Top 10 Largest Financial Service Companies in India

The financial services sector in India includes a number of important subsegments. Nonetheless, a wide range of clientele, including government agencies, ... read more...people, and commercial enterprises, are served by the services. Here are some of the Largest Financial Service Companies in India.

-

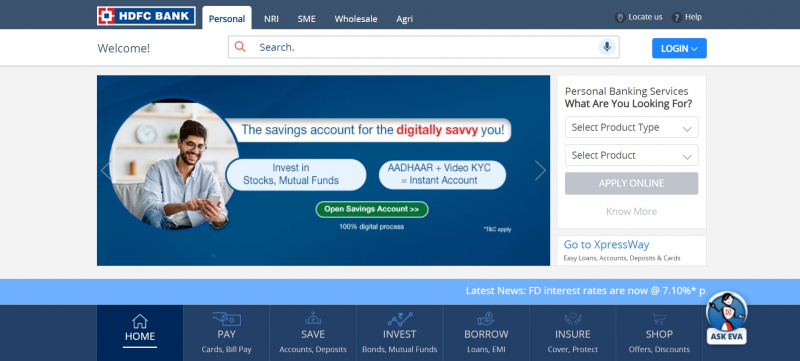

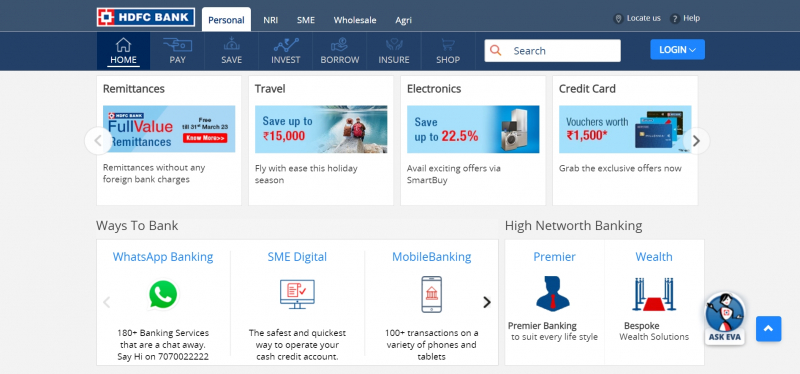

Indian banking and financial services provider HDFC Bank Ltd. has its corporate office in Mumbai. As of April 2021, it was the largest private sector bank in India by assets and the tenth-largest bank in the world by market capitalization. With a $127.16 billion market capitalization on the Indian stock exchanges, it is the third-largest firm overall. With a little under 150,000 workers, it ranks as India's fifteenth largest employer.

Being a division of the Housing Development Finance Corporation, HDFC Bank was established in 1994 and has its registered office in Mumbai, Maharashtra, India. The company's first corporate office and a full-service branch were opened by Manmohan Singh, who was the Union Finance Minister at the time, in Sandoz House in Worli.

The bank's distribution network consisted of 6,378 branches spread over 3,203 locations as of June 30, 2022. In FY 2017, it issued 12 million credit cards, 23,570,000 debit cards, and 430,000 POS terminals. As of June 30, 2022, it had a base of 1,52,511 permanent employees.The market capitalization of HDFC Bank was $122.86 billion as of March 2023. By market cap, HDFC Bank is now the 100th most valuable corporation in the world. The most recent financial reports from HDFC Bank indicate that the company's current revenue (TTM) is $14.07 billion. The corporation generated $12.43 billion in revenue in 2020, an increase over the $10.86 billion it generated in revenue in 2019.

