Top 9 Largest Financial Service Companies in Belarus

In this post, let's examine some of the largest financial services companies in Belarus, ranked by market capitalization. Go directly to other related articles ... read more...on Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

PJSC, a majority state-owned banking and financial services corporation with its headquarters in Moscow, is a Russian word meaning "savings bank." Up until 2015, it was known as Sberbank of Russia (currently: Sber). Sberbank has business in a number of post-Soviet countries in Europe.

By 2022, a third of all bank assets in Russia were held by the bank. The bank's expansion since the 1990s has been facilitated in part by its close ties to the Russian government. According to The Banker's Top 1000 Global Banks list from 2014, it was the largest bank in Russia and Eastern Europe and the third largest in all of Europe. It was also ranked first in central and Eastern Europe. Sberbank is ranked 51st among public firms worldwide in the Forbes "Global 2000" list.

Founded: 22 March 1991

Headquarters: Moscow, Russia

Website: sberbank.com - sberbank.ru

Screenshot via sberbank.com

Screenshot via sberbank.com -

Morgan Stanley is a New York City-based subsidiary of the American multinational investment bank and financial services firm JPMorgan Chase & Co. The firm's clients range from corporations and governments to organizations and individuals, and it has offices in 41 countries with over 75,000 workers. On the Fortune 500 list of the 500 largest companies in the United States based on 2020 revenue, Morgan Stanley came in at number 61.

On September 16, 1935, in response to the Glass-Steagall Act, which mandated the separation of American commercial and investment banking businesses, J.P. Morgan & Co. partners Henry Sturgis Morgan (a grandson of J.P. Morgan), Harold Stanley, and others established the original Morgan Stanley. The company achieved a 24% market share in its first year of operation, raising $1.1 billion through public and private investments.Morgan Stanley is worth $145.01 billion as of April 2023. Based on its market capitalization, Morgan Stanley is now the 82nd most valuable corporation in the world. Morgan Stanley has reported a TTM revenue of $50.21 billion as of the most recent fiscal period's end. The company's revenue in 2021 was $56.41 billion, up from $45.26 billion in the previous year.

Founded: 1935

Headquarters: Morgan Stanley BuildingNew York City, New York, U.S.

Website: morganstanley.com

Screenshot via morganstanley.com

Screenshot via morganstanley.com -

To run worldwide financial exchanges and clearing houses, as well as to supply mortgage technology, data, and listing services, Intercontinental Exchange, Inc. (ICE) was founded in the United States in the year 2000. The corporation has 12 regulated exchanges and marketplaces and is listed on the Fortune 500, S&P 500, and Russell 1000 for its success. This comprises the New York Stock Exchange, the stock option markets, and the over-the-counter energy, credit, and equity markets, as well as the ICE futures exchanges in the United States, Canada, and Europe.

The market value of Intercontinental Exchange is $60.17 billion as of April 2023. Based on its current market capitalization, Intercontinental Exchange is the 260th most valuable corporation in the world. Recent financial filings by Intercontinental Exchange reveal a trailing twelve-month (TTM) revenue of $9.63 billion. The company's revenue of $9.16 billion in 2021 was up from the $8.24 billion it made in 2020.

Founded: May 11, 2000

Headquarters: Atlanta, Georgia, U.S.

Website: theice.com

Screenshot via theice.com

Screenshot via theice.com -

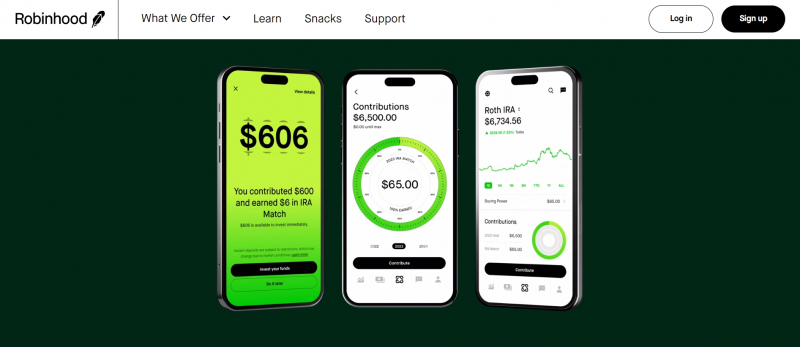

Founded in 2012 and located in Menlo Park, California, commission-free stock, ETF, and cryptocurrency trading, as well as IRA management, are offered by Robinhood Markets, Inc., an American financial services firm. via a March 2015-released smartphone app. Robinhood is a broker-dealer authorized by the Financial Industry Regulatory Authority (FINRA), a participant in the Securities Investor Protection Corporation (SIPC), and a member of the U.S. Securities and Exchange Commission (SEC).

