Top 10 Largest Financial Service Companies in Australia

In this post, let's examine some of the largest financial services companies in Australia, ranked by market capitalization. Go directly to other related ... read more...articles on Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

An international bank based in Australia, Commonwealth Bank of Australia has operations in New Zealand, Asia, the US, and the UK. Many financial services are offered by it, such as retail, commercial, and institutional banking, fund management, superannuation, insurance, investment, and broking services. As of August 2015, The Commonwealth Bank, which operates under the brands Bankwest, Colonial First State Investments, ASB Bank (New Zealand), Commonwealth Securities (CommSec), and Commonwealth Insurance, is the largest Australian firm listed on the Australian Securities Exchange (CommInsure).

The Commonwealth Trade Bank of Australia, the Commonwealth Savings Bank of Australia, and the Commonwealth Development Bank were once its constituent parts. The Commonwealth Bank, together with the National Australia Bank (NAB), ANZ, and Westpac, is one of the "big four" Australian banks. It was established in 1911 by the Australian government and fully privatized in 1996. On September 12, 1991, the bank went public on the Australian Stock Exchange.The market capitalization of Commonwealth Bank as of April 2023 was $116.44 billion. By market cap, this places Commonwealth Bank as the 113th most valuable corporation in the entire world. The most recent financial reports from Commonwealth Bank indicate that the company's current revenue (TTM) is $16.46 billion. The company generated $16.46 billion in revenue in 2022, which is a decline from $17.67 billion in revenue in 2021.

Founded: 22 December 1911

Headquarters: Darling Park Tower 1, 201 Sussex Street, Sydney, New South Wales, Australia

Website: commbank.com.au

Screenshot via commbank.com.au

Screenshot via commbank.com.au -

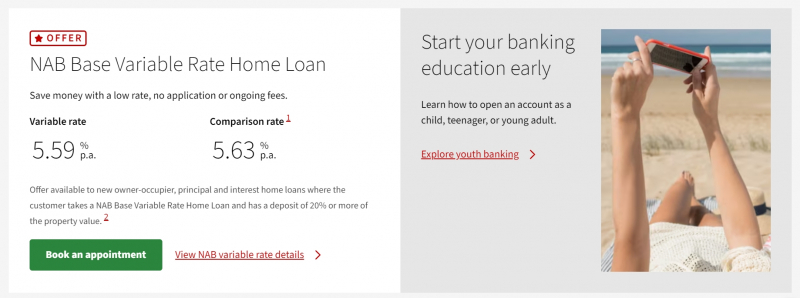

One of the four biggest financial organizations in Australia in terms of market capitalization, earnings, and clients is National Australia Bank (abbreviated NAB, branded nab). In terms of market capitalization, NAB was ranked as the world's 21st-largest bank and 52nd-largest bank in terms of total assets in 2019. NAB had 9 million customers as of January 2019 and ran 3,500 Bank@Post facilities, including 7,000+ ATMs throughout Australia, New Zealand, and Asia. NAB has a Standard & Poor's "AA-" long-term issuer rating.

The market capitalization of National Australia Bank as of April 2023 was $61.33 billion. By market capitalization, National Australia Bank is now the 248th most valuable corporation in the world. The most recent financial reports from National Australia Bank show that the company's current revenue (TTM) is $11.93 billion. The company's revenue in 2022 was $11.93 billion, down from $11.97 billion in 2021.

Founded: October 1, 1981

Headquarters: 395 Bourke StreetMelbourne, Australia

Website: nab.com.au

Screenshot via nab.com.au

Screenshot via nab.com.au -

The headquarters of the Australian international banking and financial services corporation Westpac Banking Corporation, also known as Westpac, are located at Westpac Place in Sydney, New South Wales. Formerly known as the Bank of New South Wales, it was founded in 1817. In 1981, it bought the Commercial Bank of Australia, and in 1982, it changed its name to Westpac Banking Corporation. One of the Big Four banks in Australia, Westpac is also the country's first and oldest financial organization. Its name combines the words "Western" and "Pacific." By 2021, Westpac will have 14 million clients worldwide and 40,000 employees.