Founded: August 1994

Headquarters: Mumbai, Maharashtra, India

Website: www.hdfcbank.com

Screenshot via www.hdfcbank.com

Screenshot via www.hdfcbank.com -

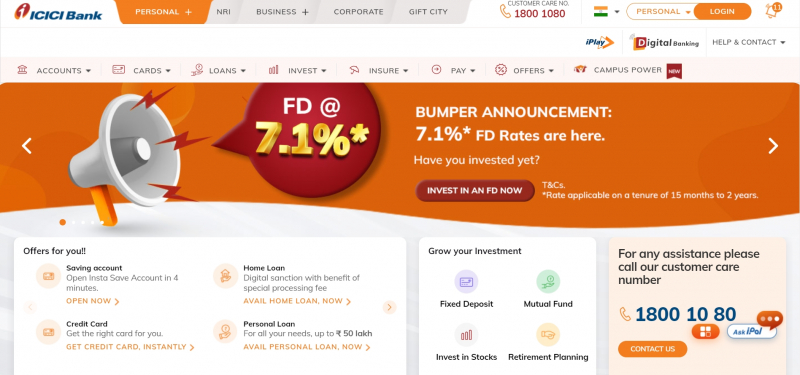

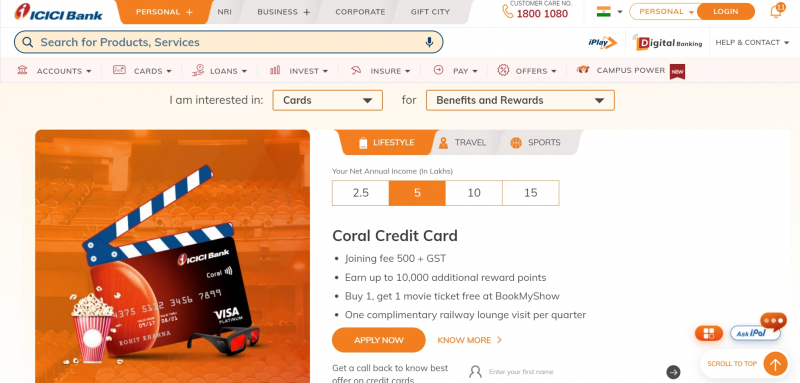

ICICI Bank Ltd. is a Mumbai-based international bank and provider of financial services. With a variety of delivery channels and specialist subsidiaries in the fields of investment banking, life and non-life insurance, venture capital, and asset management, it provides a broad range of banking products and financial services for corporate and retail customers.

This development finance institution is present in 17 countries and has a network of 5,275 branches and 15,589 ATMs throughout India. The bank maintains subsidiaries in the UK and Canada, branches in the US, Singapore, Bahrain, Hong Kong, Qatar, Oman, the Dubai International Financial Centre, China, and South Africa, and representative offices in the UAE, Bangladesh, Malaysia, and Indonesia. Belgian and German subsidiaries of the business have also been created by its UK subsidiary.The market capitalization of ICICI Bank was $73.38 billion as of March 2023. By market cap, ICICI Bank is now the 189th most valuable corporation in the world. The most recent financial reports from ICICI Bank indicate that the company's current revenue (TTM) is $16.09 billion. The corporation generated $16.37 billion in revenue in 2021, a rise from $15.32 billion in revenue in 2020.

Founded: 5 January 1994

Headquarter: Mumbai, Maharashtra, India

Market cap: $73.38 Billion

Revenue in 2022 (TTM): $16.09 B

Website: www.icicibank.com

Screenshot via www.icicibank.com

Screenshot via www.icicibank.com -

An Indian private development finance organization with its headquarters in Mumbai is called Housing Development Finance Corporation Limited (HDFC). It is a significant provider of house financing in India. Additionally, it operates in the banking industry and provides life and general insurance, asset management, venture capital, real estate, educational loans, and deposits.

It was established in 1977 with the help of the Indian business community, and it is the flagship company of the HDFC group of companies. The Industrial Credit and Investment Corporation of India promoted HDFC (ICICI). Hasmukhbhai Parekh was crucial in the establishment of this business, which initially set out to address the housing crisis in India and then grew rapidly.Home Development Financing Corporation's market capitalization as of March 2023 is $59.29 billion. By market cap, this places Home Development Finance Company as the 255th most valuable firm in the entire world. The most recent financial reports from the Housing Development Finance Corporation show that the company's current revenue (TTM) is $13.74 billion. The corporation generated $14.78 billion in revenue in 2021, an increase from $10.98 billion in revenue in 2020.

