Jobim, Roberto Sallouti, John Huw Gwili Jenkins, Cláudio Eugênio Stiller Galeazzi, Mark Clifford Maletz, and Guilhermo Ortiz Martnez. On April 29, 2022, BTG shareholders approved André Esteves' appointment as chairman once again. Esteves was exonerated by the federal justice system in 2018, and his case is already seen as a judicial misstep.BTG Pactual's market cap was $20.88 billion as of March 2023. By market cap, this places BTG Pactual as the 816th most valuable company in the world. The most recent financial reports from BTG Pactual show that the company's current revenue (TTM) is $5.74 billion. The company generated $3.31 billion in revenue in 2021, an increase from $2.03 billion in revenue in 2020.

Founded: 1983

Headquarters: São Paulo, Brazil

Website: www.btgpactual.com

Screenshot via www.btgpactual.com

Screenshot via www.btgpactual.com -

B3 S.A. (Brasil, Bolsa, Balco), formerly BM&FBOVESPA, is the second-oldest stock exchange in Brazil and is situated in So Paulo. Its current structure dates back to May 8, 2008, when the Brazilian Mercantile and Futures Exchange (BM&F) and the Sao Paulo Stock Exchange (Bovespa) amalgamated to establish BM&FBOVESPA. B3 was produced by the merger of BM&FBOVESPA and CETIP on March 30, 2017.

The index Bovespa, also referred to as Ibovespa, serves as the benchmark indicator for B3. As of October 2022, 475 firms were trading on the Bovespa. The Ibovespa index hit a record high, closing at 130,776 points on June 7, 2021. Moreover, B3 maintains offices in Shanghai, London, and Rio de Janeiro.B3's market cap is $11.96 billion as of March 2023. By market cap, this places B3 as the 1271st most valuable company in the world. The most recent financial reports from B3 indicate that the company's current revenue (TTM) is $1.76 billion. The company generated $1.68 billion in revenue in 2021, up from $1.51 billion in 2020.

Founded: August 23, 1890

Headquarters: São Paulo, Brazil

Website: b3.com.br

Screenshot via b3.com.br

Screenshot via b3.com.br -

The Brazilian investment management firm XP Inc. The business provides wealth management and other financial services, as well as fixed income, equities, investment funds, and private pension products. Brazil is one of the countries that XP supports through its offices in Sao Paulo, Rio de Janeiro, New York, Miami, London, and Geneva.

Interfloat and Senso Corretora were acquired by XP, according to a 2011 announcement. The business also formalized the acquisition of Infomoney in October 2011. XP announced their partnership with Prime Corretora in 2012. It announced the $90 million acquisition of ClearCorretora in July 2014. XP Investimentos revealed that it purchased the Rico Corretora de Valores in December 2016. At the 2022 Sao Paulo Grand Prix, the Aston Martin F1 Team established a deal with XP as the team's official global financial services partner.The market capitalization of XP Inc. as of March 2023 is $6.64 billion. By market cap, XP Inc. is now the 38th most valuable business in the world. The most recent financial reports from XP Inc. show that the company's current revenue (TTM) is $1.26 billion. The company generated $1.25 billion in revenue in 2021, an increase from $1.03 billion in revenue in 2020.

Founded: May 2001

Headquarters: São Paulo, Brazil

Website: www.xpinc.com

Screenshot via www.xpinc.com

Screenshot via www.xpinc.com -

Getnet is a one-stop-shop that provides a full range of in-store and digital solutions for businesses, from payment solutions to business process management, as well as banking and other financial services through their partnership with Santander Brasil. Their merchant clients include micro-entrepreneurs, small and medium-sized enterprises, and corporate customers.

In accordance with agreements negotiated with the Bank, they offer their broad range of services through a banking channel to the clientele of Santander Brasil, which will remain one of their primary distribution channels after the Spin-off. They also offer their services through an independent channel to clients in the open market.

Getnet's market cap was $1.75 billion as of March 2023. Getnet is now the 3905th most valuable company in the world according to market cap. The most recent financial reports from Getnet indicate that the company's current revenue (TTM) is $0.64 B. The company generated $0.52 billion in revenue in 2021, up from $0.43 billion in revenue in 2020.

Founded: 2003

Headquarters: Av. Pernambuco, 1483, São Geraldo, Porto Alegre.

Website: https://ri.getnet.com.br/

Screenshot via https://ri.getnet.com.br/

Screenshot via https://ri.getnet.com.br/ -

A financial services and digital payments business called PagSeguro is situated in So Paulo, Brazil, and was founded in the Cayman Islands' Grand Cayman. The company, which was established in 2006, specializes in providing point-of-sale terminals, mobile applications, and payment processing software for e-commerce websites. Since January 2018, it has been listed as a public corporation on the New York Stock Exchange with the ticker name "PAGS."

PagSeguro is a member of Universo Online (UOL group), the biggest Internet portal in Brazil, according to Ibope Nielsen Online, with more than 50 million monthly unique visitors and 6.7 billion page views. The Congresso Afiliados Brasil named it the "Best Payment Method" in 2015. (Brazil Affiliates Congress)PagSeguro's market cap was $2.79 billion as of March 2023. This makes PagSeguro the world's 3252nd most valuable company by market cap. The most recent financial reports from PagSeguro show that the company's current revenue (TTM) is $1.72 billion. The company generated $1.25 billion in revenue in 2021, a rise from $0.84 billion in revenue in 2020.

Founded: 2006

Headquarters: São Paulo, Brazil (operational); Grand Cayman, Cayman Islands (legal domicile)

Website: pagseguro.uol.com.br

Screenshot via pagseguro.uol.com.br

Screenshot via pagseguro.uol.com.br