Westpac Banking's market capitalization as of April 2023 was $53.05 billion. By market cap, this places Westpac Banking as the 302nd most valuable corporation in the world. The most recent financial reports from Westpac Banking show that the company's current revenue (TTM) is $7.85 billion. The company's revenue in 2022 was $13.29 billion, down from $15.09 billion in 2021.

Founded: 8 April 1817

Headquarters: Westpac PlaceSydney, New South Wales, Australia

Website:- westpac.com.au

- westpac.co.nz

Screenshot via https://www.westpac.com.au/

Screenshot via https://www.westpac.com.au/ -

A multinational Australian bank and provider of financial services, Australia and New Zealand Banking Group Limited (ANZ) is based in Melbourne, Victoria. It ranks second in terms of assets in Australia and fourth in terms of market capitalization.

The English, Scottish, and Australian Bank and the Australia and New Zealand Bank (ANZ) combined on October 1, 1970, creating the company's current corporate structure (ES&A). At the time, it was the biggest bank merger in Australian history. The Bank of Australasia and the Union Bank of Australia, which were formed in 1835 and 1837, respectively, were merged to form the Australia and New Zealand Bank in 1951. The Big Four Australian banks are the Commonwealth Bank, NAB, Westpac, and ANZ.ANZ Bank's market capitalization as of April 2023 is $48.75 billion. By market capitalization, ANZ Bank is now the 333rd most valuable corporation in the world. The most recent financial reports from ANZ Bank indicate that the company's current revenue (TTM) is $12.33 billion. The company's revenue in 2022 was $12.33 billion, down from $12.80 billion in 2021.

Founded: 2 October 1951

Headquarters: 833 Collins StreetMelbourne, Victoria,Australia

Website: www.anz.com

Screenshot via www.anz.com

Screenshot via www.anz.com -

The acquisition of Kansas City-based asset management firm Waddell & Reed for $1.7 billion was announced by the company in 2021. Furthermore, in 2021, Macquarie signed a contract to buy the Australian operations of AMP Capital's Global Equity and Fixed Income (GEFI) division. The purchase of Central Park Group, an independent investment advisory firm specializing in alternative investment methods for high-net-worth customers, by Macquarie Asset Management was finalized in March 2022.

The market capitalization of Macquarie was $47.97 billion as of April 2023. By market cap, Macquarie is now the 339th most valuable company in the world. The most recent financial reports from Macquarie indicate that the company's current revenue (TTM) is $5.16 billion. The company generated $5.16 billion in revenue in 2022, an increase from $3.93 billion in revenue in 2021.

Founded: 1969

Headquarters: 50 Martin PlaceSydney, New South Wales, Australia

Website: www.macquarie.com

Screenshot via www.macquarie.com

Screenshot via www.macquarie.com -

Brisbane, Queensland, Australia, is home to the banking, insurance, and finance company Suncorp Group Limited. When Suncorp, Metway Bank, and the Queensland Industrial Development Corporation merged on December 1, 1996, it became one of Australia's mid-size banks (by total lending and deposits) and its largest general insurance group (QIDC).

With the notable exception of health insurance, uncorp encompasses practically all facets of wealth and banking, including life insurance, general insurance, commercial insurance, compulsory third party (CTP), banking, finance, superannuation, agricultural banking, and business banking. With its headquarters in Brisbane, it is the biggest banking and insurance company.

Suncorp's market capitalization as of April 2023 is $10.77 billion. By market cap, Suncorp is now the 1396th most valuable company in the world. The most recent financial reports from Suncorp indicate that the company's current revenue (TTM) is $7.69 billion. The company's revenue in 2022 was $7.69 billion, down from $9.02 billion in 2021.

Founded: 1996

Headquarters: Brisbane, Queensland, AustraliaWebsite: suncorpgroup.com.au

Screenshot via suncorpgroup.com.au

Screenshot via suncorpgroup.com.au -

An Australian stock transfer corporation called Computershare Limited offers corporate trust, stock transfer, and employee share plan services in many nations. Computershare Limited was established in 1978 in Melbourne, Australia, and has primarily expanded by purchasing foreign companies. Currently, the corporation has offices in 20 different nations, including Australia, the UK, Ireland, the US, Canada, the Channel Islands, South Africa, Hong Kong, New Zealand, Germany, and Denmark.