Founded: 1977

Headquarters: Mumbai, Maharashtra, India

Website: www.hdfc.com

Screenshot via www.hdfc.com

Screenshot via www.hdfc.com -

The State Bank of India (SBI) is a statutory organization for financial services and a multinational public sector bank with its headquarters in Mumbai, Maharashtra. SBI, the sole Indian bank on the 2020 Fortune Global 500 list of the largest firms in the world, is the 49th-largest bank in the world by total assets and is rated 221st overall. It is a public sector bank, the biggest bank in India, and holds a 25% portion of the market for loans and deposits, as well as a 23% market share for assets.

With approximately 250,000 workers, it ranks as India's fifth-largest employer. The State Bank of India crossed the $5 trillion market capitalization threshold on the Indian stock exchanges for the first time on September 14, 2022, becoming the third lender (after HDFC Bank and ICICI Bank) and seventh Indian corporation to do so.

The market capitalization of State Bank of India was $57.67 billion as of March 2023. By market cap, this places State Bank of India as the 264th most valuable firm in the entire world. The most recent financial reports from the State Bank of India show that the company's current revenue (TTM) is $30.01 billion. The corporation generated $33.42 billion in revenue in 2021, an increase from $29.12 billion in revenue in 2020.

Founded: 1 July 1955

Headquarters: State Bank Bhawan, M.C. Road, Nariman Point, Mumbai, Maharashtra, India

Website: bank.sbi

Screenshot via bank.sbi

Screenshot via bank.sbi -

The Indian non-banking financial enterprise Bajaj Finance Limited (BFL), a division of Bajaj Finserv, is based in Pune. Initially established on March 25, 1987, as Bajaj Auto Finance Limited, a non-banking financial institution with a primary focus on financing two- and three-wheeled vehicles,

Bajaj Auto Finance Ltd. conducted its first public offering of equity shares and was listed on the Bombay Stock Exchange and National Stock Exchange of India after 11 years in the car lending industry. The company entered the consumer durables lending market around the turn of the 20th century and began providing small loans with 0% interest. Later on, Bajaj Auto Finance expanded its lending portfolio to include business and real estate loans.

Bajaj Finance's market cap as of March 2023 is $42.62 billion. By market cap, Bajaj Finance is now the 395th most valuable company in the world. The most recent financial reports from Bajaj Finance show that the company's current revenue (TTM) is $3.16 billion. The company generated $2.53 billion in revenue in 2021, an increase from $2.17 billion in revenue in 2020.

Founded: March 25, 1987

Headquarters: Pune, India

Website: www.bajajhousingfinance.in

Screenshot via www.bajajhousingfinance.in

Screenshot via www.bajajhousingfinance.in -

Mumbai serves as the corporate headquarters for the Indian banking and financial services firm Kotak Mahindra Bank Ltd. It provides banking products and financial services in the fields of personal finance, investment banking, life insurance, and wealth management for corporate and retail consumers. After ICICI Bank and HDFC Bank, it is the third-largest private sector bank in India in terms of market capitalization. The bank had 1600 locations as of February 2021 and 2519 ATMs.

Kotak Mahindra Bank's market valuation was $42.62 billion as of March 2023. By market cap, this places Kotak Mahindra Bank as the 396th most valuable corporation in the world. The most recent financial reports from Kotak Mahindra Bank show that the company's current revenue (TTM) is $6.25 billion. The company generated $6.08 billion in revenue in 2021, an increase from $5.14 billion in revenue in 2020.