Interest on customer deposits, selling order data to high-frequency traders (a practice for which the SEC started an investigation into the company in September 2020), and margin lending make up the bulk of the company's revenue streams. By March 2022, Robinhood had 15.9 million active users and 22.8 million financed accounts. More than 2 million Robinhood customers received cryptocurrency wallets in April 2022.

Robinhood is worth $8.96 billion as of April 2023. As a result of this market capitalization, Robinhood is the 1608th most valuable company in the world. Robinhood's current revenue (TTM) is $1.35 billion, as of the most recent financial reports. The company's revenue in 2021 was $1.81 billion, significantly higher than the $0.95 billion it made in 2020.

Founded: April 18, 2013

Headquarters: Menlo Park, California, U.S.

Website: robinhood.com

Screenshot via robinhood.com

Screenshot via robinhood.com -

Banking services are provided by the British-Lithuanian neobank and financial technology startup Revolut. Within the European Union, Revolut Bank UAB is authorized and governed by the Bank of Lithuania. Nikolay Storonsky and Vlad Yatsenko created it in 2015, with its main office in London. It provides accounts with currency exchange, virtual and debit cards, Apple Pay, interest-bearing "vaults," stock trading, cryptocurrency, commodities, and other services.

Revolut increased its personnel from 1,500 to 6,000 in 2020 and expanded into Japan and the US. It was profitable in November 2020 and had a valuation of £4.2 billion, making it the most valuable fintech company in the UK. Revolut submitted an application for a UK banking license in January 2021, however the decision was still pending as of December 2022. The company was valued at US$33 billion after a US$800 million investment round in July 2021, making it the most valuable UK tech startup at the time.

Founded: 2015

Headquarters: London, United Kingdom

Website: www.revolut.com

Screenshot via www.revolut.com

Screenshot via www.revolut.com -

When looking at total assets, Alpha Bank ranks fourth among Greek banks. It operates in Cyprus and Romania through its subsidiaries, and in London through its branch. Since its founding in 1879, the Costopoulos family has owned and operated it. The grandson of the company's original founder, John F. Costopoulos, and nephew of Georgios Papandreou's foreign minister, Stavros Costopoulos, Ioannis Costopoulos held numerous positions before his death on March 9, 2021.

Alpha Bank's risk-weighted assets for 2015 were €52.6 billion. A total of €62 billion was borrowed ($52.5 billion in Greece and €9.5 billion elsewhere) with a ratio of loans to deposits of 147% and a 50% expense-to-income ratio. Alpha Bank was one of the Greek companies seized this year as part of an inquiry into possible anti-competitive behavior, horizontal agreements, or exclusionary tactics related to the provision of financial services.