The market capitalization of Computershare as of April 2023 was $9.23 billion. By market cap, this places Computershare as the 1557th most valuable company in the world. The most recent financial reports from Computershare show that the company's current revenue (TTM) is $2.56 billion. The company generated $2.56 billion in revenue in 2022, an increase from $1.71 billion in 2021.

Founded: 1978

Headquarters: Abbotsford, Victoria, Australia

Website: www.computershare.com

Screenshot via www.computershare.com

Screenshot via www.computershare.com -

Australian Securities Exchange Ltd., also known as ASX, is a publicly traded Australian firm that runs Australia's main securities market (sometimes referred to outside of Australia as, or confused within Australia as, The Sydney Stock Exchange, a separate entity). The six state securities exchanges were combined to form the ASX on April 1, 1987, through incorporation pursuant to Australian Parliamentary legislation. In 2006, the ASX amalgamated with the Sydney Futures Exchange.

Nowadays, ASX is one of the top 20 listed exchange groups in the world, with an average daily turnover of A$4.685 billion and a market capitalization of over A$1.6 trillion. All shares, structured instruments, warrants, and ASX equity derivatives are cleared through ASX Clear.The market capitalization of ASX as of April 2023 was $9.14 billion. By market valuation, this places ASX as the 1566th most valuable firm in the entire world. The company's current revenue (TTM) as of the most recent ASX financial filings is $0.71 billion. The company's revenue in 2022 was $0.71 billion, down from $0.72 billion in 2021.

Founded: 1987

Headquarters: Sydney, Australia

Website: www.asx.com.au

Screenshot via www.asx.com.au

Screenshot via www.asx.com.au -

Australian financial institution Bendigo and Adelaide Bank specializes in retail banking. In November 2007, Bendigo Bank and Adelaide Bank merged to form the business. Prior to the merger, Bendigo Bank offered its services and products at around 900 locations across Australia, including more than 160 company-owned branches, 220 community-owned Community Bank branches, 100 agencies, and 400 Elders stores.

The majority of the bank's branches are in Victoria and Queensland. With the addition of 25 branches from the merger with Adelaide Bank, the combined bank currently has over 400 locations. Regional offices are located in Docklands, Melbourne, and Ipswich, Queensland. The national headquarters are still located in the city of Bendigo.

The market capitalization of Bendigo and Adelaide Bank as of April 2023 is $3.41 billion. By market capitalization, Bendigo and Adelaide Bank is now the 2958th most valuable corporation in the world. The most recent financial reports from Bendigo and Adelaide Bank indicate that the company's current revenue (TTM) is $1.16 billion. The company generated $1.16 billion in revenue in 2022, a decline from $1.34 billion in revenue in 2021.

Founded: 1858

Headquarters: Bendigo, Victoria, Australia

Website: www.bendigoadelaide.com.au

Screenshot via www.bendigoadelaide.com.au

Screenshot via www.bendigoadelaide.com.au -

The financial holding company Netwealth Group provides services for managed accounts, retirement plans, superannuation, and portfolio management. The business is headquartered in Melbourne, Australia, and was established in 1999. With an entrepreneurial zeal to defy Australian financial industry norms, Netwealth was founded. They operate a technology firm, a superannuation fund, and an office services company. They exist primarily to motivate individuals to adopt new perspectives on wealth and uncover a better future.

One of Australia's wealth management companies with the quickest growth is Netwealth, which was established in 1999. Our clients rank them number one for offering outstanding customer service, and analysts consistently rank our technology as the best in its category.The market capitalization of Netwealth as of April 2023 was $2.29 billion. By market cap, Netwealth is now the 3542nd most valuable company in the world. The most recent financial reports from Netwealth show that the company's current revenue (TTM) is $0.11 billion. The company generated $0.11 billion in revenue in 2022, an increase from $0.10 billion in revenue in 2021.

Founded: 1999

Headquarters: Melbourne, Australia

Website: http://www.netwealth.com.au/

Screenshot via http://www.netwealth.com.au/

Screenshot via http://www.netwealth.com.au/