Founded: 1985

Headquarters: Mumbai, Maharashtra, India

Website: www.kotak.com

Screenshot via www.kotak.com

Screenshot via www.kotak.com -

Mumbai, Maharashtra-based Axis Bank Limited, formerly known as UTI Bank (1993–2007), is an Indian banking and financial services organization. It offers financial services to big and small corporations, entrepreneurs, and retail outlets.

As of June 30, 2016, the promoters and the promoter group controlled 30.81% of the shares (United India Insurance Company Limited, Oriental Insurance Company Limited, National Insurance Company Limited, New India Assurance Company Ltd., GIC, LIC, and UTI). Mutual funds, FIIs, banks, insurance providers, business entities, and individual investors collectively control 69.19% of the outstanding shares.Axis Bank's market capitalization was $31.75 billion as of March 2023. By market cap, this places Axis Bank as the 546th most valuable corporation in the world. The most recent financial reports for Axis Bank show that the company's current revenue (TTM) is $7.39 billion. The company generated $6.46 billion in revenue in 2021, an increase from $5.72 billion in revenue in 2020.

Founded: 3 December 1993

Headquarters: Mumbai, Maharashtra, India

Website: www.axisbank.com

Screenshot via www.axisbank.com

Screenshot via www.axisbank.com -

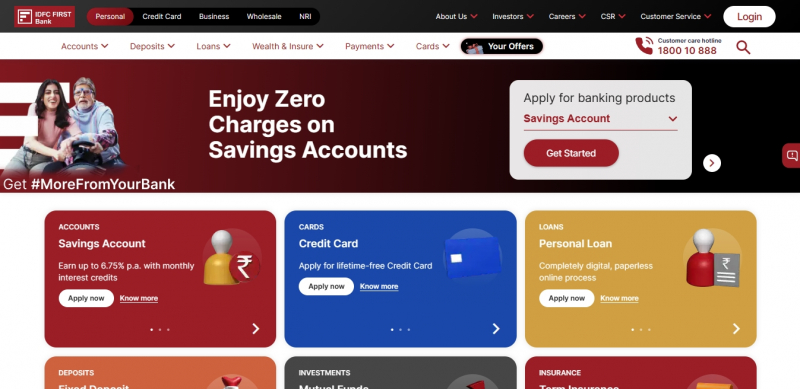

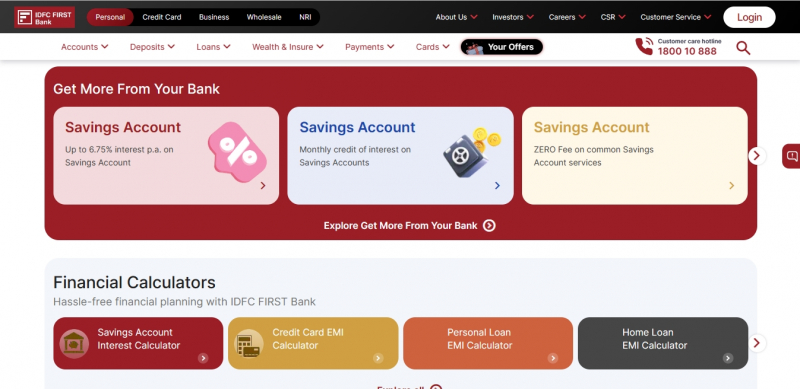

An Indian non-bank financial company called Capital First and the banking division of Infrastructure Development Financing Corporation came together to form IDFC FIRST Bank, a private sector bank in India. It is the first universal bank to provide lifetime free credit cards with dynamic and low annual percentage rates, as well as monthly interest credit on savings accounts.

In order to finance Indian infrastructure projects, IDFC Ltd. was founded in 1997. It expanded into investment banking, institutional securities, mutual funds, and infrastructure debt funds in 2007 and 2008, respectively. The Central Bank of India gave IDFC Limited in-principle clearance in 2014 to launch a new private bank. After then, IDFC Limited transferred its infrastructure finance assets and liabilities to IDFC Bank, a new company. The bank was established by this demerger from IDFC Ltd, and Prime Minister Narendra Modi gave it its formal opening in October 2015.