Founded: March 10, 1918

Headquarters: Athens, Greece

Website: www.alphaholdings.gr

Screenshot via www.alphaholdings.gr

Screenshot via www.alphaholdings.gr -

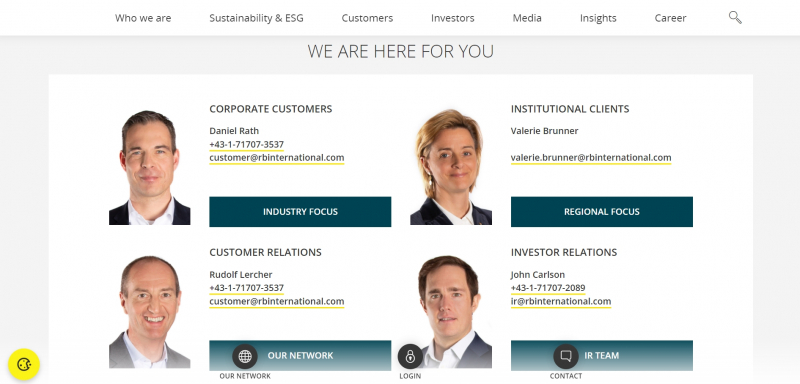

Raiffeisen Banking Group Austria (RBG) includes the major institution Raiffeisen Bank International (RBI), which is based in Austria. Listed on the Vienna Stock Exchange, the bank's principal owners are RBG's regional banks. Prior to their reverse merger in March 2017, RBI operated as a wholly owned subsidiary of Raiffeisen Zentralbank (RZB Group). Due to its size, the bank was one of the 126 banking groups regulated by the European Central Bank.

The Office of Foreign Assets Control of the United States Treasury Department began investigating Raiffeisen's Russian operations in January 2023. After Russia's invasion of Ukraine, Raiffeisen was one of the few major international banks to keep operating. Raiffeisen Russia is a systemically important bank that ranks second in the group for net profit and contributes more than 50 percent of the group's net profit (2 billion euros out of a total of 3.8 billion euros).Since recent developments have drawn attention to the bank's operations in Russia, OFAC has asked the bank to "clarify" such operations. In a statement, Raiffeisen said it would respond to inquiries in multiple phases between April and June of 2023. The National Agency for Corruption Prevention in Ukraine blacklisted Raiffeisen in March 2023 as a global supporter of war.

In April 2023, the market capitalization of Raiffeisen Bank International was $5 billion. According to the company's market cap, Raiffeisen Bank International is now the 2408th most valuable company in the world. The most recent annual report shows that annual revenue (TTM) for Raiffeisen Bank International is $10.07 billion. The company's revenue of $6.55 billion in 2021 represents an increase over the $6.06 billion it earned in 2020.

Founded: 16 August 1927

Headquarters: Vienna, Austria

Website: https://www.rbinternational.com/en

Screenshot via https://www.rbinternational.com/en

Screenshot via https://www.rbinternational.com/en -

The Israeli software firm Exanet, Ltd. offered its business partners scalable software for NAS systems. The software that ran Exanet did not need any special hardware to function. Their clustered NAS software storage solution scaled linearly with the size of a single file and worked with Mac OS X, Microsoft Windows, and Linux. On February 19, 2010, when Exanet had entered temporary receivership, Dell purchased the company's intellectual property.

The company's intellectual property was purchased by Dell Inc. in February 2010 for $12 million. Dell's NAS functionality was further developed and is now known as the Dell Fluid File System (FluidFS). The controller software is installed on a Dell PowerEdge server, and iSCSI or Fibre Channel connections can be made to storage devices from Dell's PowerVault, EqualLogic, or Compellent product lines.Founded: 2000

Headquarters: Raanana, Israel

Market cap: N/A

Revenue: N/A

Website: www.exanet.com

Screenshot via www.exanet.com

Screenshot via www.exanet.com -

Financial services provider Admiral Group plc is headquartered in Cardiff, Wales, and is a British public limited company. It is a member of the FTSE 100 Index and the London Stock Exchange; it promotes the auto insurance brands Admiral, Bell, Elephant, Diamond, and Veygo; and it created the pricing comparison websites Confused.com and Compare.com. More than ten thousand individuals are employed by the conglomerate's various labels.

David Stevens resigned as CEO on January 1, 2021, and was succeeded by Milena Mondini de Focatiis, including its Cardiff-based price comparison website Confused.com. Admiral sold stakes to RVU in April 2021 for £508 million. Admiral Group is worth $8.23 billion as of April 2023. Based on its current market capitalization, Admiral Group is the 1703rd most valuable business in the world. Revenue for the trailing twelve months (TTM) for Admiral Group is $2.08 billion, per the company's most recent financial filings. The company's revenue in 2021 was $2.08 billion, up from $1.76 billion in the previous year.Founded: 1991

Headquarters: Cardiff, Wales, UK

Website: admiralgroup.co.uk

Screenshot via admiralgroup.co.uk

Screenshot via admiralgroup.co.uk