As of April 2023, the market capitalization for IDFC FIRST Bank was $4.63 billion. By market capitalization, this places IDFC FIRST Bank as the 2503rd most valuable corporation in the world. The most recent financial reports from IDFC FIRST Bank indicate that the company's current revenue (TTM) is $2.00 billion. The company generated $1.76 billion in revenue in 2021, an increase from $1.06 billion in revenue in 2020.

Founded: October 2015

Headquarters:Mumbai, Maharashtra, India

Website: www.idfcfirstbank.com

Screenshot via www.idfcfirstbank.com

Screenshot via www.idfcfirstbank.com -

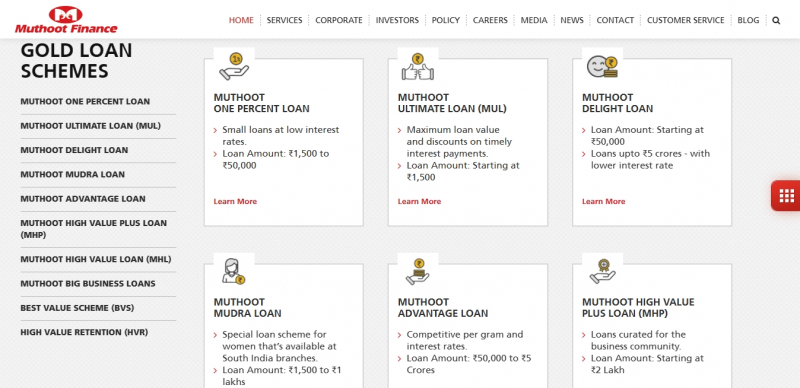

Muthoot Finance Ltd., another well-known company on the list of the biggest financial service providers in India, was founded in 1939. The Kochi-based business provides loans with gold jewelry as security. The two main business sectors of Muthoot Finance are financing and power generation. In order to satisfy their short-term working capital needs, it typically provides personal and company loans to those who have no access to conventional credit for an acceptable amount of time.

Additionally, it provides services such as gold loans, international money transfers, insurance brokerage, personal loans, house loans, foreign exchange services, home loans, collections, windmill power generation, domestic money transfers, quick transfers of money, etc.Muthoot Finance's market cap was $4.88 billion as of April 2023. By market cap, Muthoot Finance is now the 2428th most valuable company in the world. The most recent financial reports from Muthoot Finance indicate that the company's current revenue (TTM) is $0.94 B. The company generated $1.08 billion in revenue in 2021, an increase from $0.95 billion in revenue in 2020.

Founded:1939

Headquarters: Kochi, Kerala, India

Website: www.muthootfinance.com

Screenshot via www.muthootfinance.com

Screenshot via www.muthootfinance.com -

Mahindra & Mahindra Financial Services Ltd. was established in 1991 and has its headquarters in Mumbai, India. The business provides financial services to people in rural and semi-urban areas of the country. It provides a variety of retail goods and services, including loans, financing for small and medium-sized businesses (SME), tractors, and several other financial items.

Additionally, it provides personal loans, fixed deposit plans, and mutual fund distribution. The subsidiary of Mahindra & Mahindra, Mahindra Insurance Brokers Limited, has developed expertise in the distribution of life and non-life insurance products through partnerships with numerous insurance providers.

Mahindra & Mahindra's market cap was $17.29 billion as of April 2023. By market cap, Mahindra & Mahindra is now the 928th most valuable business in the world. The most recent financial reports from Mahindra & Mahindra show that the company's current revenue (TTM) is $14.26 billion. The company generated $11.42 billion in revenue in 2021, a rise from $10.79 billion in revenue in 2020.

Founded: 1991

Headquarters: Ludhiana, Punjab, India

Website: https://www.mahindrafinance.com

Screenshot via https://www.mahindrafinance.com

Screenshot via https://www.mahindrafinance.com